Drowning in Gloom

by Brian Sokolowski, CFA

Bluebird Wealth Management

After initially hearing the phrase “Drowning in Gloom” on Bloomberg Radio while on a road trip with my son in early August it has been replaying in my head often over recent weeks. The phrase was delivered by Bloomberg Surveillance host Tom Keene (noted skeptic, Red Sox fan, and hardly a perma-bull) to describe the current zeitgeist of financial markets. There was a brief hiatus in the gloom as equity markets rallied for a few months beginning in mid-June but it returned with a vengeance leading up to and following Federal Reserve Chair Powell’s recent speech in Jackson Hole, where he reiterated the Fed’s commitment to crush inflation – despite likely “pain to businesses and households” in the process. Given the Fed’s intention to tighten monetary policy, even into a possible recession, gloom is a reasonable condition for markets currently.

As active investment managers, part of our job is to follow high frequency economic data and react quickly to changing markets. However, we have found that our greatest success has been in focusing on evolving, durable trends, and the long-term investment opportunities (and risks) created from an altering landscape. While it is tempting to get distracted by near term predictions and action (when will the market bottom? which stocks will outperform over the next few months? how much lower can the market go? are investors gloomy enough?), our goal is to remain disciplined in our process of identifying investment opportunities for the next 3+ years, not 3 months.

While this is our goal in all market environments, bear markets make a long-term focus both more difficult and potentially more rewarding. The former is self-explanatory, as it is human nature to focus on downside risk during difficult times. As for the latter, we are not referring to the common advice to remain invested during a bear market (although that is often sound advice), but rather to the idea that bouts of market turbulence often occur during periods of significant change. Widespread market declines have a way of obscuring underlying, enduring changes in trends in the economy or markets, and different circumstances are in place on the other end. Or, to paraphrase a former colleague, “the leaders of the next cycle will be different from the leaders of the last cycle”.

While we do not know how long the current state of gloom will prevail, we remain focused on long-term, secular shifts that are underway. Below we discuss three of these potential shifts, each in a slightly different category of portfolio management: one related to a sector of the economy, one related to equity investment styles or factors, and one related to financial return expectations.

Energy

For years the fossil fuel industry has been under pressure on many fronts, due to several well-known reasons. From an investment perspective, the combination of the expected decline of the internal combustion engine, increasing focus on environmental concerns by investors, and a lack of capital discipline in the industry earlier this century resulted in years of meager stock returns for the energy sector. Exxon Mobil’s share price, for example, was at the same level in 2020 that it was in 1998. While oil and gas stocks were languishing in the 2015-2020 timeframe, many management teams were overhauling their exploration and production budgets and strategies, resulting in stocks that were once again “investable”, at least on a purely economic basis. This change, along with tight global capacity, increasing reluctance to invest in traditional energy infrastructure in western economies, and extremely cheap valuations (of the stocks and the underlying commodities) led to strong returns for the sector off the pandemic lows in the spring of 2020, even prior to Russia’s invasion of Ukraine.

Russia’s invasion of Ukraine marks a key turning point for global energy policy in our opinion, not a passing cyclical event. While transition away from fossil fuels remains the long-term goal of most governments, the stark reality that fossil fuels are still critical for many more years is becoming very clear, and energy independence (or at least access to energy from reliable and friendly nations) is critical. The pain of managing the transition is most acutely felt in Europe, but governments around the world are enacting policy in support of both traditional and renewable power generation, such as:

- Japan is moving to restart several idled nuclear reactors due to a potential disruption in gas supplies from Russia.

- The Biden Administration and Congressional Democrats were forced to make concessions and include some favorable provisions for fossil fuel production to the renewable energy provisions in the Inflation Reduction Act, resulting is an “all of the above” policy to spur energy investment.

- Europe is scrambling to secure energy supplies both in the near and long term, and with a preferred focus on renewables, but also in traditional forms to bridge the gap. France, for example, is planning to build at least 14 more nuclear reactors, a 10x increase in solar capacity by 2050, hydrogen investments with the UAE, and an increase in liquefied natural gas imports. The incoming UK government is planning to end the ban against fracking and approve new drilling permits in the North Sea.

