Three Tax Efficient Charitable Giving Strategies

by Keith Corbett, CFP®

Bluebird Wealth Management

In this blog post, we will explore three charitable giving strategies intended to reduce taxes, minimize record keeping, and increase donations to charity. To implement these strategies successfully, we must first understand the difference between claiming the standard tax deduction and itemizing deductions. Most taxpayers claim the standard deduction, which means they cannot deduct their charitable donations from their taxable income in 2022. While itemizing deductions can open the opportunity for higher tax savings, itemizing is not required for all three of these strategies. When discussed below, each strategy is labeled to indicate whether itemizing is required, optional or not required.

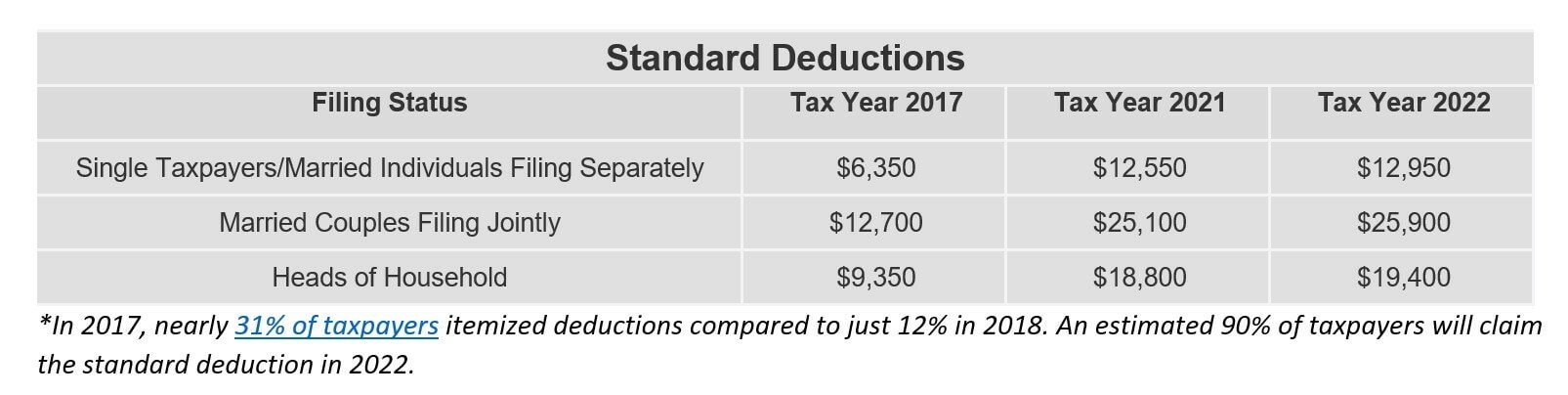

In December 2017, the tax code received a massive overhaul, which included a significant increase to the standard deduction (see image below). The updated tax code went into effect in 2018 and will “sunset” in 2025.

Due to the increase in the standard deduction, there is now less incentive to itemize. To benefit from itemized deductions, the eligible expenses must total more than $25,900 for married individuals filing jointly and $12,950 for single taxpayers in 2022. Common expenses, that a taxpayer can deduct when itemizing, include mortgage interest (mortgage capped at $750k), state and local taxes (capped at $10k), non-reimbursed medical expenses exceeding 7.5% of AGI, and qualified charitable donations (capped by AGI).

Strategy #1: Donate appreciated securities instead of cash

(Tax prevention strategy – Itemizing optional)

Gifting appreciated securities from an investment account can be a great way to improve tax efficiency. A donor can prevent capital gains tax by gifting an appreciated security, held more than one year, directly to a qualified charity, or a Donor Advised Fund – a charitable giving account created and controlled by the donor. In addition, if itemizing is in their best interest, a donor can deduct the full market value of the security at the time of the gift (up to 30% of AGI). This allows the donor to receive double tax savings – tax prevention on the capital gains and a tax deduction for the market value of the shares donated.

