Turning the Page

With most investors eager to turn the page on 2022, let’s take a look at the factors that will influence financial markets in 2023.

by Brian Sokolowski, CFA

Bluebird Wealth Management

January 27, 2023

2022 was one of the worst years ever for a Balanced portfolio (60% stocks/40% bonds). Major US stock indices were down 20% (for the S&P 500) or even more (-33% for the NASDAQ). While these declines are painful for investors, they are not extraordinary—stocks fall by 20% or more every 7 years on average. Bond returns, on the other hand, were extraordinarily poor in 2022. A major US bond index, the Bloomberg Aggregate, was down 13% in 2022. While the data varies depending upon the bond index chosen, it was likely the worst year for bonds in more than 80 years. Some observers have looked back even further, and have characterized 2022 as the worst year for bonds in centuries. The pain for an investor in a 60/40 Balanced portfolio was due to the breakdown of the historically negative correlation between stock and bond prices. In 2022 bonds did not provide their usual cushion during very weak equity markets. While painful, the good news is markets eventually recover and lower asset prices inevitably create opportunities. A bit of perspective is also warranted – it was a tough year to be an investor, but we think a comparison to the year 536 is a stretch.

It is tempting and human nature to extrapolate recent trends into the near future. This happens in both strong markets and weak. While we don’t pretend to know how 2023 will develop, we do know that 2023 will look very different than 2022. Let’s look at three of the factors that will determine the path for financial markets in 2023.

Recession?

The major question markets are grappling with currently is around the timing, length, and depth of a coming recession, rather than if there will be a recession at all. According to a survey of economists by Bloomberg, the odds of a recession in 2023 have recently increased to 65%. Bloomberg’s own proprietary research (Bloomberg Economics) indicates a 100% chance of a recession this year.

Multiple data points support the recession scenario, including:

- The December decline in retail sales marks the 4th decline in the last 6 months.

- Major manufacturing surveys, such as the Institute of Supply Management’s Purchasing Managers Index, have been heading steadily downward since mid-2021, and are now indicating contraction in the manufacturing sector.

- The Conference Board’s Leading Economic Indicator gauge is firmly negative, an indicator of a coming recession.

