Tariffs, Geopolitics, and All-time Highs

by Brian Sokolowski, CFA | Managing Partner and CIO

July 21, 2025

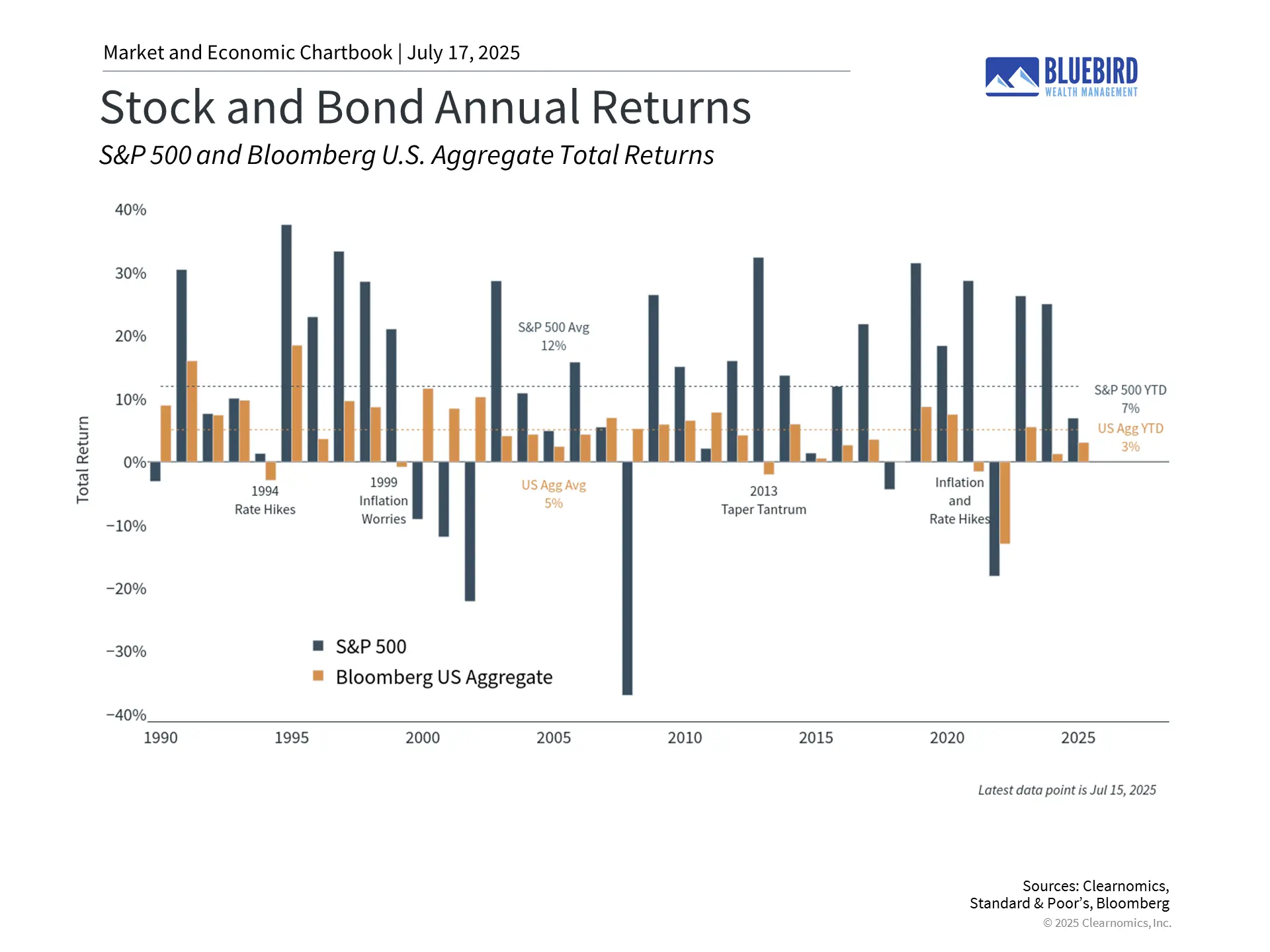

The second quarter of 2025 showcased both the resilience of financial markets and their sensitivity to policy uncertainty. From the White House’s tariff announcements in April to escalating tensions between Israel and Iran in June, investors faced many challenges. Yet, the stock market went on to stage one of the fastest rebounds in history and finished the quarter at new all-time highs. Overall, it was a strong quarter for stocks, while bonds also delivered positive outcomes.

