COMMENTARY

(Our Blog)

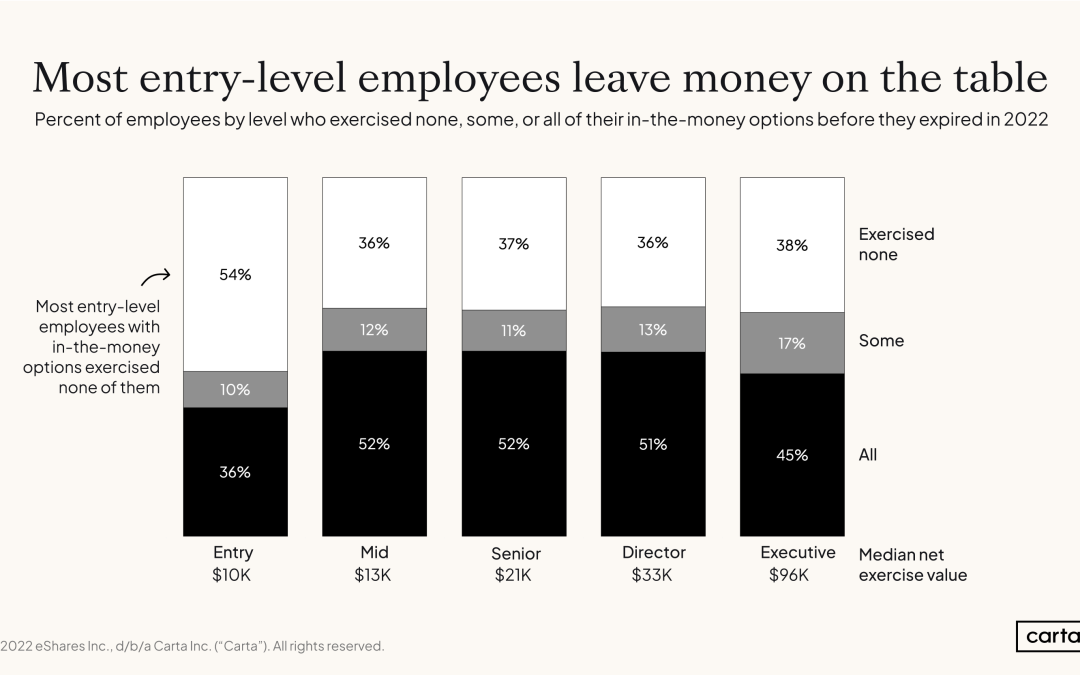

What is Equity Compensation?

Equity compensation is a type of non-cash benefit that some employers offer employees as part of their total compensation package. Instead of receiving only a salary and bonuses, employees are granted potential ownership in the company through stock options, restricted stock units (RSUs), or other equity-based incentives.

5 Insights on the Fed, Election, and Volatility in Q4

As we begin the final quarter of 2024, financial markets and the economy have defied the expectations of many investors. Rather than falling into recession, the economy has grown steadily, albeit at a slower pace, and inflation rates have fallen toward the Fed’s target.