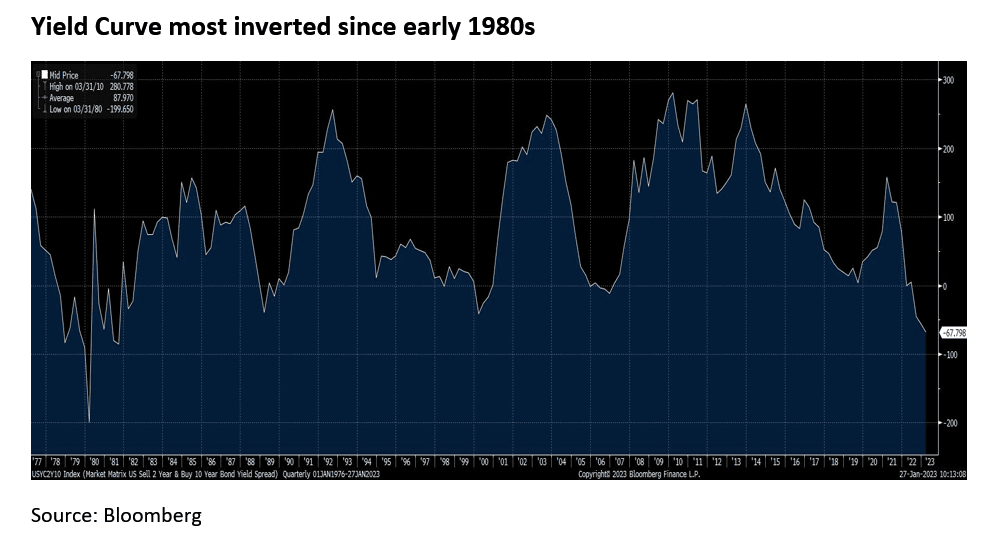

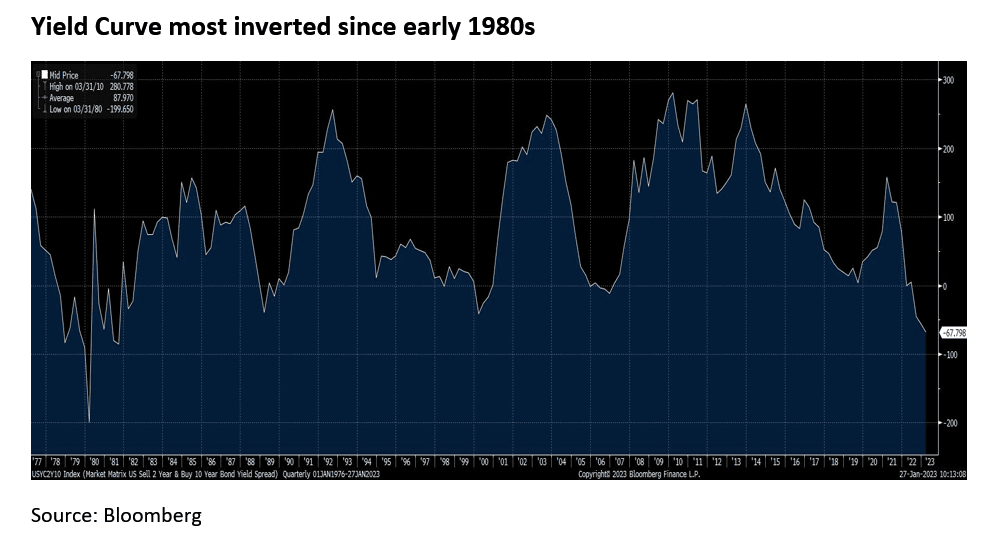

- Perhaps the most reliable recession indicator, the yield curve (the difference between short-term and long-term interest rates) remains firmly inverted across several different maturity lengths. The closely watched spread between 2 and 10 year US government bonds currently sits at -0.70%.

Equity markets are off to a strong start in 2023, partially due to optimism that the economy can thread the needle and avoid a recession, but more likely in the hope that a potential recession would be mild. There are multiple data points that support a “soft landing” scenario (generally defined as either no recession, or a mild recession).

- The US labor market remains remarkably resilient. Despite a number of high profile layoffs at technology companies, unemployment and jobless claims remain low and the labor market continues to add jobs at a steady rate. Recently announced layoffs at industrial firm 3M has raised concern that job reductions are spreading beyond the technology sector.

- The potential 2023 recession has been labeled the most anticipated recession in decades, as the Federal Reserve’s tightening program has been well-telegraphed since December 2021, allowing businesses and consumers plenty of time to adjust spending and prepare for a slowdown (contrasting the surprise recessions of 2008 and 2020). In the face of this gloom and anticipated recession, US real GDP grew 2.9% in Q4 2022, not exactly indicating recession on the horizon.

- Although not the epicenter of the economic weakness in 2022 as it was in 2007-2009, the sharp increase in mortgage rates over the past year significantly slowed housing activity in many parts of the country, with US Census Bureau data reflecting a sharp decline in new building permits during 2022. As mortgage rates have declined since peaking in fall of 2022, there are signs that housing activity is also starting to resume. Notably, pending home sales rose 3% in December, the first monthly increase since October 2021.

We are closer to the “soft landing” camp than the deep recession camp, although we recognize that this is a consensus position, indicating downside risk to equity markets if a recession were either deep or even average in depth.

Inflation

In late 2021 it became increasingly clear that the major question for equity markets in 2022 would be the path of inflation through the year. The Federal Reserve was behind the curve in its tightening regime, allowing inflation to peak above 9% during June of 2022, as measured by the Consumer Price Index (CPI). Aggressive tightening eventually began to have effect, and inflation declined at a rapid pace to close out 2022, falling to 6.5% in December. The decline from 9%+ down to 6.5% and a continued expected decline in 2023 has allowed the Fed some breathing room in its tightening program, and financial markets have responded positively to an inflation scenario that no longer appears to be “doomsday” (inflation remaining above 5% for an extended time).

While the trend on headline inflation is encouraging, the jury is still out on the more important core inflation figures, which exclude food and energy prices. Core CPI peaked at 6.7% in the fall of 2022 but has thus far remained stubbornly high at 5.5% in December. The sticky core inflation readings have forced the Fed’s rhetoric to remain hawkish, despite the more favorable headline inflation data.

