Votes, Valuation, & Volatility

Brian Sokolowski, CFA

July 25, 2024

During the first half of 2024 the stock market rally continued as investors anticipate the first Fed rate cut and artificial intelligence stocks remain (very much) in favor. Through June the S&P 500 gained 15.3% with dividends, the Nasdaq 18.6%, and the Dow Jones Industrial Average 4.8%. The 10-year Treasury yield declined from its April peak of 4.7% to 4.4%, allowing the overall bond market to be roughly flat on the year. International stocks have performed better as well, with developed markets returning 5.7% and emerging markets 7.7%.

The recession that has been anticipated since the yield curve inverted in 2022 has not yet occurred and there are signs that inflation, which ran hotter than expected for a few months in the first half of 2024, has once again begun to improve.

The market’s focus is now shifting toward major events in the second half of the year. Perhaps the most notable is the upcoming presidential election. As investors prepare to cast their ballots in November, they will also wonder what each political party could mean for their portfolios and financial plans. Investors will also watch the timing and number of Fed rate cuts closely since lower rates are generally positive for both stocks and bonds.

Below are six areas we are watching as we look towards the second half of 2024 and beyond.

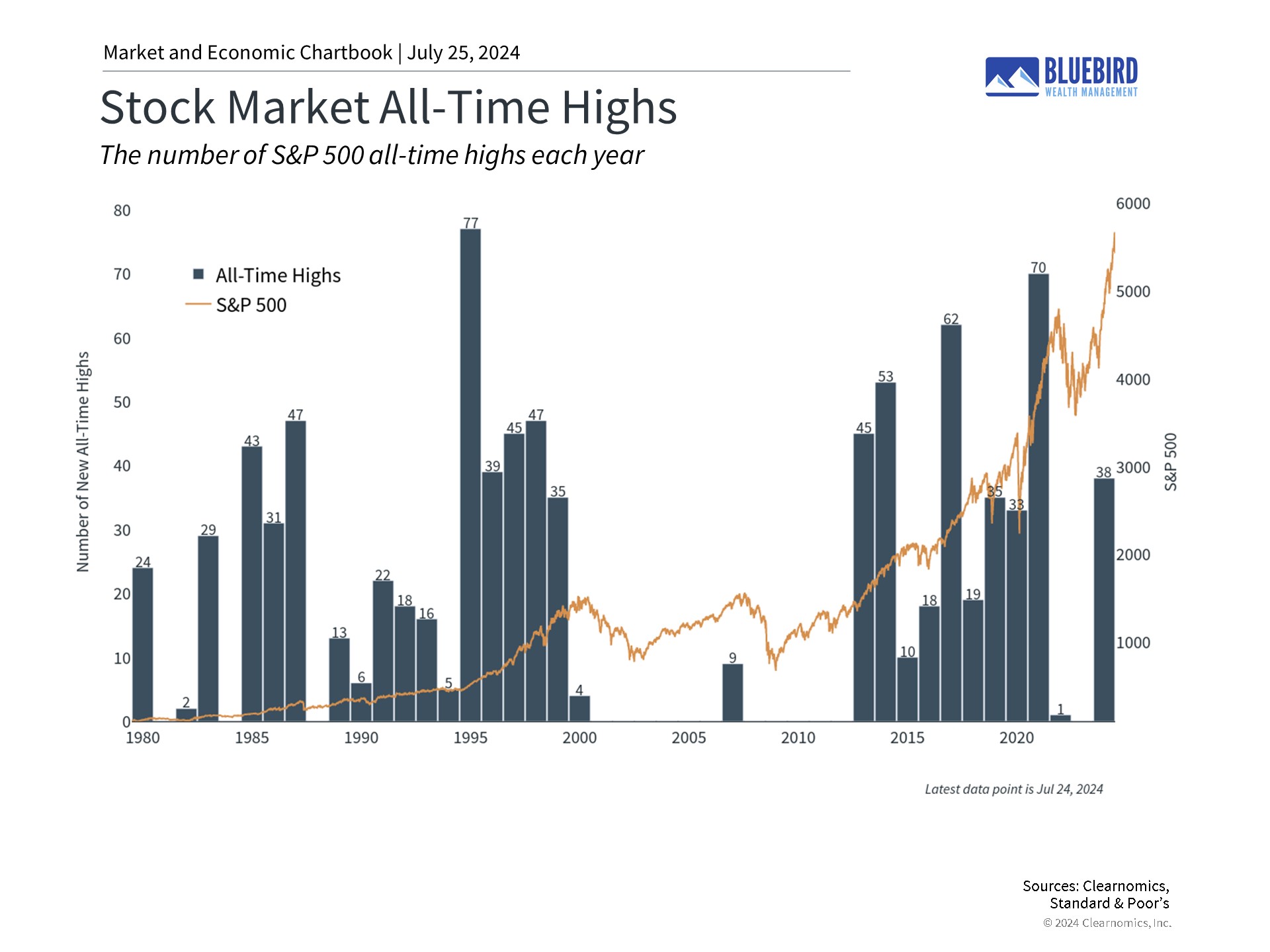

1. The market continues to reach new all-time highs

On its way to a 15.3% gain in the first half of the year, the S&P 500 has achieved over 30 new all-time highs. This year, artificial intelligence stocks – particularly Nvidia – have contributed greatly to market returns with the Information Technology and Communication Services sectors gaining 28.2% and 26.7%, respectively. However, other sectors have more recently begun to benefit as well with Energy, Financials, Utilities, and Consumer Staples all experiencing rallies of around 10%. All told, 10 of the 11 sectors are positive on the year. Given the strong run in the market overall, growth stocks more specifically, and mega-cap AI beneficiaries especially, the modestly-broadening of returns that we’ve seen in July is a welcome development.

On its way to a 15.3% gain in the first half of the year, the S&P 500 has achieved over 30 new all-time highs. This year, artificial intelligence stocks – particularly Nvidia – have contributed greatly to market returns with the Information Technology and Communication Services sectors gaining 28.2% and 26.7%, respectively. However, other sectors have more recently begun to benefit as well with Energy, Financials, Utilities, and Consumer Staples all experiencing rallies of around 10%. All told, 10 of the 11 sectors are positive on the year. Given the strong run in the market overall, growth stocks more specifically, and mega-cap AI beneficiaries especially, the modestly-broadening of returns that we’ve seen in July is a welcome development.