This strategy is especially beneficial if the current market value of the donated security is significantly higher than the original purchase price. Or if the security is missing cost basis, which means the shares were likely purchased prior to 2008. This is a common strategy for investors with a large, concentrated stock position. We often see this with clients who receive equity compensation from an employer.

Many 501(c)(3) organizations can receive a direct transfer of shares from an investment account. However, the more common approach is to gift shares to a Donor Advised Fund account. This allows the donor to use one contribution (one receipt) to distribute (grant) to multiple charities. This will simplify record keeping for donors who give to multiple charities throughout the year.

Strategy #2 — Bunching multiple years of charitable gifts to a Donor-Advised Fund

(Tax deduction strategy – Itemizing required)

Bunching or grouping multiple years of donations in a DAF can be one of the most impactful tax savings strategies available, but it requires planning. Instead of making annual donations without receiving a deduction, a donor can plan to itemize in a specific year by making a lump sum contribution to a DAF account. For tax purposes, the donation is realized at the time of the contribution, but the funds can remain in the DAF account for years. The funds can then be granted to other qualified charities over time.

For example, if a donor plans to give $2,000 per year to charity for the next 20 years, they could instead bunch the total of $40,000 in one calendar year. This $40,000 charitable donation, along with any other itemized deductions, would exceed the standard deduction – a requirement for the strategy to be effective. This would ensure the full 20 years of planned donations receive a tax deduction. This strategy can be especially impactful during a donor’s highest earning years, often within a few years of retirement.

The DAF contribution can be cash, appreciated securities (tax prevention), or a combination of the two. Cash contributions can be deducted up to 60% of AGI and appreciated securities can be deducted up to 30% of AGI. DAFs also offer other benefits such as optional anonymity and potential tax-free investment growth on any funds held in the account over time.

Strategy #3 — Qualified Charitable Distributions

(Tax prevention strategy – Itemizing not required)

A QCD is a donation that is made directly from a taxable IRA account to a qualified charity. It allows donors, who are at least 70 1/2 years old, to use their Traditional, Inherited, inactive SIMPLE or inactive SEP IRA as a tax-free giving source. Typically, distributions from these IRA types are taxed as ordinary income, including the required mandatory distributions beginning at age 72. The maximum annual QCD is $100,000, which can be used to satisfy the RMD – making it one of the few strategies available to reduce or defer taxes related to RMDs.

The IRA custodian can process the QCD requests to multiple charities as a normal distribution. While the custodian will have records of each QCD, they do not report it to the IRS. The form 1099 provided by the custodian will not indicate the QCD amount. The full amount of an annual QCD is reported on a form 1040 tax return by the donor or their tax preparer.