Consensus expectations point to a continued moderating of inflation through 2023 (see chart below), which would obviously be welcomed by markets, but is also incorporated into current asset prices. While a return towards 9% seems unlikely at this point, there is a risk that instead of steadily declining towards the 3.7% rate that economists project on average for 2023, inflation remains stubbornly high in the 4-5% range. While this is not our assumption, a few signs indicate this as a possibility including:

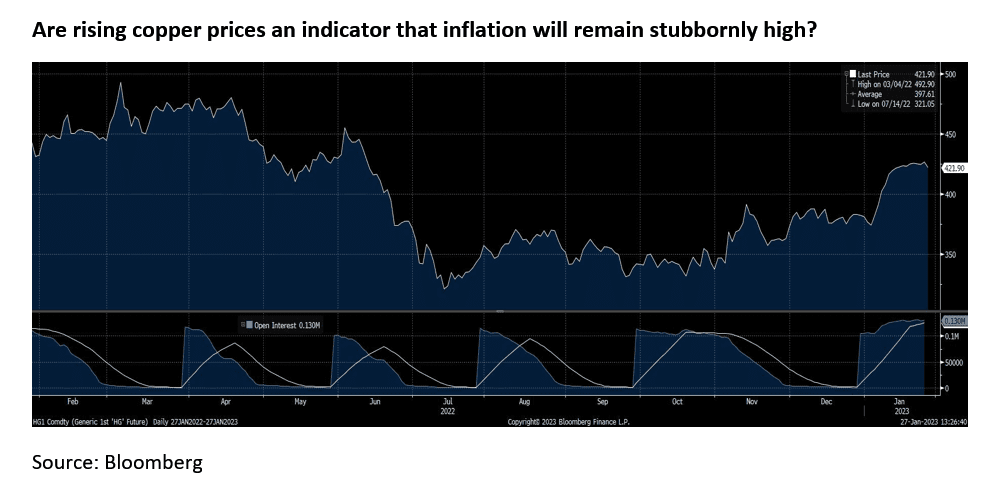

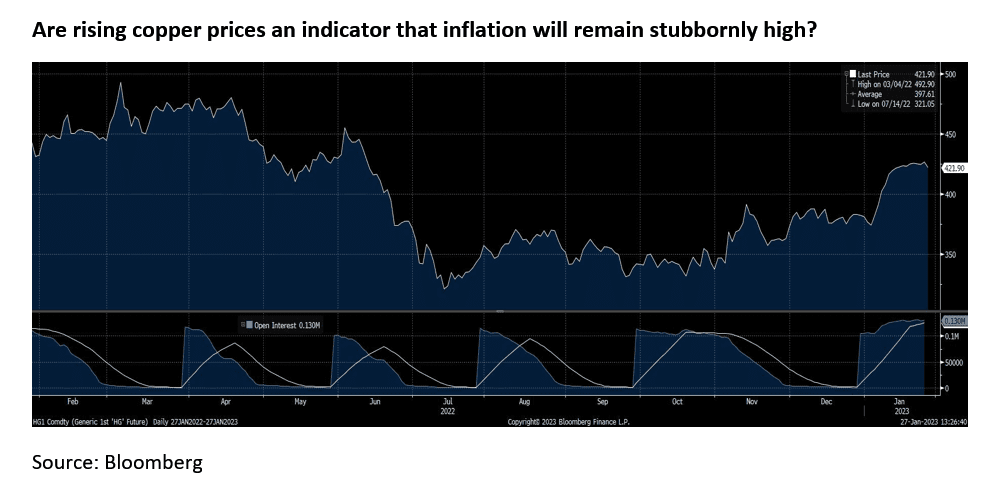

- After declining 30% from the peak in March 2022, copper prices have recently recovered and rallied 30%. Copper has long been considered a leading indicator for economic activity and inflation and could possibly be forecasting sticky inflation. Higher copper prices could also simply be reflecting China’s reopening which is inflationary to commodity prices but likely net deflationary on overall prices (due to added manufacturing and labor supply).

- While a tight labor market is supportive of a mild recession scenario, it is also the key contributor to the stickiness present thus far in the core inflation figures. Unemployment at 3.6% remains very low historically, wages are still growing faster than 6%, and the supply chain bottlenecks are largely in the rear view mirror. A full wage-price spiral appears unlikely but remains a risk to inflation and asset prices.

- Similar to employment, a nascent recovery in housing activity is both supportive of a soft-landing scenario and a risk to inflation. Higher mortgage rates and higher cost of borrowing across the economy should be enough of a governor on speculative housing activity to keep a potential resurgence from being too detrimental to overall inflation figures.