The challenge of the transition to renewable energy sources was evident recently in two announcements in California. The first was that internal combustion automobiles would no longer be sold in the state beginning in 2035. Only a few days later, the state’s grid operator asked electric vehicle owners to limit when they powered their vehicles.

Energy has not been an investment focus area for us for the past several years. We are not necessarily bullish on oil and natural gas prices over the long-term, because the increased investment noted above and the transition to renewables should help to keep prices of fossil fuels generally in-check. We are highly confident that a new, higher level of investment in the wider energy industry is here to stay for many years and continue to identify areas to gain exposure in client portfolios, including solar and other renewable companies, traditional fossil fuel producers, energy storage, suppliers to traditional energy, and energy infrastructure.

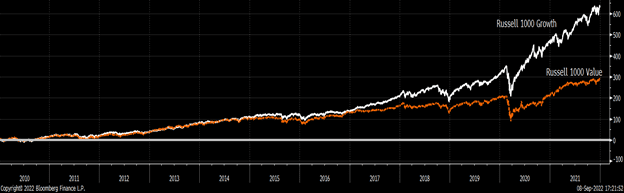

Growth is not dead; widespread stratospheric valuations are dead

For more than a decade following the Great Financial Crisis the equity market was led by growth stocks. From 2010-2021, growth stocks returned more than twice the amount of value stocks, as measured by the Russell 1000 Growth and Value Indices (see chart). Value and international outperformed US and growth stocks during the 2000-2007 timeframe, as investors poured money into emerging markets and commodity-related investments. Following the GFC, the run of growth outperformance began the way many bull markets begin, with cheap valuations and skepticism – in this case it was the lingering caution towards growth and technology stocks born out of the dot.com crash and subsequent recession. Fundamentals were also increasingly strong through the decade, with a growth and productivity boom driven by the digitization of everything – from semiconductors in parking garages to inform drivers how many parking spaces were available, to a transformation of business software, to ads following us from device to device.

Growth returns more than doubled Value returns from 2010-2021

Source: Bloomberg

Value had its temporary periods of outperformance, but growth dominated the 13-year period. For much of this run, valuations of large growth stocks generally remained reasonable versus historical levels. The pandemic and its aftermath altered the equation – serving as a blow off top for growth stocks, catapulting valuations to unsustainably high levels for even the best growth companies and expanding the list of premium valuations to many companies that did not hold defensible competitive positions. Fueling the excess along the way was easy Federal Reserve policy, and seemingly never-ending government fiscal stimulus, constantly fighting against any sign of economic slowdown.

With the trigger of high inflation causing the Fed to not only step away from years of overly accommodative policy, but begin to move towards restrictive policy, many are questioning the outlook for growth investing over coming years. We disagree with this sentiment and are confident that not only will there always be a place for well-run companies with durable competitive advantages in client portfolios, but these are the companies that will continue to lead the market over almost all longer time periods. Sustainable, profitable cash flow growth will remain the fuel that drives investment returns, even as we enter a period of tighter monetary policy. This applies regardless of company sector or “growth” or “value” classification by the index providers.

There has been a notable and warranted change in market perception around the most speculative companies, with the era of loose policy ending these companies will once again need to prove profitable growth before being rewarded with premium valuations. Even the true growth leaders will trade at lower valuations than the stratospheric levels of the last few years. While this will serve to limit returns somewhat, it still results in plenty of opportunity in innovative growth companies.

Shifting return expectations

Among many trends of the 2010-2021 era, excess equity returns were one of the most impactful on investor psychology. The S&P 500 compounded at an annual rate of 15% over this period, for a total return of almost 450%. This level was almost twice the long-run average of 9% per year. Due to the unsustainably high returns of this period and the elevated valuations of the last few years, we had been using below average long-term forward return assumptions when building financial plans for clients – we have typically been in the 6-7% per year range in our plan assumptions. With the market declines this year, and equity valuations declining towards historical averages (see chart), our long-term forward equity return assumptions are inching back closer to their historical levels. We are currently assuming 8% per year.