If an investor went into hibernation on December 31, 2024 and awoke on June 30, 2025 they would notice a 6.2% return for the S&P 500 for the first half of 2025 – a return that is closely aligned to historical average annualized returns of approximately 10-12%, depending upon the historical period chosen. Of course, few of us were in hibernation during the quarter (although many may have wanted to be for certain days!), and we witnessed extreme volatility. The S&P was down more than 12% over a four day stretch in early April, which included a 6% decline on April 4th, the day following “Liberation Day” tariff announcements. The partial walk back of tariff plans on April 9th resulted in a furious rally of almost 10% for the S&P 500, the biggest one-day gain since October 2008. The first half of the year delivered average returns for the US stock market, via a remarkable path.

Key Market and Economic Drivers in Q2

• The S&P 500 and the Nasdaq both ended the quarter at record highs, gaining 10.6% and 17.7% over the three months, respectively. The Dow Jones Industrial Average rose 5.0% and is 2% below its record level.

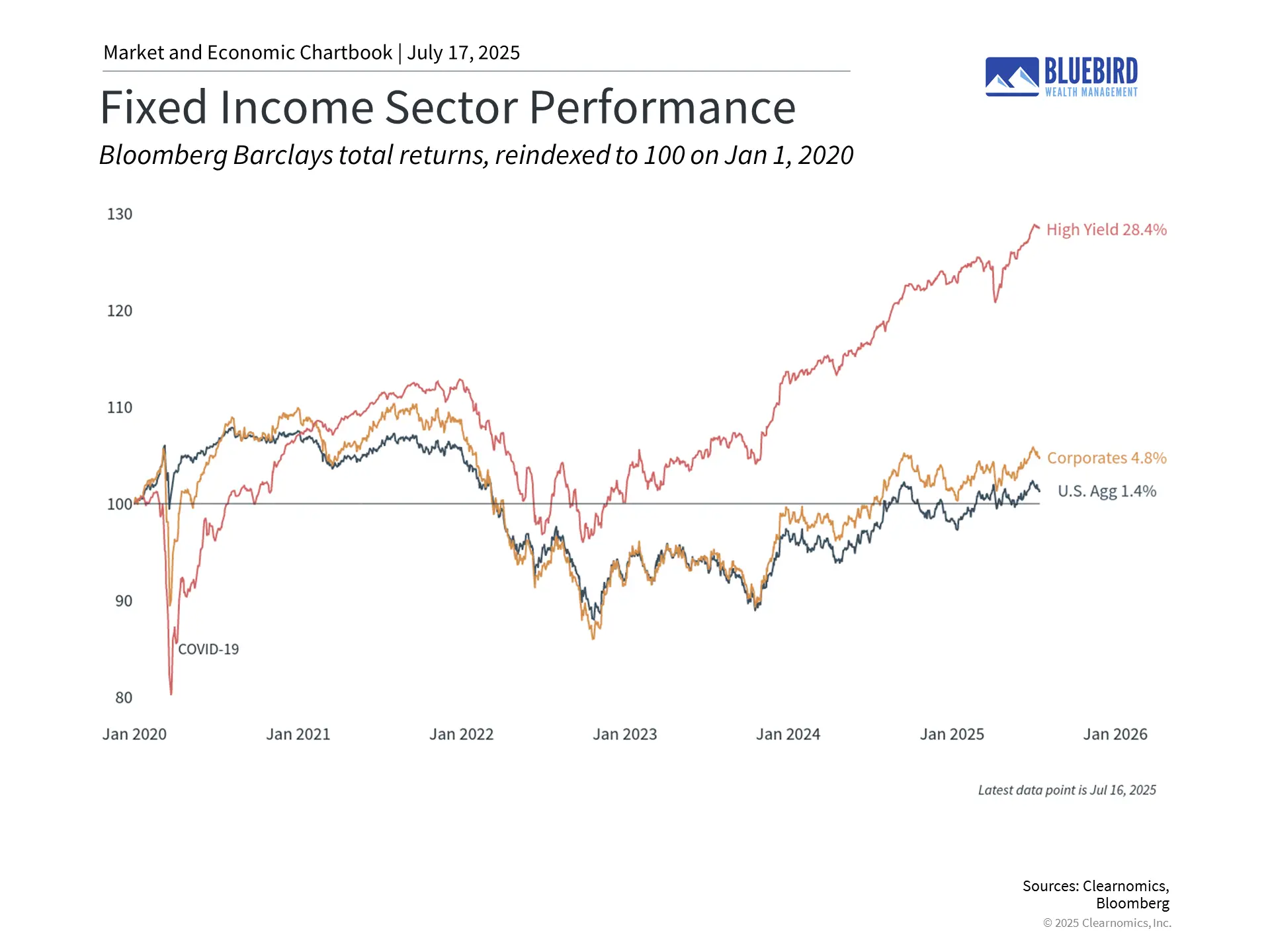

• The Bloomberg U.S. Aggregate Bond Index gained 1.2% in the second quarter. The 10-year Treasury yield ended the quarter at 4.2% after reaching as high as 4.6% in May.

• Developed market international stocks (MSCI EAFE) rose 10.6% and emerging market stocks (MSCI EM) increased 11.0% in the quarter.

• Gold rallied to a new record level of $3,431 per ounce, before settling at $3,308 to end the quarter.

• Bitcoin reached a high of $111,092 in May and hovered around $107,000 at the end of June.