Earnings

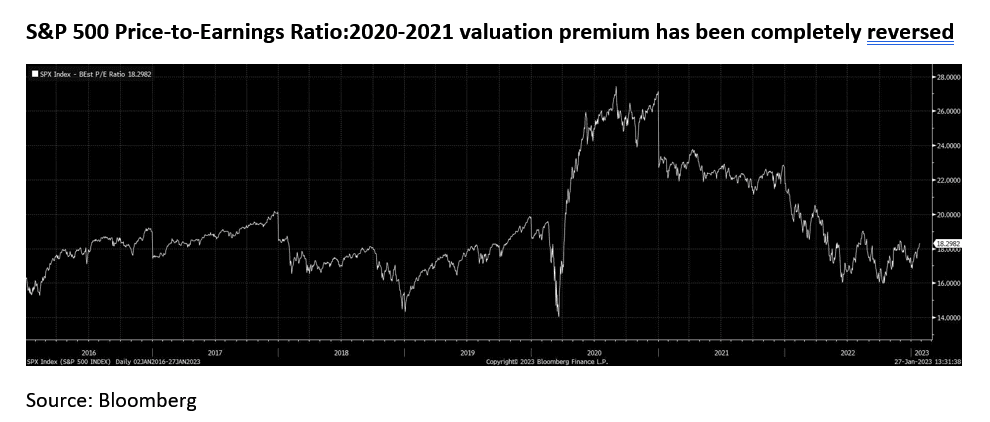

Over the long term the main driver of stock prices is the rate of earnings growth. This generally holds at the individual company and index level. Over shorter periods of time changes in expectations about future earnings, and changes in valuation level (the price multiple investors are willing to place on each dollar worth of earnings), are more significant drivers than earnings growth. Market valuation multiples increased sharply over the 2018-2021 timeframe (briefly interrupted by the early 2020 Covid recession), driving excess returns in equities (see chart below). As interest rates increased due to inflationary pressures in late 2021 and into 2022, the market has mostly reversed the valuation premiums which were placed on equities over the previous four years – more than offsetting the positive earnings growth in 2022.

With most of the equity market damage over the last year largely attributed to a resetting of valuation multiples, a popular concern now is another leg of the bear market will develop as company earnings disappoint in 2023. Current consensus estimates for the aggregate S&P 500 earnings for 2023 sit at $224, which compares to an expected $220 in 2022 – implying almost no growth year over year in aggregate S&P 500 earnings. The current 2023 estimate is already down 5% from $235 just six months ago, although many firms’ estimates still sit well below the current level. Morgan Stanley, for example, is looking for $195 in S&P 500 earnings for 2023, for a roughly 11% decline versus 2022. A decrease in estimates over recent quarters is not surprising, as this coincides with an increase in recession probability. While current estimates may still prove to be too rosy, given current consensus expectations for a mild recession or soft-landing scenario, flat S&P 500 earnings is a reasonable ballpark as a starting point. Of course, if the deep recession scenario were to occur earnings would miss the current estimates by a wide margin, pressuring stock prices lower.

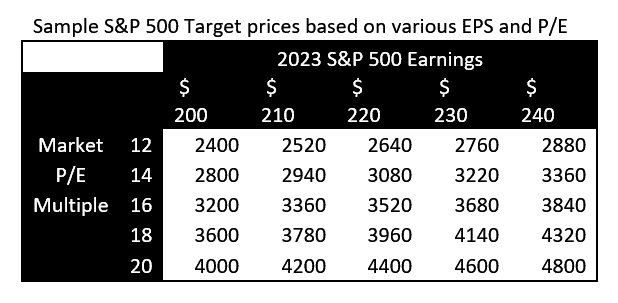

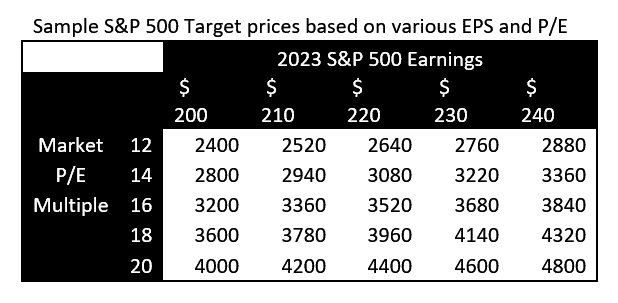

A common way for Wall Street strategists to set market price “targets” is to simply apply a price multiple on an estimate of aggregate earnings. The price multiple is somewhat arbitrary, but generally confined to the 12-20x range due to historic precedent. The earnings level is unknown, but usually falls in the range of +/- 10% from the current estimate. We can build our own simple range of targets based on these parameters:

** for simplicity we use a single year’s earnings estimates, when in practice the market will begin incorporating 2024 earnings expectations as we move through 2023. 2024 is even less knowable than 2023, but likely more important than 2023.

