The Great Recalibration

by Brian Sokolowski, CFA

Bluebird Wealth Management

Last Thursday, Cleveland Federal Reserve Bank President Loretta Mester characterized the current Federal Reserve policy stance as “the great recalibration of monetary policy”. While Ms. Mester referred to the “real extraordinary level of accommodation that was needed at the start of the pandemic (emphasis added)”, it appears that the Fed needs to unwind more than just the most recent, extra layer of accommodation added in 2020 (and left in place too long), but also the already-accommodative policy which was in place heading into the pandemic-induced recession in early 2020.

President Mester’s comments are the latest in a parade of Federal Reserve officials signaling the coming tightening (normalizing) of the Fed’s monetary policy to combat the highest US inflation in 40 years. While the Fed has barely begun moving in terms of actual policy actions to tighten monetary policy, financial markets have priced in at least a portion of pending Fed actions largely through a rapid and sharp increase in interest rates across the yield curve – which is exactly what Federal Reserve officials were hoping would happen. Assets are being repriced (recalibrated) towards a “normal” level of monetary policy/interest rates, high-frequency economic indicators are slowing, and the probability of a recession in the US over the coming quarters is increasing.

Markets Update

The first quarter of 2022 was notable in multiple ways, with many trends continuing into April. A late-March rally for the S&P 500 left the index down only 4.6% for the quarter, in which it fared much better than many other equity and bond indices. The NASDAQ returned -9% and the Russell Small Cap Index declined 7.5%. Particularly striking – and at the heart of financial market weakness – was the return of bonds in the first quarter. The Barclays Government/Credit Index, for example, returned -6.3% in the first quarter as interest rates rapidly increased across the yield curve, pressuring bond prices. Selling resumed in April, and as of April 22 the S&P 500 and bonds are each down almost 10% for the year, with the NASDAQ down almost 18%.

Inflation

After a year of hot inflation data with CPI approaching 8% and not proving “transitory” as previously characterized by Chair Powell, the US Federal Reserve made an abrupt pivot in December 2021, clearly communicating to markets that combating inflation is the Federal Reserve’s primary objective at this time. Since December, market expectations of the number and level of interest rate increases have climbed as a myriad of Fed officials have consistently communicated the need for tighter policy. Global geopolitics have not helped the situation. The war in Ukraine is inflationary at exactly the wrong time for the Federal Reserve and the global economy. China’s repeated lockdowns to combat covid are the latest inflationary pressure.

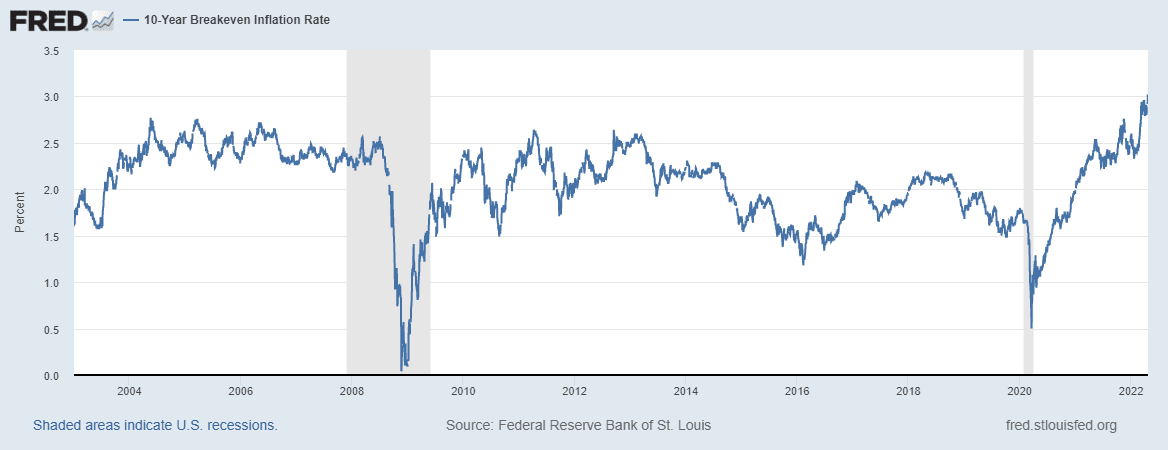

While recent inflation readings in the 8% range are very elevated, long-term forward inflation expectations have also risen sharply over recent quarters, although remain only modestly above historic levels. The Ten-Year Breakeven Inflation Rate is a measure of market expectations for long-term inflation that is closely monitored by the Federal Reserve. The measure recently hit 3%, having quickly risen from the 2%- 2.5% range it held throughout 2021 and the roughly 2% average of the 2014-2019 period. The 3% reading implies market expectations are for future inflation levels to cool substantially from the current level. But 3% is the highest reading in the (short) 20-year history of the data series, indicating the urgency of the situation facing the Fed – it is imperative that long-run inflation expectations do not become unanchored, or too far above its 2% target.