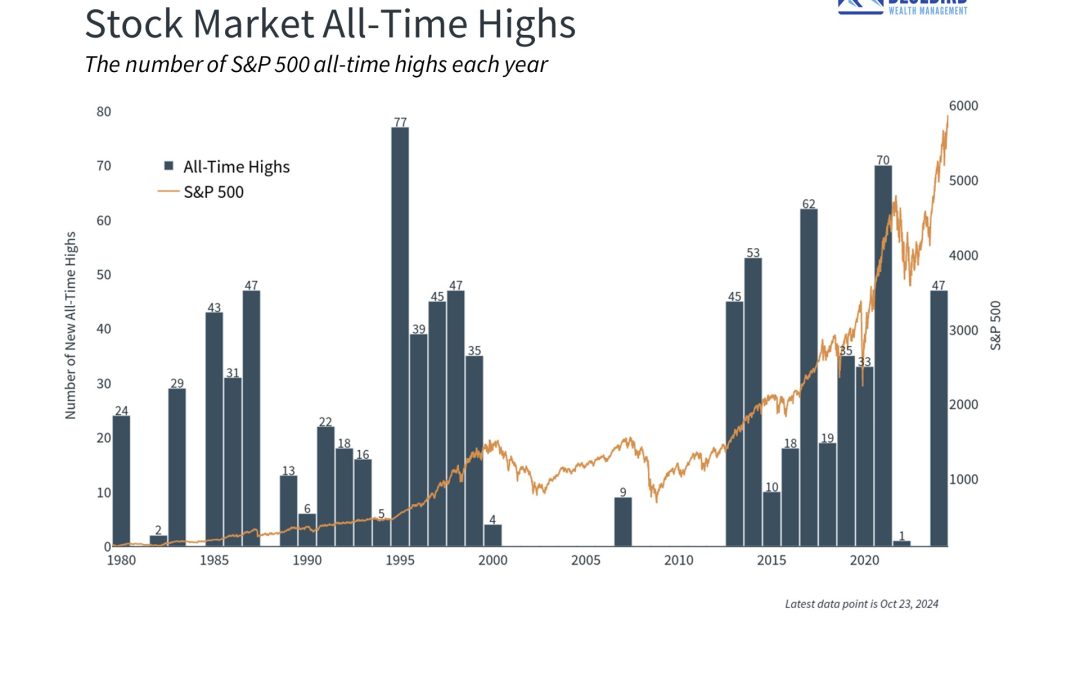

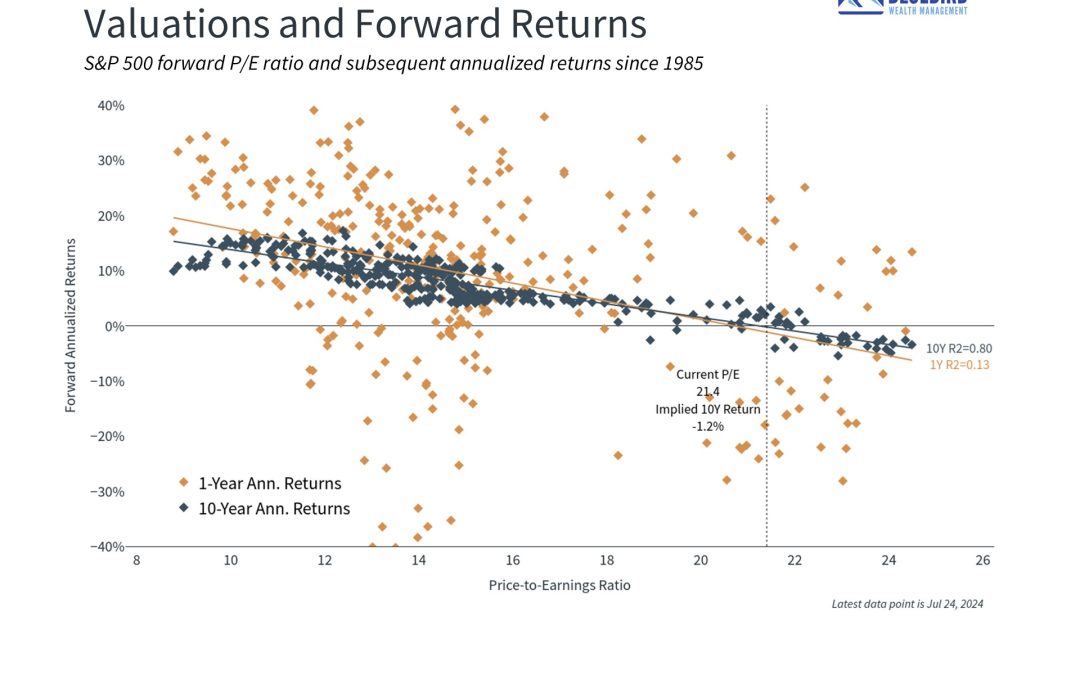

Votes, Valuation, & Volatility

During the first half of 2024 the stock market rally continued as investors anticipate the first Fed rate cut and artificial intelligence stocks remain (very much) in favor. Through June the S&P 500 gained 15.3% with dividends, the Nasdaq 18.6%, and the Dow Jones Industrial Average 4.8%. The 10-year Treasury yield declined from its April peak of 4.7% to 4.4%, allowing the overall bond market to be roughly flat on the year. International stocks have performed better as well, with developed markets returning 5.7% and emerging markets 7.7%.

