Three Tax-Efficient Charitable Giving Strategies (Updated for 2025 Tax Law Changes)

Keith Corbett CFP® | Bluebird Wealth Management

December 15th, 2025

In this blog post, we will explore three charitable giving strategies intended to reduce taxes, minimize recordkeeping, and increase donations to charity. To implement these strategies successfully, we must first understand the difference between claiming the standard tax deduction and itemizing deductions. Most taxpayers claim the standard deduction, which means they cannot deduct their charitable donations from their taxable income in 2025 (changes coming 2026). While itemizing deductions can open the opportunity for higher tax savings, itemizing is not required for all three of these strategies. Each strategy below is labeled to indicate whether itemizing is required, optional, or not required.

2025 Tax Law Update

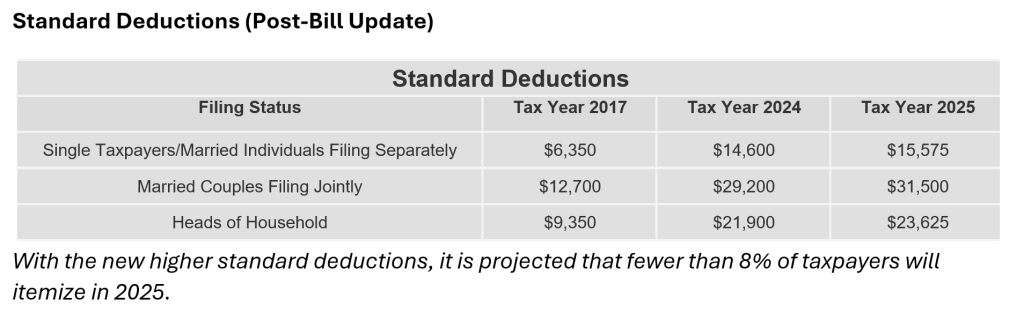

The “One Big Beautiful Bill” passed in 2025 extended or made permanent many TCJA provisions, including a permanently higher standard deduction. Starting in 2026, standard deduction filers can deduct up to $1,000 ($2,000 for joint filers) in charitable donations. However, itemizers will face a new 0.5% AGI floor, meaning the first $1,000 of donations for someone with $200,000 in AGI isn’t deductible. Also, deductions for those in the top tax bracket (37%) will be capped at 35%.

To benefit from itemized deductions, eligible expenses must now exceed $31,500 for married couples filing jointly and $15,575 for single taxpayers. Common itemized deductions include mortgage interest, state and local taxes, unreimbursed medical expenses, and qualified charitable donations. Certain limitations apply to each of these categories, so be sure to check with a CPA or Enrolled Agent to confirm which expenses qualify for itemizing.

1) Donate Appreciated Securities Instead of Cash

(Tax prevention strategy – Itemizing optional)

Gifting appreciated securities from an investment account can be a great way to improve tax efficiency. A donor can prevent capital gains tax by gifting an appreciated security directly to a qualified charity or to a Donor-Advised Fund (DAF) – a charitable giving account controlled by the donor. If itemizing is beneficial, the donor may deduct the full market value of the security at the time of the gift (up to 30% of AGI).

This provides a double tax benefit:

-

- No capital gains tax on the appreciation

- A potential deduction for the full value of the donation

This is especially useful when securities have a high market value relative to their cost basis, including missing-cost-basis holdings (typically purchased prior to 2008) or employer stock. Donors often use a DAF to simplify donations to multiple charities and consolidate receipts for recordkeeping.

2) Bunch Multiple Years of Charitable Gifts to a Donor-Advised Fund

(Tax deduction strategy – Itemizing required)

Bunching several years of charitable gifts into one large donation to a DAF allows a donor to itemize in a single high-deduction year, while distributing grants to charities over time. For example, instead of donating $3,000 annually for 20 years, a donor could contribute $60,000 to a DAF in one year and itemize that year to exceed the standard deduction ($31,500 in 2025).

DAF contributions can be in the form of cash (deductible up to 60% of AGI), appreciated securities (up to 30% of AGI), or a combination. Additionally, DAFs allow funds to grow tax-free and offer anonymity for grants if desired.

This strategy is particularly powerful in peak income years, such as the final working years before retirement, when the tax deduction could be most valuable.

3) Qualified Charitable Distributions (QCDs) from IRAs

(Tax prevention strategy – Itemizing not required)

A QCD is a direct transfer from an IRA to a qualified charity for individuals age 70½ or older. This allows taxpayers to reduce their taxable income by donating directly from their IRA without claiming the distribution as income, and without needing to itemize deductions.

-

- QCDs count toward the Required Minimum Distribution (RMD)

- Maximum annual QCD is now $105,000 (indexed for inflation by the 2025 bill).

QCDs help manage adjusted gross income (AGI), which may help avoid Medicare IRMAA surcharges. While the IRA custodian assists with processing, the donor must report the QCD manually on their tax return using Form 1040.

Are These Strategies Right for You?

These three strategies remain extremely effective in 2025 for reducing taxes, simplifying recordkeeping, and maximizing charitable impact. As always, charitable giving and tax planning should be personalized. We recommend working closely with your advisor and tax professional to determine which strategies align best with your goals.

If you would like to schedule a time to speak with Bluebird Wealth Management about these strategies or any other personal finance topics, please use our contact form. We offer a free consultation to answer your questions and explain our unique service structure.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This content is not a substitute for individualized tax advice.

This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.