It’s an Analog Marketplace….For Now

by Brian Sokolowski, CFA

Bluebird Wealth Management

Considering the following data points, which company’s stock would one expect to have performed better over the past 3 months?

1) Zoom reported a 369% increase in revenue for its quarter ending on January 31, 2021.

2) Norwegian Cruise Lines reported a 99% revenue decrease for its quarter ending March 31, 2021.

Perhaps surprisingly, Norwegian Cruise Lines has outperformed Zoom over the past 3 and 6 months by a wide margin. Despite booming business for the digital economy, and much of the world still (at least) partially closed from the pandemic, “analog” assets have sharply outperformed “digital” assets recently.

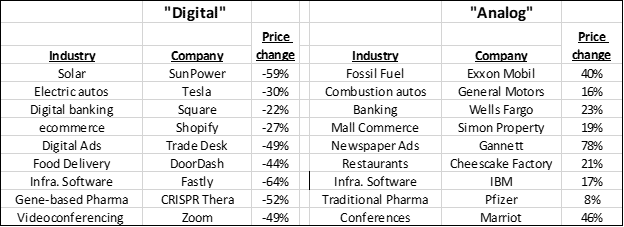

Let us review the stock performance of a list of digital and analog stock pairs. The price change for each stock is measured from the date of the peak price in the digital asset from each pair:

** – Price change for all pairs is measured from the date of the peak price in the “digital” asset through May 10, 2021, indicating that the price appreciation for each “analog” from its low is often significantly greater than the change listed in the table

Check the time period

While recent months have been painful for growth investors, it is important to keep the price action in context. 2020 was an excellent year for most growth stocks, with growth returns beating value stock returns 38% to 3% (as measured by the Russell 1000 Growth and Russell 1000 Value indexes). Many of the “digital” assets in the table above appreciated 300-1000% in 2020 and are still up significantly over the past 18 months, despite very sharp recent corrections. The Trade Desk, for example, appreciated 500% from its March 2020 low to its peak at the very end of 2020 and despite a painful recent correction currently trades at roughly 3x its level of March 2020. Tesla has been even more impressive – appreciating almost 10x at one point in 2020, it still retains almost 8x its March 2020 value.

Growth asset prices correct, often and deeply

Corrections are normal occurrences in equity markets, particularly for assets levered to small changes in market or company-specific factors. Growth stocks are very sensitive to the rate of change of a particular company’s expected growth rate, to inflation, and to interest rates. A reduction in the expected growth rate of a growth company from, say, 35% to 30%, can have a very sharp negative impact on share price. With the bulk of a growth company’s value residing in cash flow which will likely occur years in the future, a reduction in growth expectations or increase in interest rates can have a significant negative impact on a company’s stock price.

By our count, the Russell Mid Cap Growth Index corrected (a decline of 10% or more) 23 times since the March 2009 market low, with 7 of those corrections exceeding 20%. Patient investors have been rewarded, with the index returning 800% since March 2009, compounding at an annual rate of 20%.

While growth has outperformed value for most of the past 12 years, 2016 was a rare year of relative strength for value stocks, with value outperforming growth 17% to 7%. Most of the damage for growth occurred early in the year, sparked by a disappointing earnings report from LinkedIn in early February which sent that company’s stock down almost 50% in a single trading session and dragged many other software stocks along for the ride. For example, large and well-established growth software company salesforce.com was down 25% over two sessions in sympathy, despite minimal business overlap. LinkedIn was comparable to many of the growth stocks on the table above: an innovative disruptor in an attractive market, medium or large capitalization, and generally perceived to be well-managed. Investors who sold the stock following the 50% selloff were soon to be disappointed, as LinkedIn was subsequently acquired by Microsoft a few months later at a 100% premium to its current trading price– bringing LinkedIn stock on a round trip right back to from where it declined on the disappointing earnings report.

Unique conditions in global economy

While growth stocks periodically correct for seemingly minor reasons, the current pullback is complicated and compounded by a unique set of economic fundamentals related to the pandemic.

· US GDP is on track to record its strongest year of growth since 1984, when it grew by 7.2%. If current consensus estimates of 6.3% growth in 2021 end up proving conservative, and the 7.2% rate of 1984 is surpassed, 2021 will be the strongest GDP growth since the 8.7% growth rate in 1950. Strong economic growth lifts all boats, providing a tailwind for analog and value companies, rendering the growth achieved by secular growth companies relatively less valuable in the eyes of investors.