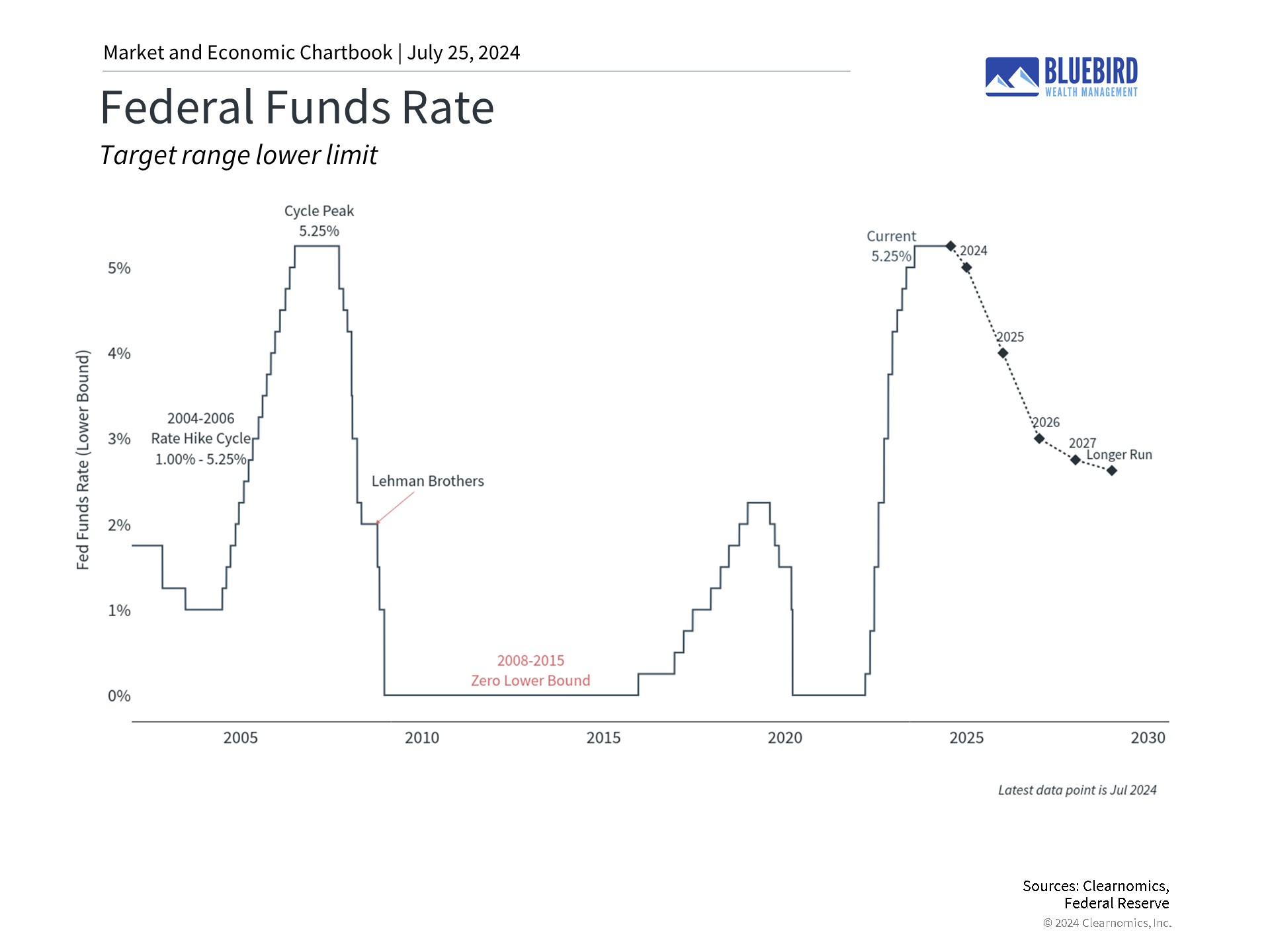

2. With inflation cooling, the Fed is on track to cut rates later this year

Investors have been anticipating the first rate cut of the cycle since the beginning of the year. This has not only driven returns but is one reason markets have swung when new economic data has caused expectations to shift.

Investors have been anticipating the first rate cut of the cycle since the beginning of the year. This has not only driven returns but is one reason markets have swung when new economic data has caused expectations to shift.

The accompanying chart shows the possible path of the federal funds rate based on the Fed’s latest projections. At its last meeting, the Fed cited strong job gains and low unemployment as indicators of solid economic activity but emphasized that “inflation has eased over the past year but remains elevated.” Fortunately, the latest inflation data in May showed a significant deceleration that has preserved the possibility of a rate cut this year.

Many of the additional rate cuts that investors previously expected have been pushed into next year and will depend on the economic data over the next six months. Regardless of the exact timing and path of Fed rate cuts, these projections represent a reversal of the emergency monetary policy actions that began in early 2022.

3. Steadier rates support the bond market

The path of interest rates has been highly uncertain over the past few years due to inflation, economic growth, and the Fed. Higher rates have defied the expectations of investors and economists, creating a challenging environment for the bond market, since rising rates push down bond prices.

After hotter-than-expected readings in the first quarter of the year, the latest Consumer Price Index data showed no change in overall prices in May for the first time in almost two years. Core CPI rose 0.2% in May, or 3.4% year-over-year, a healthy deceleration from the previous month’s 3.6% pace. Other data, such as the Personal Consumption Expenditures index that the Fed favors, and the Producer Price Index, have shown similar patterns.

These developments, along with new Fed guidance, have pushed rates lower over the past six weeks, supporting bond prices. The Bloomberg U.S. Aggregate Bond Index, a measure of the overall bond market, was nearly flat through the first half of the year after declining as much as 4% in April. This is in sharp contrast to 2022 when bonds fell into a bear market during the historic jump in interest rates, before stabilizing and rebounding in 2023.