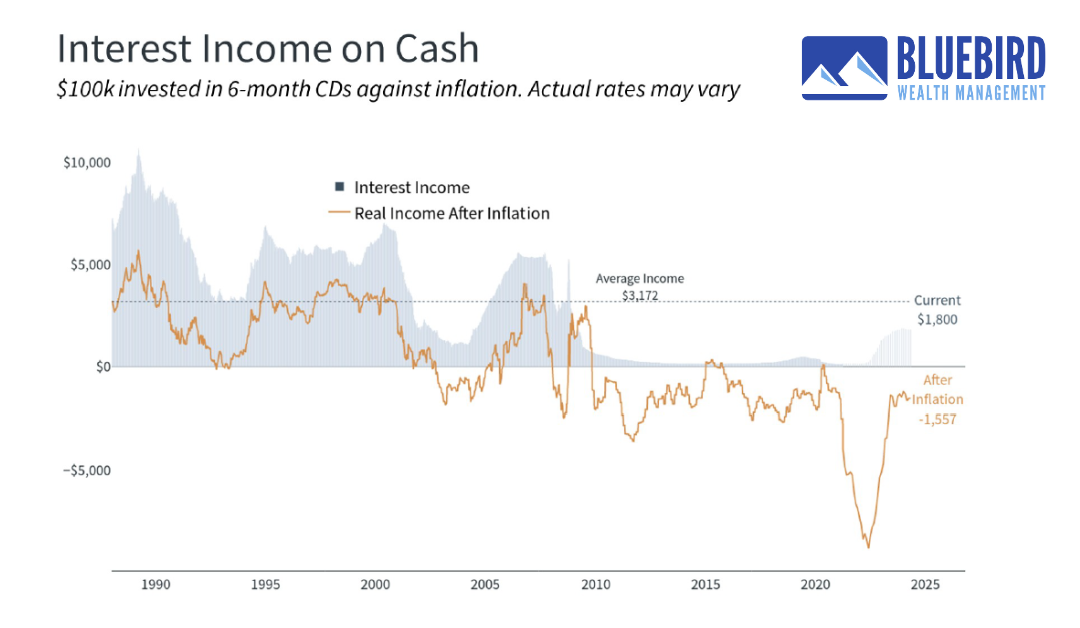

Why Cash is Not a Long-Term Investment

In times of market uncertainty, investors often seek the safety of cash. This has been true over the past several years as markets have swung due to the pandemic, geopolitical events, Fed rate hikes, inflation, gridlock in Washington, technology trends, and more. More recently, the possibility of worse-than-expected inflation and a delay of the first Fed rate cut have led to renewed investor concerns. At the same time, interest rates on cash are at their highest levels in decades, making it appear that there are attractive “risk-free” returns. What role should cash play in investor portfolios today?

Inflation, Oil, and Rate Expectations

The onset of 2024 ushered in discussions regarding the Federal Reserve’s strategy for steering the economy, with debates revolving around the prospects of a “soft” or “hard” landing.

Too Resilient?

In this blog post, we discuss the recent resiliency of the US Economy.