S&P 500 Forward P/E Ratio is slightly above its long-term average

While these may appear to be small differences in return assumptions, there are a few important takeaways. First, despite the current state of gloom and significant near-term risks, our forward long-term equity return assumptions have increased since the beginning of the year, not decreased. Second, while our equity return assumptions have increased, it is important to note that they still remain well beneath the returns of the past decade, which were unsustainably high at 15% per year over an extended period. We do not believe investors should expect returns of that magnitude going forward.

Equity market declines have been driven by rising interest rates, which have also resulted in pressure on bond prices, which move inversely to interest rates. Returns for bonds this year have been almost as bad as equity returns, with many bond indices declining by 12% or more year-to-date. While the prices of current bonds held decrease for the time being (but still mature at par for investors in individual bonds), new bonds are available for purchase at significantly higher yields. This is especially important for investors in need of current income, such as those in or approaching retirement or pension plans. There are many high-quality corporate bonds available at yields to maturity in the 4-5% range or higher (per year), twice the yields available less than 12 months ago. If the Federal Reserve is successful in bringing inflation back towards its long-term target of 2%, bond returns of 4%+ can have a meaningful positive impact on return profile and portfolio construction for many investors. For example, a 6% return target can now potentially be achieved through a 50/50 allocation to stocks and bonds, versus requiring a 70 or 80% allocation to equities in recent years – dramatically reducing volatility in portfolios, although at the cost of foregoing potential upside if equity returns were to meet or exceed historical levels.

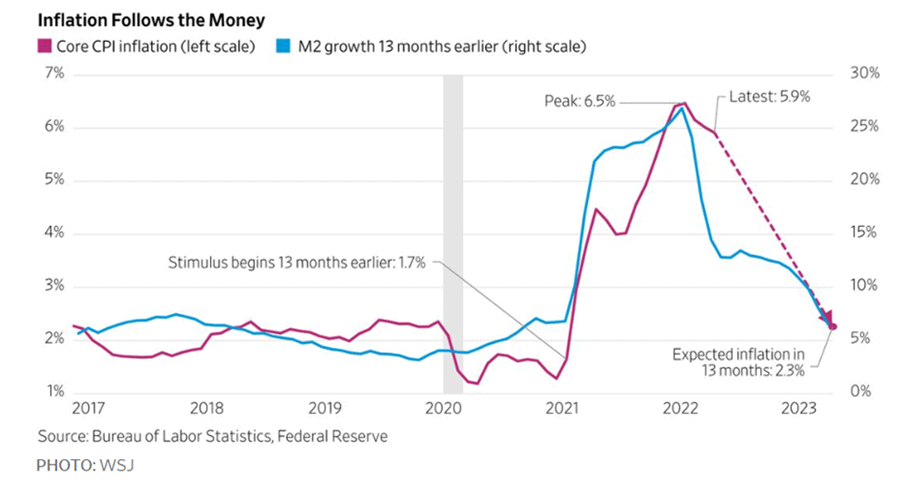

Could CPI be under 3% in 2023?

Gloom, for now

Markets face numerous risks including: an inverted yield curve, US recession or “growth recession”, extremely high inflation, a potential policy mistake from the Federal Reserve, a potentially severe winter energy crisis in Europe, and continued property and Covid-related challenges in China. Gloom is logical, as is increased caution. On the positive side of the ledger: these risks are well-known by investors, markets tend to lead both the onset and resolution of risks, inflation could fall faster than expected (see chart above) and investor sentiment is very poor which is often a precursor of better equity returns. Rather than attempting to predict the bottom or end of the current set of concerns, we are looking forward and identifying opportunities in the renewable and traditional energy sector, buying select quality growth stocks at discounted valuations, and where appropriate adding bonds to portfolios at significantly higher yields.