As evident in the chart, we can create quite a range of S&P 500 price “targets” depending on our earnings assumptions and the price multiple we decide to place on earnings. Recently, a prominent Boston-based (almost always bearish) money manager stated his bear-case target for the S&P 500 is 2200, or almost 50% lower than current levels and a 60% decline from the late 2021 peak. The mechanics of a bearish target are to place the lowest realistic price multiple on depressed (or “trough” earnings). Fortunately, market mechanics are often the opposite – since the market knows recession earnings are cyclically depressed, it does not typically place a low multiple on those earnings (except during periods of very elevated and well-embedded inflation).

So, what is our target? We do not have one. The direction of corporate earnings and the market’s expectations for levels in 2023 and 2024 are both very important, as is knowing the current multiple versus history, but placing a multiple to create a target is arbitrary and short term focused. We would much prefer to focus on identifying innovate companies with sustainable growth prospects, strong and durable competitive advantages, in attractive markets, trading at acceptable valuation levels, and own these companies in client portfolios for the next several years.

Conclusion

For simplicity we left the possibility of a Federal Reserve policy error (restrictive for too long or easing too early) out of the above discussion, although that is a meaningful risk. Our assumption is that slowing inflation would allow the Fed to pause/ease and resurgent inflation would cause the Fed to continue tightening policy above current expectations.

The three factors discussed above are clearly linked, as illustrated by labor and housing data points appearing in both the Recession and Inflation discussions. A deep recession would result in a significant slowing of inflation. Robust economic growth in 2023 would likely stoke inflation and embolden the Fed to tighten further, which would slow economic growth. Both these scenarios have partially offsetting impacts to financial asset prices. The most bullish potential scenario is somewhat better than expected economic growth with inflation declining into the 3% range.

As always, we look forward to your questions or comments.

If you would like to schedule a time to speak directly with Bluebird Wealth Management about these strategies, or any other personal finance topics, please reach out to us. We offer a free consultation to answer your questions and review our unique service structure.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This information is not intended to be a substitute for specific individualized tax or investment advice. Have questions?

Turning the Page

Turning the Page

With most investors eager to turn the page on 2022, let’s take a look at the factors that will influence financial markets in 2023.

by Brian Sokolowski, CFA

Bluebird Wealth Management

January 27, 2023

2022 was one of the worst years ever for a Balanced portfolio (60% stocks/40% bonds). Major US stock indices were down 20% (for the S&P 500) or even more (-33% for the NASDAQ). While these declines are painful for investors, they are not extraordinary—stocks fall by 20% or more every 7 years on average. Bond returns, on the other hand, were extraordinarily poor in 2022. A major US bond index, the Bloomberg Aggregate, was down 13% in 2022. While the data varies depending upon the bond index chosen, it was likely the worst year for bonds in more than 80 years. Some observers have looked back even further, and have characterized 2022 as the worst year for bonds in centuries. The pain for an investor in a 60/40 Balanced portfolio was due to the breakdown of the historically negative correlation between stock and bond prices. In 2022 bonds did not provide their usual cushion during very weak equity markets. While painful, the good news is markets eventually recover and lower asset prices inevitably create opportunities. A bit of perspective is also warranted – it was a tough year to be an investor, but we think a comparison to the year 536 is a stretch.

It is tempting and human nature to extrapolate recent trends into the near future. This happens in both strong markets and weak. While we don’t pretend to know how 2023 will develop, we do know that 2023 will look very different than 2022. Let’s look at three of the factors that will determine the path for financial markets in 2023.

Recession?

The major question markets are grappling with currently is around the timing, length, and depth of a coming recession, rather than if there will be a recession at all. According to a survey of economists by Bloomberg, the odds of a recession in 2023 have recently increased to 65%. Bloomberg’s own proprietary research (Bloomberg Economics) indicates a 100% chance of a recession this year.