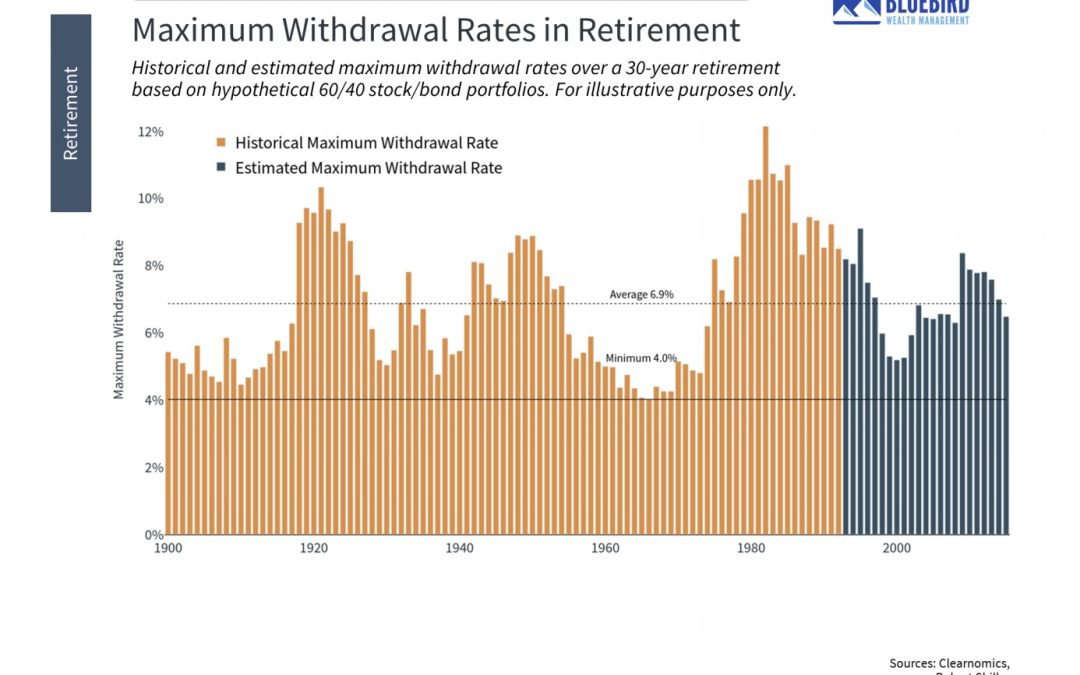

Why the 4% Rule is Only a Starting Point for Retirement—Keith Corbett, Bluebird Wealth Management

In this blog post, we speak about the 4% rule and its’ place in a retirement strategy.

Turning the Page — By Brian Sokolowski, CFA, Bluebird Wealth Management

In this blog post, we discuss the challenges of the 2022 investment environment and what to expect in 2023.

Three Tax Efficient Charitable Giving Strategies by Keith Corbett, CFP® | Bluebird Wealth Management

In this blog post, we will explore three charitable giving strategies intended to reduce taxes, minimize record keeping, and increase donations to charity.

“Drowning in Gloom” by Brian Sokolowski, CFA | Bluebird Wealth Management

After initially hearing the phrase “Drowning in Gloom” on Bloomberg Radio while on a road trip with my son in early August it has been replaying in my head often over recent weeks. The phrase was delivered by Bloomberg Surveillance host Tom Keene (noted skeptic, Red Sox fan, and hardly a perma-bull) to describe the current zeitgeist of financial markets…

Bluebird Financial Advisor Keith Corbett Selected as Part of Zoe Financial Network

We are proud to share that our VP/Financial Advisor, Keith Corbett has been accepted to the Zoe Financial Network.

The Great Recalibration by Brian Sokolowski, CFA | Bluebird Wealth Management

Last Thursday, Cleveland Federal Reserve Bank President Loretta Mester characterized the current Federal Reserve policy stance as “the great recalibration of monetary policy.”

Passing the Baton to Inflation by Brian Sokolowski, CFA | Bluebird Wealth Management

The dominant theme for the market this year has been the continued strong economic recovery, albeit at a rate slightly slower than the consensus had expected entering the year. Strong – but slightly disappointing – economic growth explains above average equity returns paired with relatively defensive leadership, and rotations between growth and value groups through the year.

An Introduction to Bluebird Wealth Management

Please watch the following Video introduction to Bluebird Wealth Management put together by

by Keith Corbett, CFP

Client Questions from Q3, 2021 | Bluebird Wealth Management

Chief Investment Officer, Brian Sokolowski, sits down with Financial Advisor, Keith Corbett, to review investor questions from Q3, 2021.

It’s an Analog Market…for Now, by Brian Sokolowski, CFA Bluebird Wealth Management

We believe investors are well served by owning innovative companies with durable competitive advantages, in attractive categories, over long periods of time; we are growth investors at our core.

Robin Hood and His Merry Band – The Return of Active Investing| Bluebird Wealth Management

Prior to founding Bluebird in 2018, I had spent the previous 14 years in investment research and portfolio management. A central function of the role was to attend a dozen or so investment conferences each year, which involved meeting with company management and discovering opportunities to actively invest client capital.