– Brian

Drowning in Gloom

by Brian Sokolowski, CFA

Bluebird Wealth Management

After initially hearing the phrase “Drowning in Gloom” on Bloomberg Radio while on a road trip with my son in early August it has been replaying in my head often over recent weeks. The phrase was delivered by Bloomberg Surveillance host Tom Keene (noted skeptic, Red Sox fan, and hardly a perma-bull) to describe the current zeitgeist of financial markets. There was a brief hiatus in the gloom as equity markets rallied for a few months beginning in mid-June but it returned with a vengeance leading up to and following Federal Reserve Chair Powell’s recent speech in Jackson Hole, where he reiterated the Fed’s commitment to crush inflation – despite likely “pain to businesses and households” in the process. Given the Fed’s intention to tighten monetary policy, even into a possible recession, gloom is a reasonable condition for markets currently.

As active investment managers, part of our job is to follow high frequency economic data and react quickly to changing markets. However, we have found that our greatest success has been in focusing on evolving, durable trends, and the long-term investment opportunities (and risks) created from an altering landscape. While it is tempting to get distracted by near term predictions and action (when will the market bottom? which stocks will outperform over the next few months? how much lower can the market go? are investors gloomy enough?), our goal is to remain disciplined in our process of identifying investment opportunities for the next 3+ years, not 3 months.

While this is our goal in all market environments, bear markets make a long-term focus both more difficult and potentially more rewarding. The former is self-explanatory, as it is human nature to focus on downside risk during difficult times. As for the latter, we are not referring to the common advice to remain invested during a bear market (although that is often sound advice), but rather to the idea that bouts of market turbulence often occur during periods of significant change. Widespread market declines have a way of obscuring underlying, enduring changes in trends in the economy or markets, and different circumstances are in place on the other end. Or, to paraphrase a former colleague, “the leaders of the next cycle will be different from the leaders of the last cycle”.

While we do not know how long the current state of gloom will prevail, we remain focused on long-term, secular shifts that are underway. Below we discuss three of these potential shifts, each in a slightly different category of portfolio management: one related to a sector of the economy, one related to equity investment styles or factors, and one related to financial return expectations.

Energy

For years the fossil fuel industry has been under pressure on many fronts, due to several well-known reasons. From an investment perspective, the combination of the expected decline of the internal combustion engine, increasing focus on environmental concerns by investors, and a lack of capital discipline in the industry earlier this century resulted in years of meager stock returns for the energy sector. Exxon Mobil’s share price, for example, was at the same level in 2020 that it was in 1998. While oil and gas stocks were languishing in the 2015-2020 timeframe, many management teams were overhauling their exploration and production budgets and strategies, resulting in stocks that were once again “investable”, at least on a purely economic basis. This change, along with tight global capacity, increasing reluctance to invest in traditional energy infrastructure in western economies, and extremely cheap valuations (of the stocks and the underlying commodities) led to strong returns for the sector off the pandemic lows in the spring of 2020, even prior to Russia’s invasion of Ukraine.

Russia’s invasion of Ukraine marks a key turning point for global energy policy in our opinion, not a passing cyclical event. While transition away from fossil fuels remains the long-term goal of most governments, the stark reality that fossil fuels are still critical for many more years is becoming very clear, and energy independence (or at least access to energy from reliable and friendly nations) is critical. The pain of managing the transition is most acutely felt in Europe, but governments around the world are enacting policy in support of both traditional and renewable power generation, such as:

- Japan is moving to restart several idled nuclear reactors due to a potential disruption in gas supplies from Russia.

- The Biden Administration and Congressional Democrats were forced to make concessions and include some favorable provisions for fossil fuel production to the renewable energy provisions in the Inflation Reduction Act, resulting is an “all of the above” policy to spur energy investment.

- Europe is scrambling to secure energy supplies both in the near and long term, and with a preferred focus on renewables, but also in traditional forms to bridge the gap. France, for example, is planning to build at least 14 more nuclear reactors, a 10x increase in solar capacity by 2050, hydrogen investments with the UAE, and an increase in liquefied natural gas imports. The incoming UK government is planning to end the ban against fracking and approve new drilling permits in the North Sea.