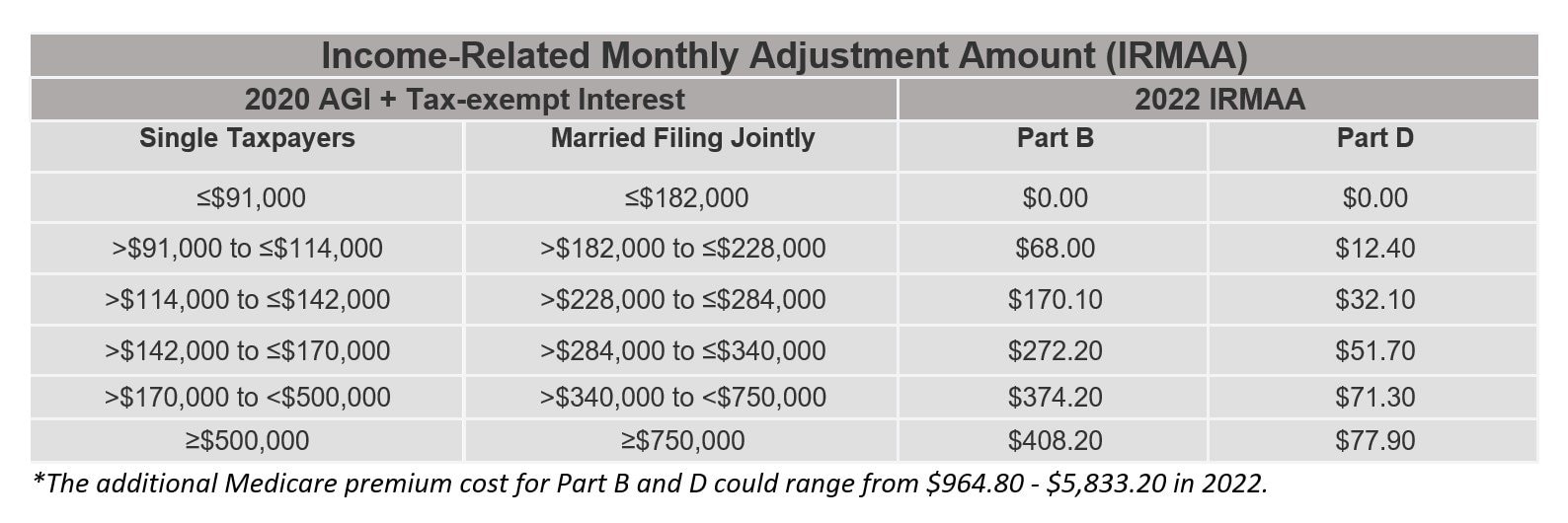

This strategy is often used instead of cash donations for donors claiming the standard deduction or looking to reduce their taxable income. It can be especially beneficial to those who are subject to IRMAA, a Medicare surcharge on parts B and D. The image below will provide an overview of the additional premium costs based on income levels.

Are these three charitable giving strategies in your best interest?

These three strategies can be extremely effective to reduce taxes, minimize record keeping, and increase charitable donations. However, financial planning should be personalized, and we suggest reviewing any new strategies with a trusted advisor and tax preparer. Implementing any of these strategies will likely have an impact on your investment portfolio, tax reporting and process for making charitable donations.

If you would like to schedule a time to speak directly with Bluebird Wealth Management about these strategies, or any other personal finance topics, please reach out to us. We offer a free consultation to answer your questions and review our unique service structure.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This information is not intended to be a substitute for specific individualized tax advice. Have questions?

Three Tax Efficient Charitable Giving Strategies

by Keith Corbett, CFP®

Bluebird Wealth Management

In this blog post, we will explore three charitable giving strategies intended to reduce taxes, minimize record keeping, and increase donations to charity. To implement these strategies successfully, we must first understand the difference between claiming the standard tax deduction and itemizing deductions. Most taxpayers claim the standard deduction, which means they cannot deduct their charitable donations from their taxable income in 2022. While itemizing deductions can open the opportunity for higher tax savings, itemizing is not required for all three of these strategies. When discussed below, each strategy is labeled to indicate whether itemizing is required, optional or not required.