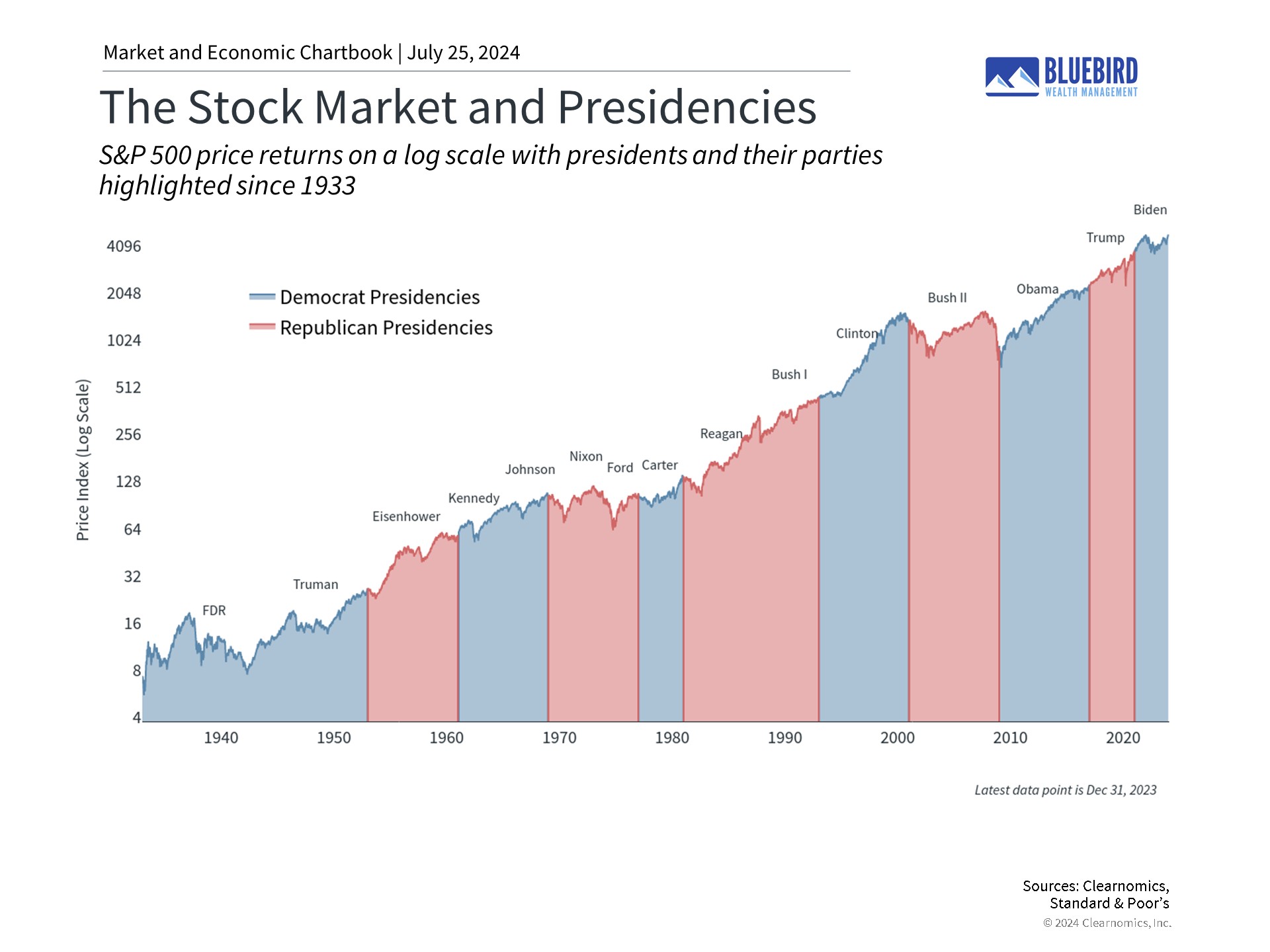

4. The presidential election is heating up

With US elections less than four months away, the political front has been heating up this month with the assassination attempt of President Trump, party conventions and President Biden’s exit from the race. Market responses to political expectations are complex and often counterintuitive. We have found that political events often have less of an impact on markets than one might expect. There are exceptions during periods of significant policy changes or, more common, in certain portions of markets – such as sectors of the economy or international regions. As US elections approach, we expect volatility to modestly increase, especially within sectors as the market begins to price in various election outcomes.