The challenge of the transition to renewable energy sources was evident recently in two announcements in California. The first was that internal combustion automobiles would no longer be sold in the state beginning in 2035. Only a few days later, the state’s grid operator asked electric vehicle owners to limit when they powered their vehicles.

Energy has not been an investment focus area for us for the past several years. We are not necessarily bullish on oil and natural gas prices over the long-term, because the increased investment noted above and the transition to renewables should help to keep prices of fossil fuels generally in-check. We are highly confident that a new, higher level of investment in the wider energy industry is here to stay for many years and continue to identify areas to gain exposure in client portfolios, including solar and other renewable companies, traditional fossil fuel producers, energy storage, suppliers to traditional energy, and energy infrastructure.

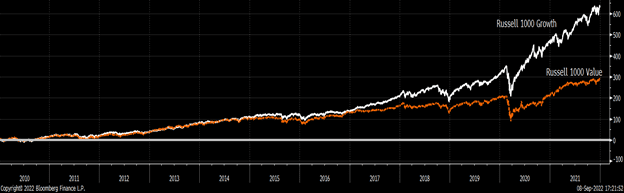

Growth is not dead; widespread stratospheric valuations are dead

For more than a decade following the Great Financial Crisis the equity market was led by growth stocks. From 2010-2021, growth stocks returned more than twice the amount of value stocks, as measured by the Russell 1000 Growth and Value Indices (see chart). Value and international outperformed US and growth stocks during the 2000-2007 timeframe, as investors poured money into emerging markets and commodity-related investments. Following the GFC, the run of growth outperformance began the way many bull markets begin, with cheap valuations and skepticism – in this case it was the lingering caution towards growth and technology stocks born out of the dot.com crash and subsequent recession. Fundamentals were also increasingly strong through the decade, with a growth and productivity boom driven by the digitization of everything – from semiconductors in parking garages to inform drivers how many parking spaces were available, to a transformation of business software, to ads following us from device to device.

Growth returns more than doubled Value returns from 2010-2021

Source: Bloomberg

Value had its temporary periods of outperformance, but growth dominated the 13-year period. For much of this run, valuations of large growth stocks generally remained reasonable versus historical levels. The pandemic and its aftermath altered the equation – serving as a blow off top for growth stocks, catapulting valuations to unsustainably high levels for even the best growth companies and expanding the list of premium valuations to many companies that did not hold defensible competitive positions. Fueling the excess along the way was easy Federal Reserve policy, and seemingly never-ending government fiscal stimulus, constantly fighting against any sign of economic slowdown.

With the trigger of high inflation causing the Fed to not only step away from years of overly accommodative policy, but begin to move towards restrictive policy, many are questioning the outlook for growth investing over coming years. We disagree with this sentiment and are confident that not only will there always be a place for well-run companies with durable competitive advantages in client portfolios, but these are the companies that will continue to lead the market over almost all longer time periods. Sustainable, profitable cash flow growth will remain the fuel that drives investment returns, even as we enter a period of tighter monetary policy. This applies regardless of company sector or “growth” or “value” classification by the index providers.

There has been a notable and warranted change in market perception around the most speculative companies, with the era of loose policy ending these companies will once again need to prove profitable growth before being rewarded with premium valuations. Even the true growth leaders will trade at lower valuations than the stratospheric levels of the last few years. While this will serve to limit returns somewhat, it still results in plenty of opportunity in innovative growth companies.

Shifting return expectations

Among many trends of the 2010-2021 era, excess equity returns were one of the most impactful on investor psychology. The S&P 500 compounded at an annual rate of 15% over this period, for a total return of almost 450%. This level was almost twice the long-run average of 9% per year. Due to the unsustainably high returns of this period and the elevated valuations of the last few years, we had been using below average long-term forward return assumptions when building financial plans for clients – we have typically been in the 6-7% per year range in our plan assumptions. With the market declines this year, and equity valuations declining towards historical averages (see chart), our long-term forward equity return assumptions are inching back closer to their historical levels. We are currently assuming 8% per year.