Market expectations for long-term inflation levels have rapidly increased

Source: St. Louis Federal Reserve

Slamming on the Brakes

If overly accommodative monetary policy is the root cause of current inflation, global supply disruptions are also partially responsible; initiated during the pandemic-driven supply disruptions of 2020-2021, and now exacerbated by the war in Ukraine and yet another wave of covid shutdowns in China. Unfortunately, the Federal Reserve has few or no tools to induce a supply response to these issues. The Fed is limited to the blunt instrument of demand destruction, largely through the repricing of money (higher interest rates), which in turn slows economic activity and inflation, hopefully.

Despite only one increase in the Fed Funds policy rate thus far, to 0.25%, the US 2-Year Treasury yield has increased from 0.20% in April 2021 to 2.55% currently. The 2-Year Treasury yield is set by the market and is regarded as the future path of the Fed Funds policy rate –indicating the market is pricing in a further ~2% increase in the Fed Funds rate.

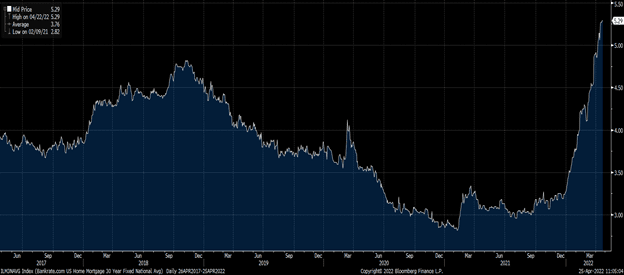

A measure that will hit home for many Americans is the impact of recent Fed actions on the cost of mortgage borrowing, with 30 Year conforming mortgage rates averaging 5.3% currently, up from 3.25% at the beginning of 2022 – the sharpest increase in the 20+ year history of the Bankrate 30 Year Mortgage Index, and reminiscent of the rapid expansion of mortgage rates in the 1980s. The 1980s comparison ends at the speed of a 2% increase in mortgage rates, however, as at 5.3% the current rate is a fraction of the high-teens rates of the 1980s. It is also lower than the average rate through most of the 2000-2010 timeframe, and only modestly above the 4.80% level in 2018.

A meteoric rise in mortgage rates to cool housing and rent inflation

Source: Bloomberg

The rising cost of money is already beginning to have the Fed’s desired impact on demand destruction in various parts of the economy, which should eventually result in lower inflation. Recent high frequency economic data which indicates cooling include:

• A sharp reduction in the Philadelphia Fed’s business activity survey, and even steeper decline in the new orders category. These readings likely presage a coming contraction in the widely followed Purchasing Managers Index compiled by the Institute for Supply Management.

• The lowest reading on the University of Michigan Consumer Sentiment Index since 2011.

• 5% reduction in weekly mortgage applications, continuing the trend of declines in 2022

• Falling commodity prices, including oil (-20% from peak); copper (down 10% from peak); lumber (down 33% from peak), and others.

Rising Recession Risk

The increasingly hawkish tone from Chairman Powell and other Fed governors in recent months, and the resulting impact on interest rates and economic activity, has increased the risk of a recession in the US over coming quarters. A recurring survey of economists by Bloomberg indicates the probability of a recession over the coming 12 months has increased from 10% a year ago to 25% currently. An historically reliable indicator of recessions is an inverted yield curve – if short term interest rates are higher than longer term interest rates, the US economy has tended towards a recession in subsequent quarters. Portions of the curve flashed inverted for brief periods in 2022, although the fact that it did not (yet) remain inverted for very long may limit the predictive capacity of the measure. Finally, stock prices and returns within sectors and styles of the equity market are indicating that recession odds have increased.

Chairman Powell has stated that the Fed’s goal is to reduce inflation back towards the long-term target of 2% while not inducing a recession in the process, dubbed a “soft landing”. This is a very difficult, and perhaps impossible, feat to maneuver with few analogs of success in the past. Our assumption is the probability of recession will continue to increase over coming months. The Federal Reserve has made its position very clear – a US recession would be an acceptable cost to rein in inflation. This is the Powell Fed’s “Volcker moment.”