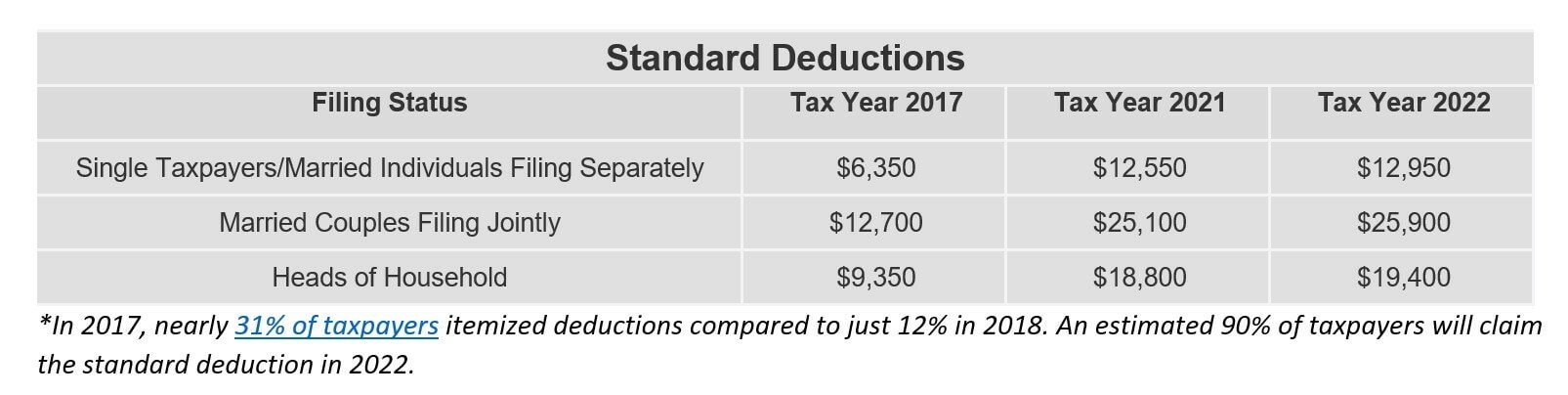

In December 2017, the tax code received a massive overhaul, which included a significant increase to the standard deduction (see image below). The updated tax code went into effect in 2018 and will “sunset” in 2025.

Due to the increase in the standard deduction, there is now less incentive to itemize. To benefit from itemized deductions, the eligible expenses must total more than $25,900 for married individuals filing jointly and $12,950 for single taxpayers in 2022. Common expenses, that a taxpayer can deduct when itemizing, include mortgage interest (mortgage capped at $750k), state and local taxes (capped at $10k), un-reimbursed medical expenses exceeding 7.5% of AGI, and qualified charitable donations (capped by AGI).

Strategy #1

Donate Appreciated Securities Instead of Cash

(Tax prevention strategy – Itemizing optional)

Gifting appreciated securities from an investment account can be a great way to improve tax efficiency. A donor can prevent capital gains tax by gifting an appreciated security, held more than one year, directly to a qualified charity, or a Donor Advised Fund – a charitable giving account created and controlled by the donor. In addition, if itemizing is in their best interest, a donor can deduct the full market value of the security at the time of the gift (up to 30% of AGI). This allows the donor to receive double tax savings – tax prevention on the capital gains and a tax deduction for the market value of the shares donated.

This strategy is especially beneficial if the current market value of the donated security is significantly higher than the original purchase price. Or if the security is missing cost basis, which means the shares were likely purchased prior to 2008. This is a common strategy for investors with a large, concentrated stock position. We often see this with clients who receive equity compensation from an employer.

Many 501(c)(3) organizations can receive a direct transfer of shares from an investment account. However, the more common approach is to gift shares to a Donor Advised Fund account. This allows the donor to use one contribution (one receipt) to distribute (grant) to multiple charities. This will simplify record keeping for donors who give to multiple charities throughout the year.

Strategy #2

Bunching Multiple Years of Charitable Gifts to a Donor-Advised Fund

(Tax deduction strategy – Itemizing required)

Bunching or grouping multiple years of donations in a DAF can be one of the most impactful tax savings strategies available, but it requires planning. Instead of making annual donations without receiving a deduction, a donor can plan to itemize in a specific year by making a lump sum contribution to a DAF account. For tax purposes, the donation is realized at the time of the contribution, but the funds can remain in the DAF account for years. The funds can then be granted to other qualified charities over time.

For example, if a donor plans to give $2,000 per year to charity for the next 20 years, they could instead bunch the total of $40,000 in one calendar year. This $40,000 charitable donation, along with any other itemized deductions, would exceed the standard deduction – a requirement for the strategy to be effective. This would ensure the full 20 years of planned donations receive a tax deduction. This strategy can be especially impactful during a donor’s highest earning years, often within a few years of retirement.

The DAF contribution can be cash, appreciated securities (tax prevention), or a combination of the two. Cash contributions can be deducted up to 60% of AGI and appreciated securities can be deducted up to 30% of AGI. DAFs also offer other benefits such as optional anonymity and potential tax-free investment growth on any funds held in the account over time.

Strategy #3

Qualified Charitable Distributions

(Tax prevention strategy – Itemizing not required)

A QCD is a donation that is made directly from a taxable IRA account to a qualified charity. It allows donors, who are at least 70 1/2 years old, to use their Traditional, Inherited, inactive SIMPLE or inactive SEP IRA as a tax-free giving source. Typically, distributions from these IRA types are taxed as ordinary income, including the required mandatory distributions beginning at age 72. The maximum annual QCD is $100,000, which can be used to satisfy the RMD – making it one of the few strategies available to reduce or defer taxes related to RMDs.