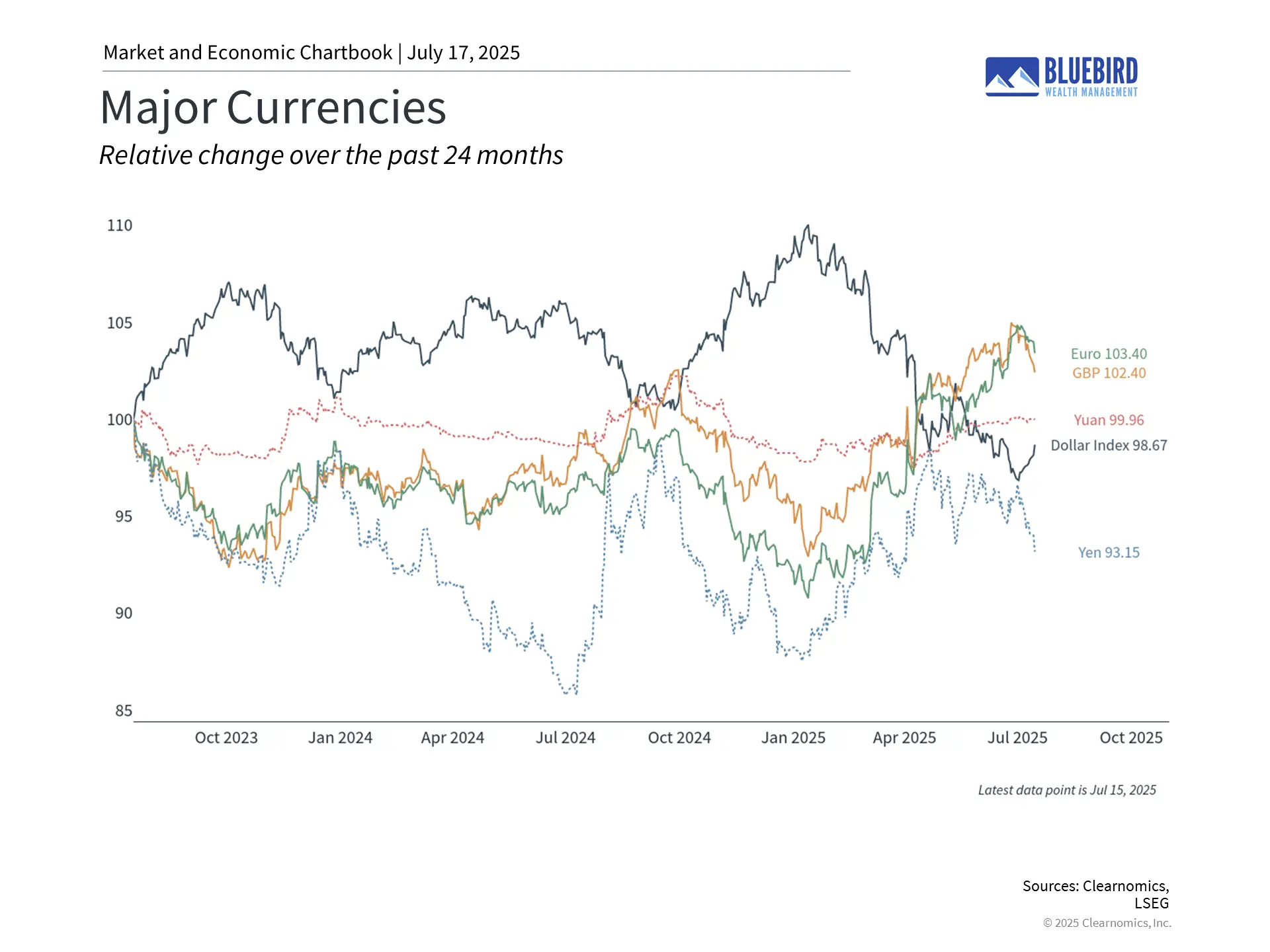

• The U.S. Dollar Index continued to fall over the quarter, ending the quarter at 96.88. It started the year at 108.49.

• The Consumer Price Index rose 2.4% year-over-year in May, while core inflation, which excludes food and energy, came in at 2.8%.

• The University of Michigan Consumer Sentiment Index improved in May to 60.7, its first increase in six months. Consumers expect an inflation rate of 5.0% over the next year, down from 6.6% in the previous survey.

• At its June meeting, the Federal Reserve kept rates unchanged within a range of 4.25 to 4.5%.

Markets rebounded to new all-time highs

Despite significant volatility, the stock market recovered quickly once the worst-case scenarios for tariffs and geopolitical tensions did not materialize. The quarter began with heightened uncertainty following the announcement of new tariffs on April 2, which were more far-reaching than many investors had anticipated. However, as the administration engaged in negotiations and reached preliminary trade agreements with several partners, market sentiment improved.

The second quarter of 2025 showcased both the resilience of financial markets and their sensitivity to policy uncertainty. From the White House’s tariff announcements in April to escalating tensions between Israel and Iran in June, investors faced many challenges. Yet, the stock market went on to stage one of the fastest rebounds in history and finished the quarter at new all-time highs. Overall, it was a strong quarter for stocks, while bonds also delivered positive outcomes.

