Inflation, Oil, and Rate Expectations

Brian Sokolowski, CFA

May 1, 2024

The onset of 2024 ushered in discussions regarding the Federal Reserve’s strategy for steering the economy, with debates revolving around the prospects of a “soft” or “hard” landing. Questions also lingered about the sustainability of the previous year’s equity market surge. Only three months later, those concerns have given way to a calmer environment centered around fading inflation and the Fed’s plans for reducing interest rates. This has resulted in a strong market rally with the S&P 500 index, Dow Jones Industrial Average, and Nasdaq gaining 10.2%, 5.6%, and 9.1% in the first quarter, respectively. The S&P 500 has returned more than 25% since this recent run began in October 2023, and approximately 50% from the 2022 low.

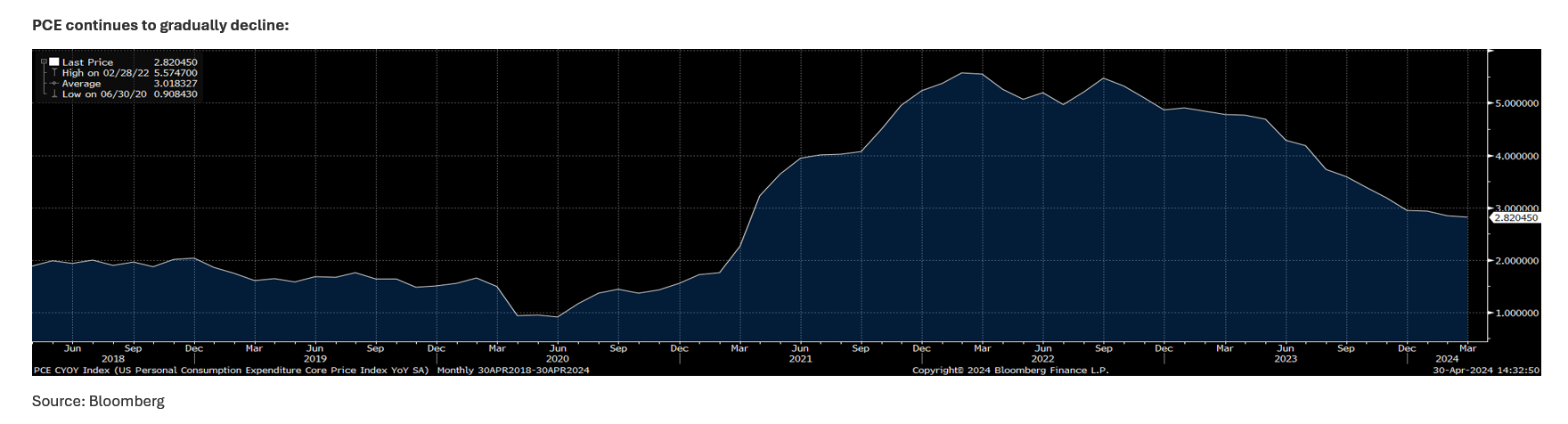

The economic environment has surprised many investors as inflation continues to fade. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures index, rose 2.5% on a year-over-year basis for all prices and 2.8% when excluding food and energy, both significant improvements from their peaks only a year and a half ago. While some areas of inflation such as shelter and energy costs remain problematic, inflation is steadily moving back to the Fed’s long-term 2% target.

Meanwhile, unemployment is still under 4% despite layoffs in the technology sector, interest rates were generally stable, with the 10-year Treasury yield exiting the first quarter around 4.2% (although rates have risen in April), and stock market returns have broadened beyond artificial intelligence stocks. Despite these positive trends, some investors are concerned about the upcoming presidential election and the next phase of Fed policy. These worries are only amplified by the fact that the market is hovering near all-time highs.

Persistent Inflationary Pressures

Many measures of inflation have proven to be more stubborn than economists had hoped. The latest Consumer Price Index (CPI) report for March showed that headline inflation remained hotter than anticipated at 3.5% year-over-year, while core inflation, which excludes food and energy prices, rose 3.8%. Rising shelter costs, i.e., the cost of renting and owning a home, are a large reason inflation has not cooled as quickly.

Combined with stronger-than-expected recent job market data, many investors now anticipate that the Fed may cut rates more slowly this year – or not at all. The Fed’s economic projections have suggested all along that it might cut rates three times this year. Market expectations, however, have swung 180 degrees since the start of the year when some believed the Fed could begin cutting rates in March or earlier. Today, markets only expect 1 or 2 rate cuts in 2024.

It’s important for investors to maintain a balanced perspective, focusing on the trajectory rather than the precise timing or magnitude of rate adjustments. Although risks persist, particularly concerning monthly inflation dynamics and potential oil price escalations due to geopolitical tensions, the current inflationary landscape is far more manageable, alleviating the necessity for emergency monetary interventions.

Geopolitical Risk and Oil prices Rising

Geopolitical tensions have introduced a degree of uncertainty into global markets. Such conflicts have the potential to disrupt oil production and supply chains, consequently driving up oil prices and exacerbating inflationary pressures. Energy stocks have responded, with the sector leading returns for the market thus far in 2024.