The IRA custodian can process the QCD requests to multiple charities as a normal distribution. While the custodian will have records of each QCD, they do not report it to the IRS. The form 1099 provided by the custodian will not indicate the QCD amount. The full amount of an annual QCD is reported on a form 1040 tax return by the donor or their tax preparer.

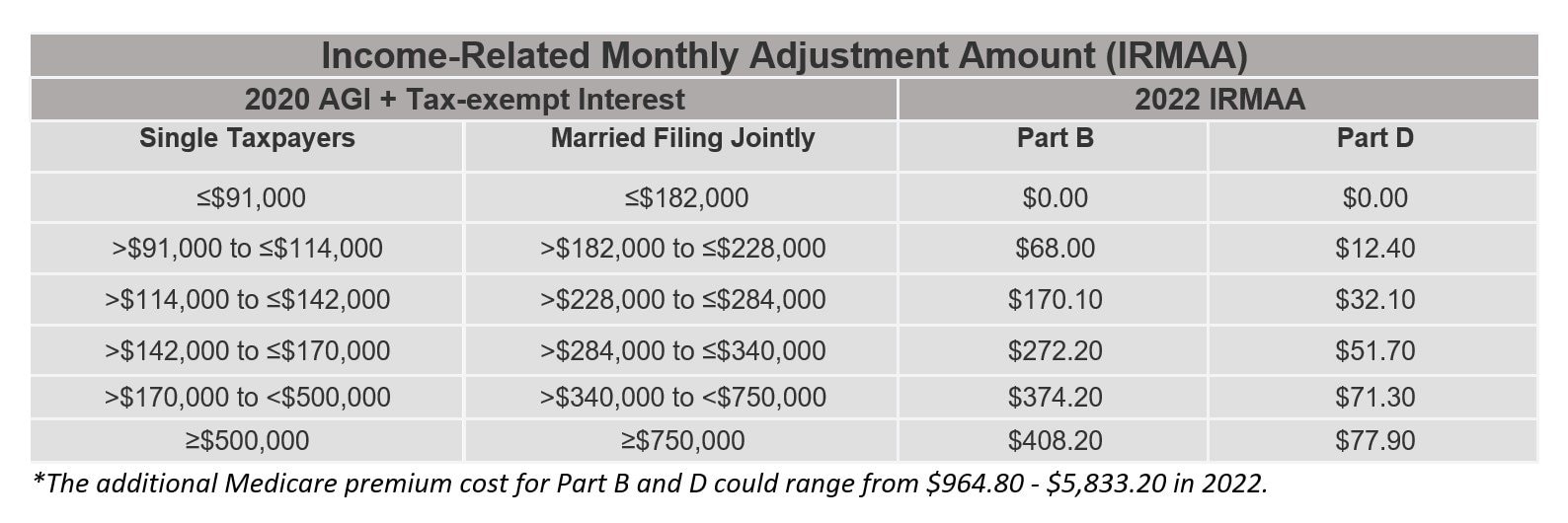

This strategy is often used instead of cash donations for donors claiming the standard deduction or looking to reduce their taxable income. It can be especially beneficial to those who are subject to IRMAA, a Medicare surcharge on parts B and D. The image below will provide an overview of the additional premium costs based on income levels.

Are these three charitable giving strategies in your best interest?

These three strategies can be extremely effective to reduce taxes, minimize record keeping, and increase charitable donations. However, financial planning should be personalized, and we suggest reviewing any new strategies with a trusted advisor and tax preparer. Implementing any of these strategies will likely have an impact on your investment portfolio, tax reporting and process for making charitable donations.

If you would like to schedule a time to speak directly with Bluebird Wealth Management about these strategies, or any other personal finance topics, please reach out to us. We offer a free consultation to answer your questions and review our unique service structure.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Advisor. This information is not intended to be a substitute for specific individualized tax advice. Have questions?