If an investor went into hibernation on December 31, 2024 and awoke on June 30, 2025 they would notice a 6.2% return for the S&P 500 for the first half of 2025 – a return that is closely aligned to historical average annualized returns of approximately 10-12%, depending upon the historical period chosen. Of course, few of us were in hibernation during the quarter (although many may have wanted to be for certain days!), and we witnessed extreme volatility. The S&P was down more than 12% over a four day stretch in early April, which included a 6% decline on April 4th, the day following “Liberation Day” tariff announcements. The partial walk back of tariff plans on April 9th resulted in a furious rally of almost 10% for the S&P 500, the biggest one-day gain since October 2008. The first half of the year delivered average returns for the US stock market, via a remarkable path.

Key Market and Economic Drivers in Q2

- The S&P 500 and the Nasdaq both ended the quarter at record highs, gaining 10.6% and 17.7% over the three months, respectively. The Dow Jones Industrial Average rose 5.0% and is 2% below its record level.

- The Bloomberg U.S. Aggregate Bond Index gained 1.2% in the second quarter. The 10-year Treasury yield ended the quarter at 4.2% after reaching as high as 4.6% in May.

- Developed market international stocks (MSCI EAFE) rose 10.6% and emerging market stocks (MSCI EM) increased 11.0% in the quarter.

- Gold rallied to a new record level of $3,431 per ounce, before settling at $3,308 to end the quarter.

- Bitcoin reached a high of $111,092 in May and hovered around $107,000 at the end of June.

- The U.S. Dollar Index continued to fall over the quarter, ending the quarter at 96.88. It started the year at 108.49.

- The Consumer Price Index rose 2.4% year-over-year in May, while core inflation, which excludes food and energy, came in at 2.8%.