Multiple data points support the recession scenario, including:

- The December decline in retail sales marks the 4th decline in the last 6 months.

- Major manufacturing surveys, such as the Institute of Supply Management’s Purchasing Managers Index, have been heading steadily downward since mid-2021, and are now indicating contraction in the manufacturing sector.

- The Conference Board’s Leading Economic Indicator gauge is firmly negative, an indicator of a coming recession.

- Perhaps the most reliable recession indicator, the yield curve (the difference between short-term and long-term interest rates) remains firmly inverted across several different maturity lengths. The closely watched spread between 2 and 10 year US government bonds currently sits at -0.70%.

Equity markets are off to a strong start in 2023, partially due to optimism that the economy can thread the needle and avoid a recession, but more likely in the hope that a potential recession would be mild. There are multiple data points that support a “soft landing” scenario (generally defined as either no recession, or a mild recession).

- The US labor market remains remarkably resilient. Despite a number of high profile layoffs at technology companies, unemployment and jobless claims remain low and the labor market continues to add jobs at a steady rate. Recently announced layoffs at industrial firm 3M has raised concern that job reductions are spreading beyond the technology sector.

- The potential 2023 recession has been labeled the most anticipated recession in decades, as the Federal Reserve’s tightening program has been well-telegraphed since December 2021, allowing businesses and consumers plenty of time to adjust spending and prepare for a slowdown (contrasting the surprise recessions of 2008 and 2020). In the face of this gloom and anticipated recession, US real GDP grew 2.9% in Q4 2022, not exactly indicating recession on the horizon.

- Although not the epicenter of the economic weakness in 2022 as it was in 2007-2009, the sharp increase in mortgage rates over the past year significantly slowed housing activity in many parts of the country, with US Census Bureau data reflecting a sharp decline in new building permits during 2022. As mortgage rates have declined since peaking in fall of 2022, there are signs that housing activity is also starting to resume. Notably, pending home sales rose 3% in December, the first monthly increase since October 2021.

We are closer to the “soft landing” camp than the deep recession camp, although we recognize that this is a consensus position, indicating downside risk to equity markets if a recession were either deep or even average in depth.

Inflation

In late 2021 it became increasingly clear that the major question for equity markets in 2022 would be the path of inflation through the year. The Federal Reserve was behind the curve in its tightening regime, allowing inflation to peak above 9% during June of 2022, as measured by the Consumer Price Index (CPI). Aggressive tightening eventually began to have effect, and inflation declined at a rapid pace to close out 2022, falling to 6.5% in December. The decline from 9%+ down to 6.5% and a continued expected decline in 2023 has allowed the Fed some breathing room in its tightening program, and financial markets have responded positively to an inflation scenario that no longer appears to be “doomsday” (inflation remaining above 5% for an extended time).

While the trend on headline inflation is encouraging, the jury is still out on the more important core inflation figures, which exclude food and energy prices. Core CPI peaked at 6.7% in the fall of 2022 but has thus far remained stubbornly high at 5.5% in December. The sticky core inflation readings have forced the Fed’s rhetoric to remain hawkish, despite the more favorable headline inflation data.

Consensus expectations point to a continued moderating of inflation through 2023 (see chart below), which would obviously be welcomed by markets, but is also incorporated into current asset prices. While a return towards 9% seems unlikely at this point, there is a risk that instead of steadily declining towards the 3.7% rate that economists project on average for 2023, inflation remains stubbornly high in the 4-5% range. While this is not our assumption, a few signs indicate this as a possibility including:

- After declining 30% from the peak in March 2022, copper prices have recently recovered and rallied 30%. Copper has long been considered a leading indicator for economic activity and inflation and could possibly be forecasting sticky inflation. Higher copper prices could also simply be reflecting China’s reopening which is inflationary to commodity prices but likely net deflationary on overall prices (due to added manufacturing and labor supply).

- While a tight labor market is supportive of a mild recession scenario, it is also the key contributor to the stickiness present thus far in the core inflation figures. Unemployment at 3.6% remains very low historically, wages are still growing faster than 6%, and the supply chain bottlenecks are largely in the rear view mirror. A full wage-price spiral appears unlikely but remains a risk to inflation and asset prices.