Tensions escalated in the Middle East due to an attack by Iran on Israel, the first time a direct strike has occurred between the two nations. The attack involved hundreds of drones and missiles launched from Iran and appears to have been designed to allow ample time for Israel and its allies to deploy countermeasures, resulting in minimal damage. While it’s uncertain how Israel might respond to this shot across its bow, many hope that both nations will show restraint and avoid an overt conflict.

Of the many factors driving markets today, perhaps the most uncertain is the impact geopolitical conflicts could have on the price of oil. The world is still highly dependent on oil with a global demand estimate of 102 million barrels per day in 2023 according to the International Energy Agency. Thus, oil is a way for geopolitical instability to be transmitted to the global economy since conflicts can disrupt oil production and supply chains, driving prices higher. Perhaps most importantly in today’s economic environment, rising oil prices lead to higher inflation, impacting consumers, Fed decision-making and interest rates.

For example, Russia’s invasion of Ukraine in early 2022 led to a spike in oil prices to over $127 a barrel. This is an important reason headline inflation, including the Consumer Price Index (CPI), jumped to four-decade highs a few months later. Gasoline prices at the pump rose to $5 on average across the country, hurting consumer sentiment and leading to fears of a recession. Oil prices did eventually settle and have been relatively calm in recent weeks amid rising tensions between Israel and Iran as well as shipping disruptions in the Red Sea.

Still, oil prices are about 8% higher this year with Brent crude and WTI recently trading around $87 and $83 per barrel, respectively. This pushed the energy component of CPI higher in February and March, propping up overall inflation. While economists tend to focus on core CPI which excludes food and energy prices, it’s impossible to ignore the impact higher oil prices have on consumers and economic growth. Thus, oil remains a wildcard when it comes to monetary policy and the timing of the Fed’s first rate cut.

An important difference between today’s inflationary environment and that of the 1970s and early 1980s is that the U.S. is now the largest producer of both oil and gas in the world. The U.S. has produced more crude oil than any other nation over the past few years. Domestic oil production has fully rebounded from the pandemic and now exceeds 13 million barrels per day, more than Saudi Arabia, Russia, and other members of OPEC+. There have also been hopes that the U.S. would play the role of a “swing producer” to raise production when required by global supply and demand. In theory, greater energy independence is one reason the U.S. may be more insulated from global events than in the past.

That said, the U.S. is still dependent on oil imports for a variety of reasons, including the type and quality of crude oil. Although the U.S. theoretically produces enough oil to meet its energy needs, overseas oil is often cheaper than domestically-produced crude due to a variety of other factors. In recent years, Canada, Mexico, and Saudi Arabia have been the largest sources of U.S. imports of foreign oil. U.S. imports from OPEC countries have declined to just 15% from a peak of over 70% of U.S. crude oil and petroleum imports in the late 1970s. However, since oil is a global commodity, price swings still impact U.S. producers and consumers despite strong U.S. oil production and strong trading partners.

Addressing Stagflation Concerns

Last week’s release of the Q1 GDP report sparked market jitters, as it unveiled a concerning combination of higher-than-anticipated inflation alongside lower-than-expected GDP growth. This unexpected confluence reignited fears of “stagflation” among some analysts. The persistence of inflation, as evidenced once again in the Q1 GDP report, has proven to be more resilient than initially projected. Surprisingly, GDP growth faltered despite a recent history of robust economic expansion, with growth rates of 4.9% in Q3 2023 and 3.4% in Q4 2023. Q1 GDP growth slowed to 1.6%, significantly below the consensus forecast of 2.4%, leading to initial market reactions including a nearly 2% decline in leading indices.

However, beneath the surface, the underlying growth story remains robust, with a 3.1% increase in the first quarter after accounting for volatile factors such as inventory fluctuations and imports. Domestic demand continues to exhibit strength, mitigating the validity of the stagflation narrative. Despite the recent uptick in inflation prompting adjustments in Fed interest rate policy, the correlation between growth and inflation remains conventional—both moving in tandem, rather than diverging, as typically observed in stagflation scenarios.

A recent analysis from Bloomberg Economics attributes Chair Powell’s dovish pivot in December as a driving factor in both the resurgence of inflation in 2024 and the stronger-than-expected underlying economic performance. Without Powell’s accommodative shift, the authors suggest that the US economy might have been on the brink of recession, citing a rise in unemployment toward the end of 2023. They argue that the change in Federal Reserve rhetoric played a crucial role in arresting the upward trajectory of unemployment and supporting GDP growth, albeit at the expense of an additional 0.50% inflationary pressure throughout 2024.

As always, we look forward to your questions or comments. If you would like to schedule a time to speak directly with Bluebird Wealth Management about these strategies, or any other personal finance topics, please reach out to us We offer a free consultation to answer your questions and review our unique service structure.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This information is not intended to be a substitute for specific individualized tax or investment advice. Have questions?