Financial Markets

How has 2022 market activity impacted portfolio construction and return expectations? Of course, current portfolio values have generally been negatively impacted for both equities and fixed income, depending on sector exposure and other factors. Looking forward there are some positive developments emerging in the current markets for various types of investors.

Bonds

While volatility and drawdowns are an expected (although uncomfortable) feature of equity markets, sharp and protracted declines in bond prices are an experience that is for the most part unfamiliar to investors over the past 50 years. The 6.3% decline for the Barclays Govt/Credit Index in the first quarter 2022 is the second largest decline for bonds over the past 50 years – trailing only the 8.3% decline of the first quarter of 1980. Roughly half of the periods with quarterly declines for bonds over the past 50 years have coincided with positive equity market returns, cushioning the impact for most investors. For a Balanced portfolio of 50% bonds and 50% stocks (comprised equally of the Barclays Govt/Credit Index and the S&P 500), the Q1 2022 return of -5.6% ranks amongst the worst 10 quarters of the last 50 years. Extending out through last Friday, April 22, the Balanced portfolio decrease of almost 10% likely ranks amongst the three worst 4-month periods over the last 50 years.

Fortunately, there are three critical silver linings to recent bond returns:

-

Many of the worst quarters for Balanced portfolios over this period were soon followed by some of the best quarters over the period.

-

For bond investors that generally buy and hold bonds to maturity with “laddered” bond portfolios largely comprised of relatively short to medium maturity, high-quality bonds, bond price movements are only minimally relevant, as any price depreciation/appreciation is unrealized unless sold, and if the credits remain solvent the bonds will mature at par regardless of price fluctuations preceding maturity.

-

Declining bond prices/higher interest rates provide for increased returns on new bond purchases. In recent weeks we have been purchasing bonds that mature in 5 years or less, from high quality corporate issuers, with yields approaching 4% – double the rate that we were able to buy only a short time ago. This factor is especially favorable to those in or nearing retirement who are now able to earn rates of return meaningfully closer to expected long-term equity returns, allowing for lower equity exposure in a portfolio to achieve long term return targets.

Equities

The improved relative attractiveness of bonds as compared to stocks is one way in which higher interest rates pressure stock prices. In recent years, the prolonged period of low interest rates gave rise to the acronym TINA, for “There is No Alternative” to stocks to meet portfolio return targets. One of our favorite examples in recent years has been to compare the dividend yield on Johnson and Johnson (JNJ) stock to the yield-to-maturity on a 5-year JNJ bond. For much of the past ten years, the stock’s dividend yield has exceeded the bond yield, often by a meaningful margin. This relationship has recently reversed, with the bond yield of 3.2% now exceeding the stock’s yield of 2.4%, a more “normal” historical relationship.

Higher interest rates also reduce the attractiveness of stocks generally, and long duration growth stocks especially, by increasing the rate at which future company earnings are discounted and therefore reducing the prices that investors are willing to pay for those future cash flows. This factor helps to explain the difference between the returns for Utilities or Consumer Staples equities in 2022 (+5% return, including dividends) which have plenty of near-term earnings, versus Netflix (-66% return) where the bulk of earnings are years in the future.

Bear markets bring opportunities, although timing is uncertain and uneven across the market. While the capitalization-weighted S&P 500 is not in a bear market and is only down 10% from its peak, the average US stock is down over 30% from its peak and more than half of NASDAQ issues are down over 50% from their peak, offering potentially attractive opportunities for investment at reduced valuations.

While many of the highest-flying growth stocks of 2020 have fallen 75% or more from their peak price (examples include Zoom Video or Peloton), there are still questions regarding future demand and valuation with many of these companies. Winners will emerge, although the valuation cases do not appear to be particularly clear for this cohort right now. This contrasts with a company such as Facebook (Meta Platforms) that is currently trading at 13.5x expected 2022 earnings as compared to its 5-year average of over 20x, following its recent 50% share price decline. We do not currently own, or have not recently owned, Facebook shares for clients, but believe it is a good illustration for valuation opportunities that are finally emerging in certain growth equities. While the benefits of these equity opportunities may take longer to materialize than the opportunities arising in bonds (and clearly carry higher risk in the near-term, particularly if recession risks continue to increase), they are likely more significant and attractive for patient investors with long-term horizons.

I look forward to your questions and comments. – Brian