With US elections less than four months away, the political front has been heating up this month with the assassination attempt of President Trump, party conventions and President Biden’s exit from the race. Market responses to political expectations are complex and often counterintuitive. We have found that political events often have less of an impact on markets than one might expect. There are exceptions during periods of significant policy changes or, more common, in certain portions of markets – such as sectors of the economy or international regions. As US elections approach, we expect volatility to modestly increase, especially within sectors as the market begins to price in various election outcomes.

Taking a step back to the bigger picture, history shows that markets can perform well under both major political parties. As the accompanying chart shows, the economy and stock market have grown over decades regardless of who was in the White House. What mattered more across these periods were the ups and downs of the business cycle.

Of course, politics can impact taxes, trade, industrial activity, regulations, and more. However, not only do policy changes tend to be incremental, but also the exact timing and effects are often overestimated. Thus, we have found it is important to focus less on day-to-day election poll results and more on the long-term economic and market trends.

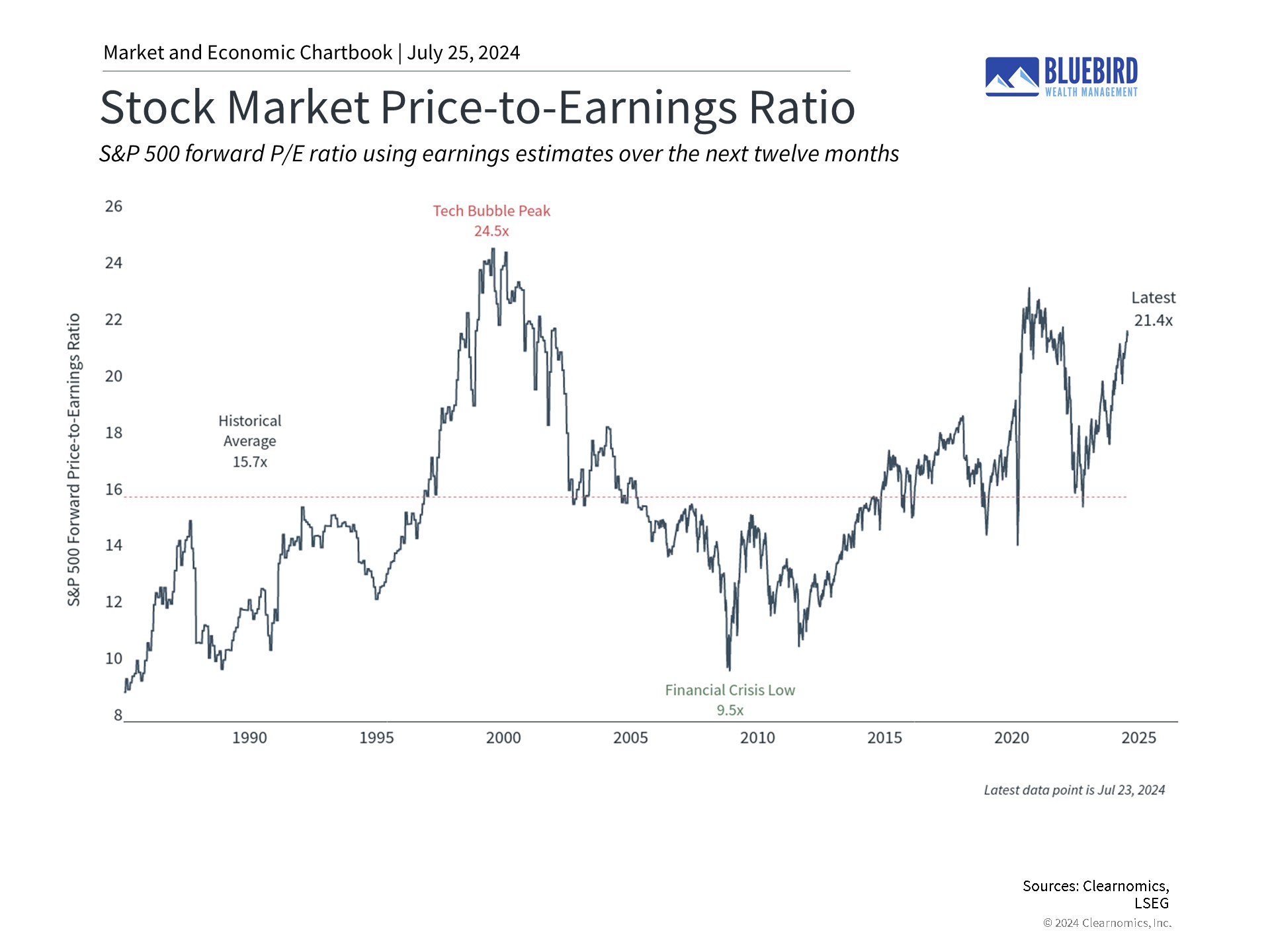

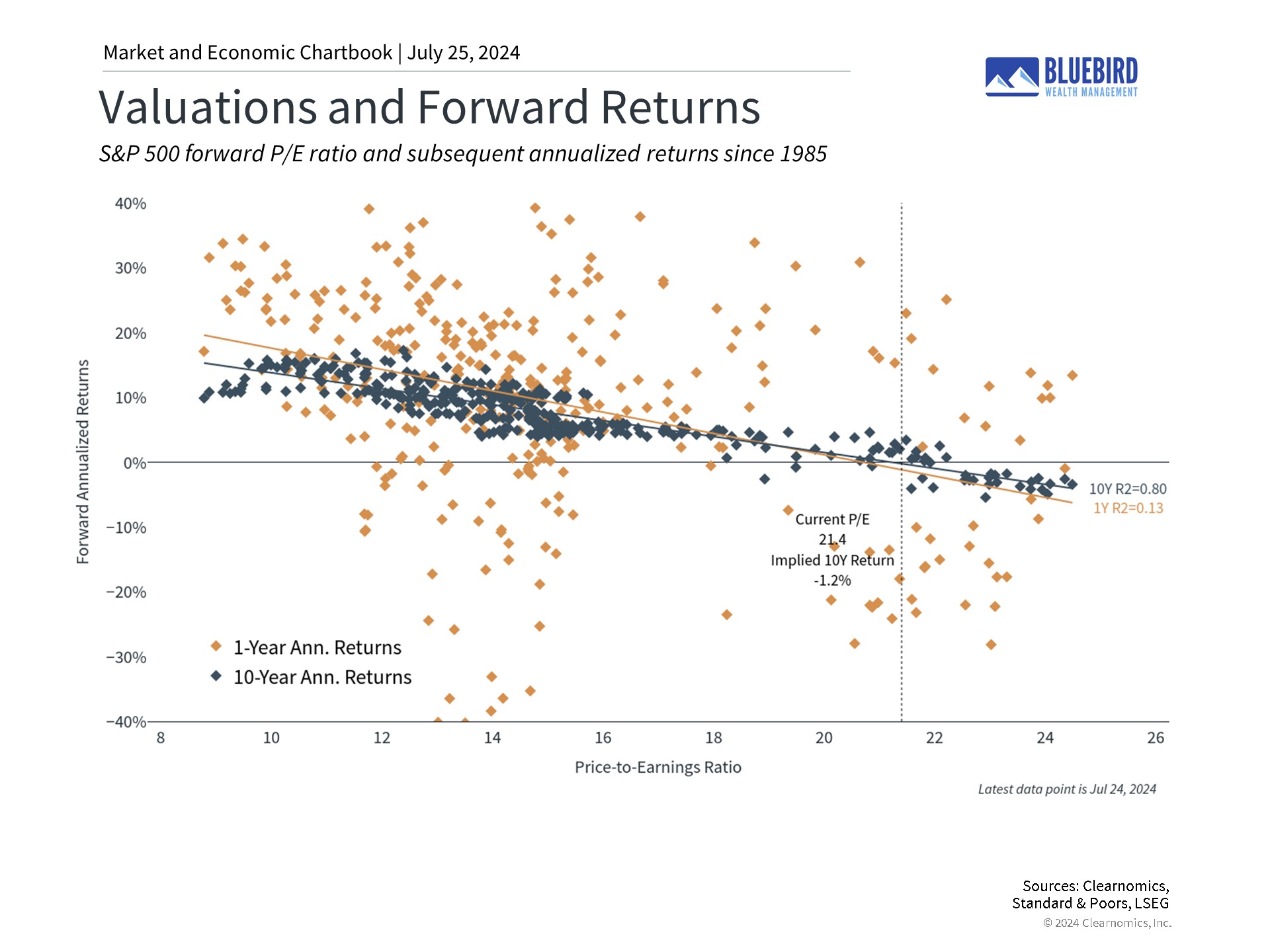

5. Valuation is becoming a headwind to forward stock returns

The forward price-to-earnings multiple for the S&P 500 currently sits at 21x, well above the long-term historical average of 15.7x, and at the high end of the elevated P/E range that has been the trend over the past 15 years.

The forward price-to-earnings multiple for the S&P 500 currently sits at 21x, well above the long-term historical average of 15.7x, and at the high end of the elevated P/E range that has been the trend over the past 15 years.

Valuation is a poor timing tool. Individual stocks, sectors, and the wider market can all appear to be too expensive or too cheap for extended periods of time. However, when looking over longer time frames, such as five or ten years, valuation is correlated to equity market returns. The below chart shows little correlation between market P/E level and subsequent one year returns but shows a strong correlation between market P/E and subsequent ten-year returns.

While there is a case to be made for valuations to be higher now versus history, mainly due to the S&P 500 holding a larger weight of high profitability, higher return companies which often carry a more expensive valuation, it is nonetheless reasonable to assume lower long-term forward returns from this point due to elevated market valuation.