S&P 500 Forward P/E Ratio is slightly above its long-term average

While these may appear to be small differences in return assumptions, there are a few important takeaways. First, despite the current state of gloom and significant near-term risks, our forward long-term equity return assumptions have increased since the beginning of the year, not decreased. Second, while our equity return assumptions have increased, it is important to note that they still remain well beneath the returns of the past decade, which were unsustainably high at 15% per year over an extended period. We do not believe investors should expect returns of that magnitude going forward.

Equity market declines have been driven by rising interest rates, which have also resulted in pressure on bond prices, which move inversely to interest rates. Returns for bonds this year have been almost as bad as equity returns, with many bond indices declining by 12% or more year-to-date. While the prices of current bonds held decrease for the time being (but still mature at par for investors in individual bonds), new bonds are available for purchase at significantly higher yields. This is especially important for investors in need of current income, such as those in or approaching retirement or pension plans. There are many high-quality corporate bonds available at yields to maturity in the 4-5% range or higher (per year), twice the yields available less than 12 months ago. If the Federal Reserve is successful in bringing inflation back towards its long-term target of 2%, bond returns of 4%+ can have a meaningful positive impact on return profile and portfolio construction for many investors. For example, a 6% return target can now potentially be achieved through a 50/50 allocation to stocks and bonds, versus requiring a 70 or 80% allocation to equities in recent years – dramatically reducing volatility in portfolios, although at the cost of foregoing potential upside if equity returns were to meet or exceed historical levels.

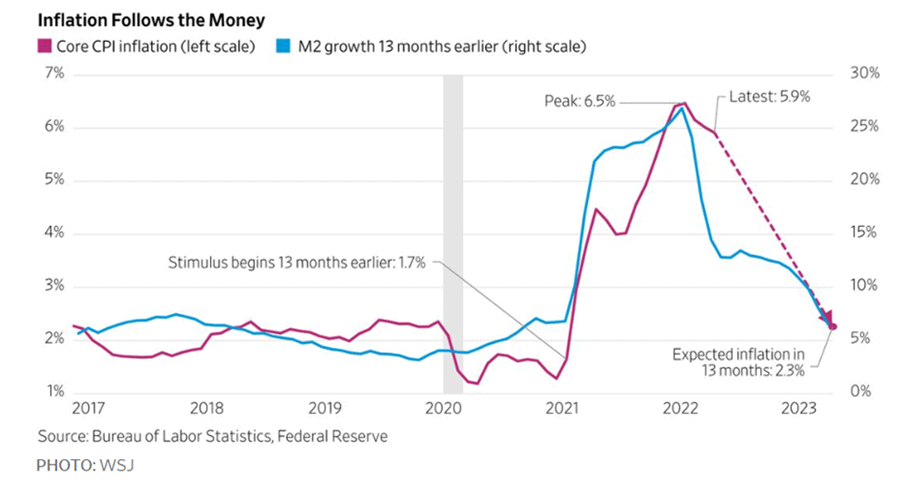

Could CPI be under 3% in 2023?

Gloom, for now

Markets face numerous risks including: an inverted yield curve, US recession or “growth recession”, extremely high inflation, a potential policy mistake from the Federal Reserve, a potentially severe winter energy crisis in Europe, and continued property and Covid-related challenges in China. Gloom is logical, as is increased caution. On the positive side of the ledger: these risks are well-known by investors, markets tend to lead both the onset and resolution of risks, inflation could fall faster than expected (see chart above) and investor sentiment is very poor which is often a precursor of better equity returns. Rather than attempting to predict the bottom or end of the current set of concerns, we are looking forward and identifying opportunities in the renewable and traditional energy sector, buying select quality growth stocks at discounted valuations, and where appropriate adding bonds to portfolios at significantly higher yields.

– Brian