· Typically, an economy exiting recession holds plenty of labor slack, with potential workers eager to fill new jobs as the economy recovers. As evident in last Friday’s Bureau of Labor Statistics jobs report, and this week’s job openings report, the US economy is creating many job openings but filling those openings has proven challenging. This week’s data shows over 8 million open positions in the US, more than double the level of open positions as the economy exited the 2008-2009 recession. Covid caution, childcare challenges, and enhanced unemployment benefits remain barriers to hiring, with a combination of time and increased pay the likely remedies.

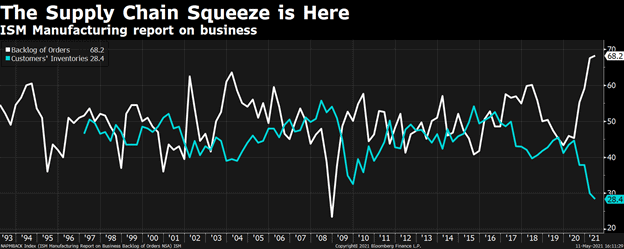

· Inflation signs are becoming evident across the economy: home prices, lumber prices, contractor price quotes, used and new car prices, and ride-sharing prices are all skyrocketing. The current consensus (and Federal Reserve position) is that inflation pressures will prove transitory, although this is a key market question with many investors growing skeptical of the transitory inflation consensus. Charts such as the one below make us wonder if the transitory period will take longer than many expect.

US manufacturers citing record-high backlogs and record low inventories – a very challenging combination:

Source: Bloomberg

Unsurprisingly, soaring GDP, unfilled job openings, spiking input prices, and disrupted supply chains are resulting in higher consumer prices. There were several records set in Wednesday’s Consumer Price Index (CPI) release, headlined by the highest annual increase in consumer prices since 2009 (+4.2%) and the highest monthly increase since 1982 (+0.9%).

Actions Bluebird has been taking in client portfolios

We believe investors are well served by owning innovative companies with durable competitive advantages, in attractive categories, over long periods of time; we are growth investors at our core. Excellent growth companies often appear expensive through their journey: Amazon is a “prime” example. The company has relentlessly innovated and grown into its seemingly expensive valuation. However, current valuation is also important, and we think it is critical to anticipate and adapt to changing market circumstances. Growth stocks have returned more than twice the amount of value stocks over the past 12 years; these trends cannot continue indefinitely.

In late 2020, we began to pivot away from a large overweight to the growth style and increase client exposure to companies that would benefit from a sharp increase in economic growth. We focused on opportunities in the financials, industrials, materials, and travel and leisure sectors. We reduced or eliminated many of the most aggressive and expensive growth stocks that were previously held in client portfolios (if appropriate for a given client risk profile), while continuing to hold modest positions in some of these promising growth companies. With the recent damage in the growth portion of the market, we are finding opportunities to gradually add to strong growth companies at reduced prices and are focusing our research to identify new opportunities in the space. Timing can be difficult, but we do not think “analog” stocks will be durable, long-term winners.

Our overall equity positioning remains roughly neutral in terms of growth versus value. We remain slightly overweight equities, which is down from a meaningful overweight previously. We are underweight defensive equities, although less so than previously. We continue to remain constructive on equities given strong economic growth, a steepening yield curve, recent rolling corrections through portions of the market (small cap, growth), and no recession in sight. However, we do not expect the unsustainably strong recent market returns (the S&P 500 annualized at a 25% return for the 9 quarters ending March 31, 2021) to continue at the same level, and expect volatility to remain elevated. Primary risks are an overheating economy and attendant sharp increase in inflation and/or interest rates.

** – All portfolio comments are general; client portfolios are managed to specific client circumstances; some comments above may not be applicable given client risk profile and situation.

I look forward to your questions and comments. – Brian

Bluebird Wealth Management, LLC

Metrowest Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

North Shore Office

12 Oakland St.

Suite 308

Amesbury, MA 01913

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Metrowest Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

North Shore Office

(978) 775-1287

12 Oakland St.

Suite 308

Amesbury, MA 01913

We serve individuals and families throughout the United States.