- The University of Michigan Consumer Sentiment Index improved in May to 60.7, its first increase in six months. Consumers expect an inflation rate of 5.0% over the next year, down from 6.6% in the previous survey.

- At its June meeting, the Federal Reserve kept rates unchanged within a range of 4.25 to 4.5%.

Markets rebounded to new all-time highs

Despite significant volatility, the stock market recovered quickly once the worst-case scenarios for tariffs and geopolitical tensions did not materialize. The quarter began with heightened uncertainty following the announcement of new tariffs on April 2, which were more far-reaching than many investors had anticipated. However, as the administration engaged in negotiations and reached preliminary trade agreements with several partners, market sentiment improved.

The equity market rebound was widespread, with many sectors, styles, and regions delivering positive outcomes. International stocks continue to lead the way in 2025, with a weakening adding to returns for US investors. Small cap stocks have lagged other parts of the market due to their greater sensitivity to tariffs and interest rates. The Russell 2000 index is still down -2.5% this year.

At a sector level within the S&P 500, Information Technology stocks experienced a strong recovery and led the market to new highs. Many other sectors are supporting markets too, including Industrials which are now up 11.4% on the year, Communications which have gained 10.2%, and Financials up 7.5%. On the other end, Healthcare and Energy saw weakness.

Bond markets are also quietly contributing to portfolio outcomes, with relatively strong yields and falling credit spreads contributing in the quarter. Treasury securities and corporate bonds also experienced volatility during the tariff-induced drawdown, although the quarter ended in positive territory.

The dollar continued to weaken

The U.S. dollar weakened through the second quarter, pressured by tariff news. While a weaker dollar can be negative for consumers, it can be positive for U.S. businesses and exporters, since it becomes cheaper for those using foreign currencies to buy our goods. While the dollar has declined this year and is near the low end of its range since 2022, its value is still high compared to the past decade.

The Federal Reserve held interest rates steady at 4.25% to 4.5% throughout the quarter, reflecting a measured approach to monetary policy in an evolving economic environment. Fed Chair Jerome Powell emphasized the Fed’s focus on price stability even as other factors complicate the economic outlook.

Specifically, the Fed’s updated economic projections reveal the challenges policymakers face. Officials now expect inflation to reach 3% in 2025 before moderating to 2.1% by 2027, marking an upward revision from earlier forecasts. They also expect real GDP growth to slow this year to 1.4%, a downgrade from a 1.7% projection in March. These adjustments reflect concerns that tariffs could spur inflation and slow growth.

The conflict between Israel and Iran added another layer of complexity to an already challenging environment. Israeli strikes on Iranian nuclear facilities and military targets beginning June 13 created immediate concerns about regional stability and potential escalation. However, the two countries agreed to a ceasefire after 12 days of fighting.

Bonds helped to provide portfolio balance

The While the stock market has ended the quarter at new all-time highs, the decline and rebound was challenging for many investors. Fortunately, bonds helped to support balanced portfolios during the quarter. High yield, corporate, and Treasury bonds all provided balance and are positive year-to-date. Interest rates have remained higher than many had expected, and short-lived concerns in April about a flight from U.S. Treasury securities did not occur.

Budget discussions in Washington have brought renewed attention to America’s fiscal trajectory. The national debt now exceeds $36 trillion, or approximately $106,000 per American. According to the Congressional Budget Office, the recent budget bill could add an estimated $3.3 trillion in deficits over the next decade. While the bill includes spending reductions, these are outweighed by tax cuts and spending increases elsewhere.

Moody’s downgraded the U.S. credit rating in May, citing concerns about successive administrations and Congress failing to address “large annual fiscal deficits and growing interest costs.” This echoes similar challenges raised during previous budget standoffs in 2011, 2013, and from 2018 to 2019. However, in each instance, agreements were eventually reached, markets stabilized, and economic growth resumed.

For long-term investors, these fiscal debates underscore the importance of maintaining diversified portfolios that can weather various policy outcomes. While deficit levels deserve attention, history suggests that the U.S. economy’s fundamental strengths and adaptability remain intact.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This information is not intended to be a substitute for specific individualized tax or investment advice. Have questions?

This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.