- Similar to employment, a nascent recovery in housing activity is both supportive of a soft-landing scenario and a risk to inflation. Higher mortgage rates and higher cost of borrowing across the economy should be enough of a governor on speculative housing activity to keep a potential resurgence from being too detrimental to overall inflation figures.

Earnings

Over the long term the main driver of stock prices is the rate of earnings growth. This generally holds at the individual company and index level. Over shorter periods of time changes in expectations about future earnings, and changes in valuation level (the price multiple investors are willing to place on each dollar worth of earnings), are more significant drivers than earnings growth. Market valuation multiples increased sharply over the 2018-2021 timeframe (briefly interrupted by the early 2020 Covid recession), driving excess returns in equities (see chart below). As interest rates increased due to inflationary pressures in late 2021 and into 2022, the market has mostly reversed the valuation premiums which were placed on equities over the previous four years – more than offsetting the positive earnings growth in 2022.

With most of the equity market damage over the last year largely attributed to a resetting of valuation multiples, a popular concern now is another leg of the bear market will develop as company earnings disappoint in 2023. Current consensus estimates for the aggregate S&P 500 earnings for 2023 sit at $224, which compares to an expected $220 in 2022 – implying almost no growth year over year in aggregate S&P 500 earnings. The current 2023 estimate is already down 5% from $235 just six months ago, although many firms’ estimates still sit well below the current level. Morgan Stanley, for example, is looking for $195 in S&P 500 earnings for 2023, for a roughly 11% decline versus 2022. A decrease in estimates over recent quarters is not surprising, as this coincides with an increase in recession probability. While current estimates may still prove to be too rosy, given current consensus expectations for a mild recession or soft-landing scenario, flat S&P 500 earnings is a reasonable ballpark as a starting point. Of course, if the deep recession scenario were to occur earnings would miss the current estimates by a wide margin, pressuring stock prices lower.

A common way for Wall Street strategists to set market price “targets” is to simply apply a price multiple on an estimate of aggregate earnings. The price multiple is somewhat arbitrary, but generally confined to the 12-20x range due to historic precedent. The earnings level is unknown, but usually falls in the range of +/- 10% from the current estimate. We can build our own simple range of targets based on these parameters:

** for simplicity we use a single year’s earnings estimates, when in practice the market will begin incorporating 2024 earnings expectations as we move through 2023. 2024 is even less knowable than 2023, but likely more important than 2023.

As evident in the chart, we can create quite a range of S&P 500 price “targets” depending on our earnings assumptions and the price multiple we decide to place on earnings. Recently, a prominent Boston-based (almost always bearish) money manager stated his bear-case target for the S&P 500 is 2200, or almost 50% lower than current levels and a 60% decline from the late 2021 peak. The mechanics of a bearish target are to place the lowest realistic price multiple on depressed (or “trough” earnings). Fortunately, market mechanics are often the opposite – since the market knows recession earnings are cyclically depressed, it does not typically place a low multiple on those earnings (except during periods of very elevated and well-embedded inflation).

So, what is our target? We do not have one. The direction of corporate earnings and the market’s expectations for levels in 2023 and 2024 are both very important, as is knowing the current multiple versus history, but placing a multiple to create a target is arbitrary and short term focused. We would much prefer to focus on identifying innovate companies with sustainable growth prospects, strong and durable competitive advantages, in attractive markets, trading at acceptable valuation levels, and own these companies in client portfolios for the next several years.

Conclusion

For simplicity we left the possibility of a Federal Reserve policy error (restrictive for too long or easing too early) out of the above discussion, although that is a meaningful risk. Our assumption is that slowing inflation would allow the Fed to pause/ease and resurgent inflation would cause the Fed to continue tightening policy above current expectations.

The three factors discussed above are clearly linked, as illustrated by labor and housing data points appearing in both the Recession and Inflation discussions. A deep recession would result in a significant slowing of inflation. Robust economic growth in 2023 would likely stoke inflation and embolden the Fed to tighten further, which would slow economic growth. Both these scenarios have partially offsetting impacts to financial asset prices. The most bullish potential scenario is somewhat better than expected economic growth with inflation declining into the 3% range.

As always, we look forward to your questions or comments.

If you would like to schedule a time to speak directly with Bluebird Wealth Management about these strategies, or any other personal finance topics, please reach out to us. We offer a free consultation to answer your questions and review our unique service structure.

Turning the Page

Turning the Page