Bracing for the Fall| Bluebird Wealth Management

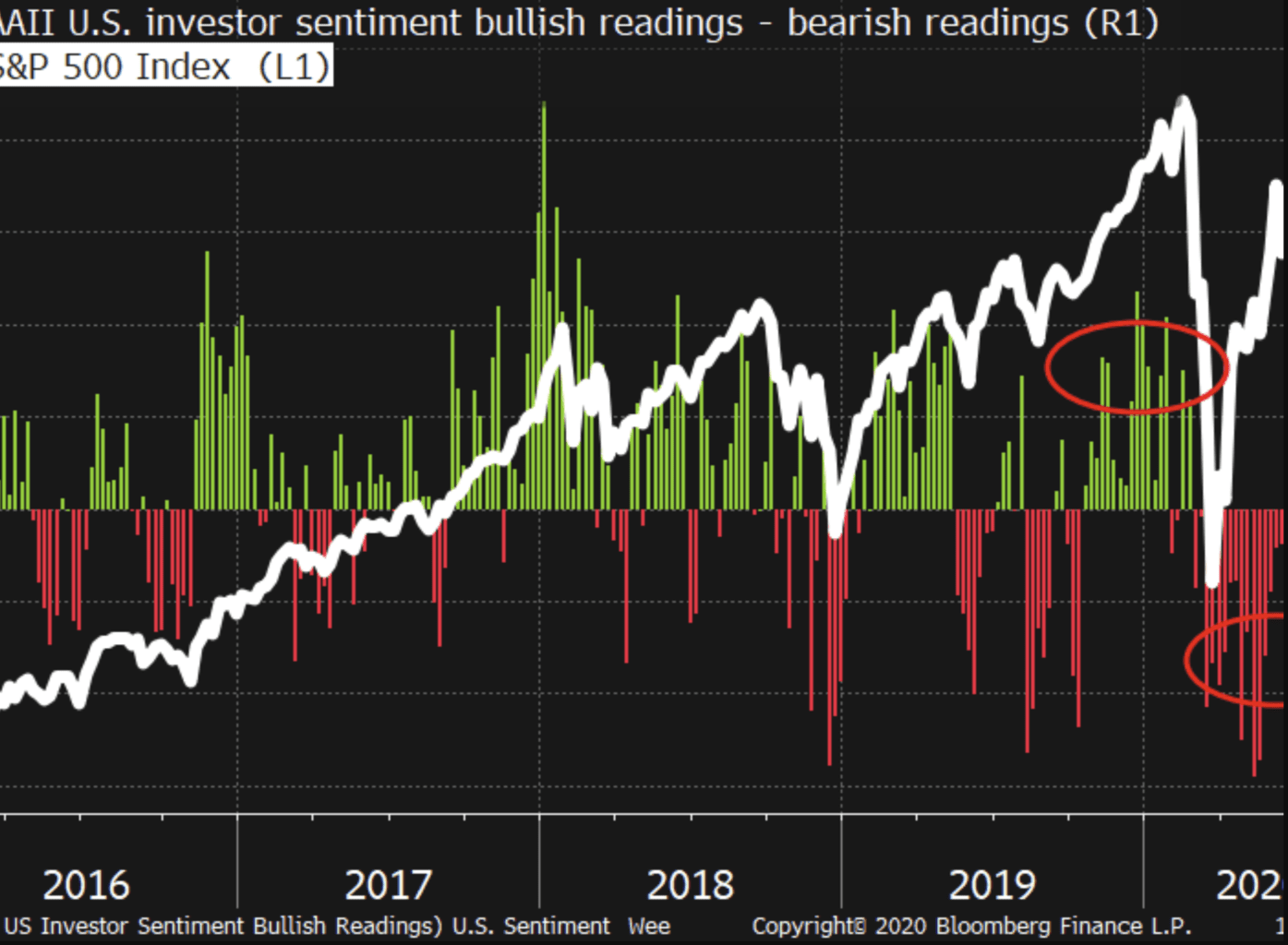

While “The Most Hated Stock Market Rally” was a common refrain over much of the 2009-2020 bull market, the remarkable rally off the March 2020 lows has truly earned the moniker, in our opinion.

Bluebird Wealth Management, LLC

Metrowest Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

North Shore Office

(978) 775-1287

12 Oakland St.

Suite 308

Amesbury, MA 01913

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Metrowest Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

North Shore Office

12 Oakland St.

Suite 308

Amesbury, MA 01913

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.