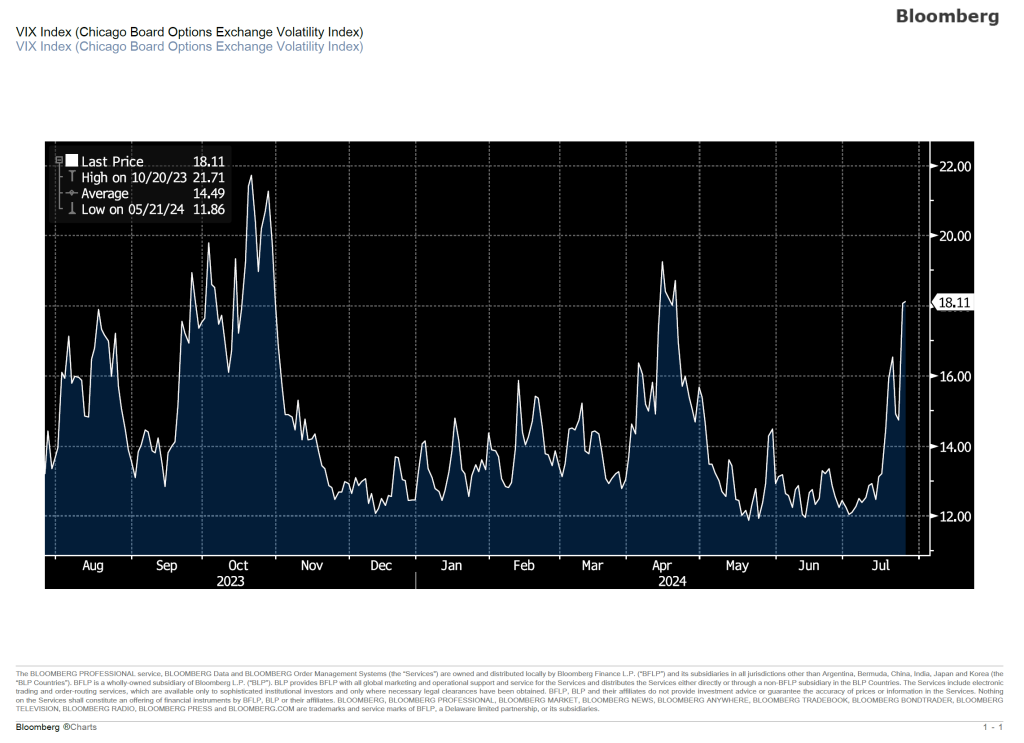

6. Volatility unlikely to stay low during the second half of 2024

Equity market volatility has been very low through the first half of 2024 and for most of 2023 as well. The VIX measure of stock market volatility has been well under historical levels, mostly sitting in a range of 12-14% through the first six months of the year.

Source: Bloomberg

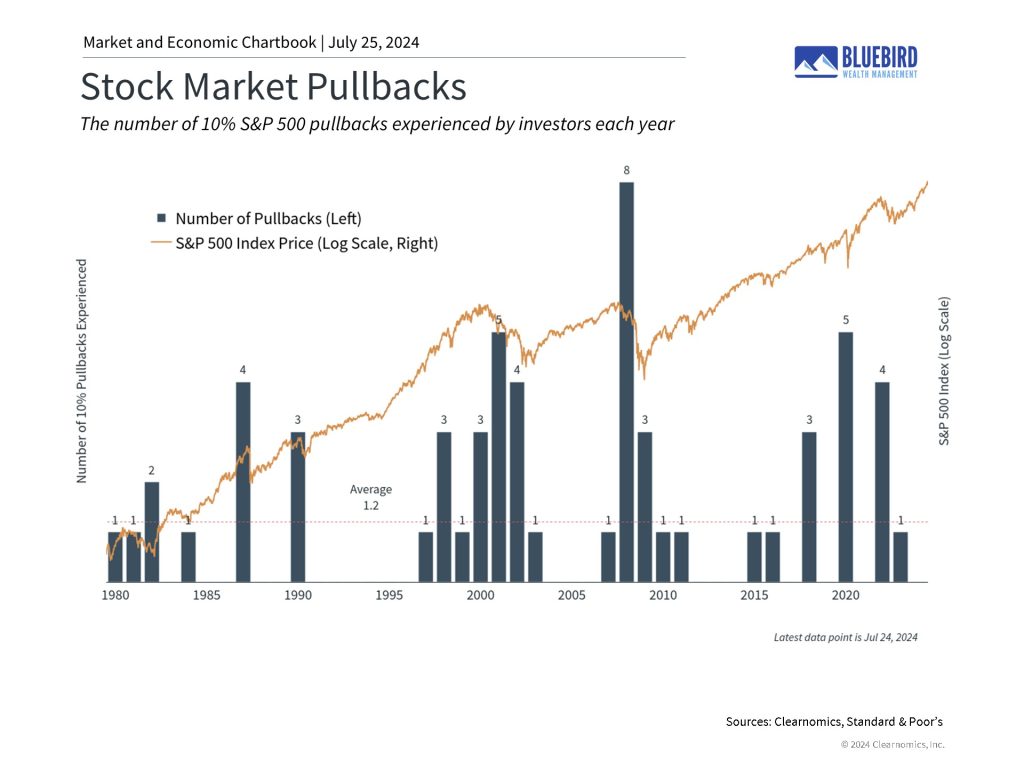

Another way to look at volatility is through the frequency and depth of market declines. The average annual drawdown for the S&P 500 is 14%, despite returning 10% per year on average. The maximum drawdown in the first half of 2024 was 5%, and the maximum in 2023 was only 10%. Similarly, on average there are 1.2 corrections (an equity market decline of 10% or more) each year, and there has only been 1 over the past 24 months.

While the S&P 500 is still roughly flat for July, we have seen some of the factors discussed above beginning to impact markets over recent days. The evolving US political landscape, sky-high expectations for mega-cap growth and AI stocks, stretched valuations and a level of complacency as evidenced by a lack of volatility, have resulted in increased volatility this month, and especially this week.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This information is not intended to be a substitute for specific individualized tax or investment advice. Have questions?

“This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.”