2025 Year in Review

Brian Sokolowski, CFA

Managing Partner and CIO

January 26th, 2026

2025 was a strong year for markets despite the many events that took place along the way, including a 19% pullback in the S&P 500 in the spring. The past year delivered no shortage of headlines including April’s tariff announcements, ongoing developments in artificial intelligence stocks, the passage of the One Big Beautiful Bill Act, and more. Yet through it all, investors are likely happy as U.S. stocks rose to new record highs, international markets outperformed, and bonds continued their rebound. The S&P 500 has now generated double-digit returns in six of the past seven years and has nearly doubled in value since the market bottom in 2022.

The past year reinforces the lesson that the best way to weather uncertainty is to remain disciplined and focused on long-term goals. As we look ahead to 2026, understanding what drove markets last year can help investors navigate the challenges and opportunities that lie ahead.

Key Market and Economic Drivers in 2025

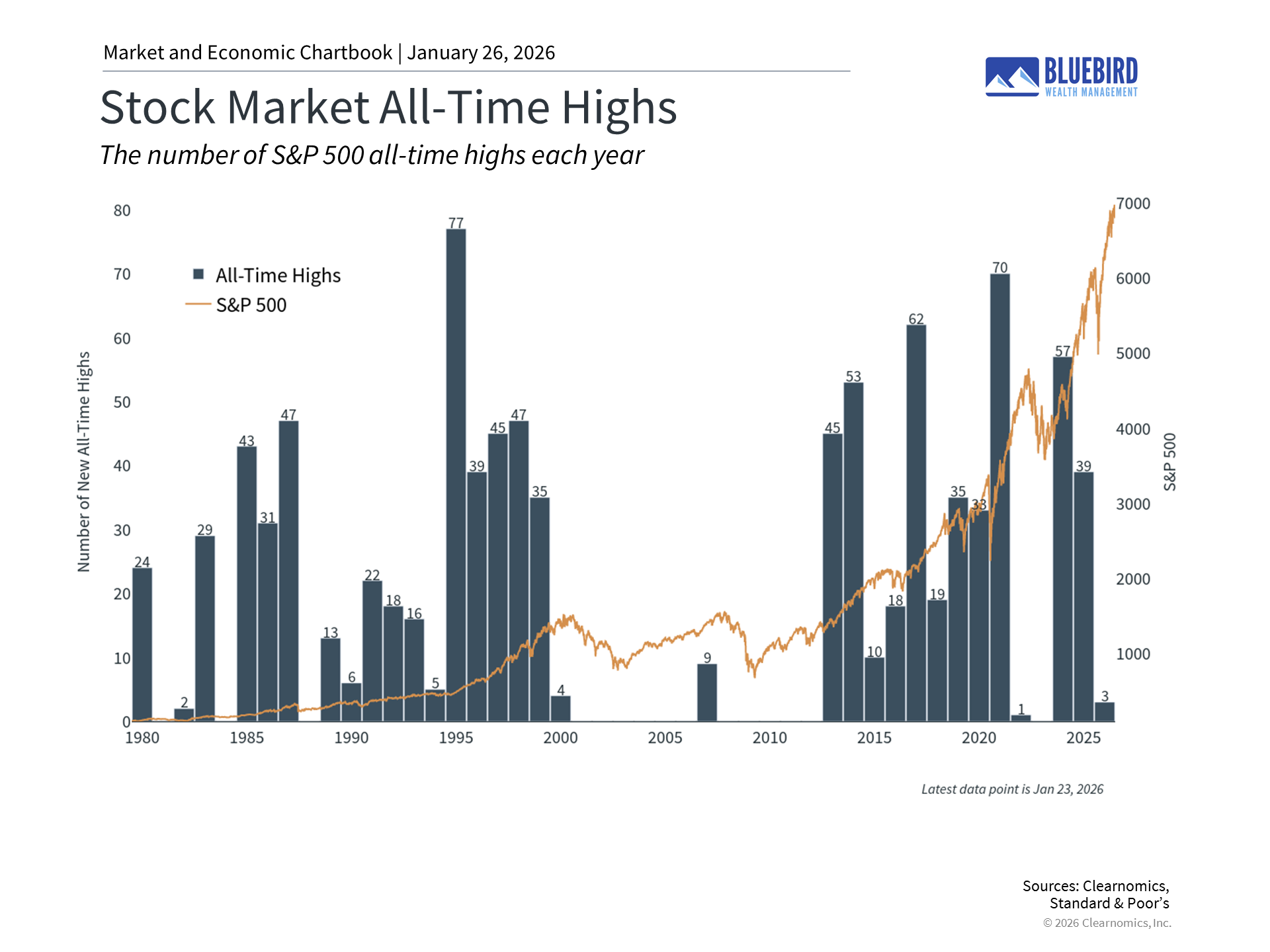

• The S&P 500 gained 17.9% including dividends in 2025, achieving 39 new all-time highs. The Dow Jones Industrial Average rose 14.9% and the Nasdaq returned 21.2%.

• The VIX, a measure of stock market volatility, remains low by historical standards, finishing at 14.95 after climbing as high as 52.33 in April.

• The Bloomberg U.S. Aggregate Bond Index gained 7.3%, its best performance since 2020. The 10-year Treasury yield ended the year lower at 4.17%, down from 4.57% at the start of the year.

• International developed markets and emerging markets each gained over 30% in U.S. dollar terms based on the MSCI EAFE Index and MSCI EM Index, respectively.

• The U.S. dollar index ended the year at 98.32, falling 9.3% from 108.49 at the beginning of the year. The dollar reached a low of 96.63 in September.

• Bitcoin experienced a decline of about 6.5% from $93,714 to $87,647, after rising as high as $125,260 in October.

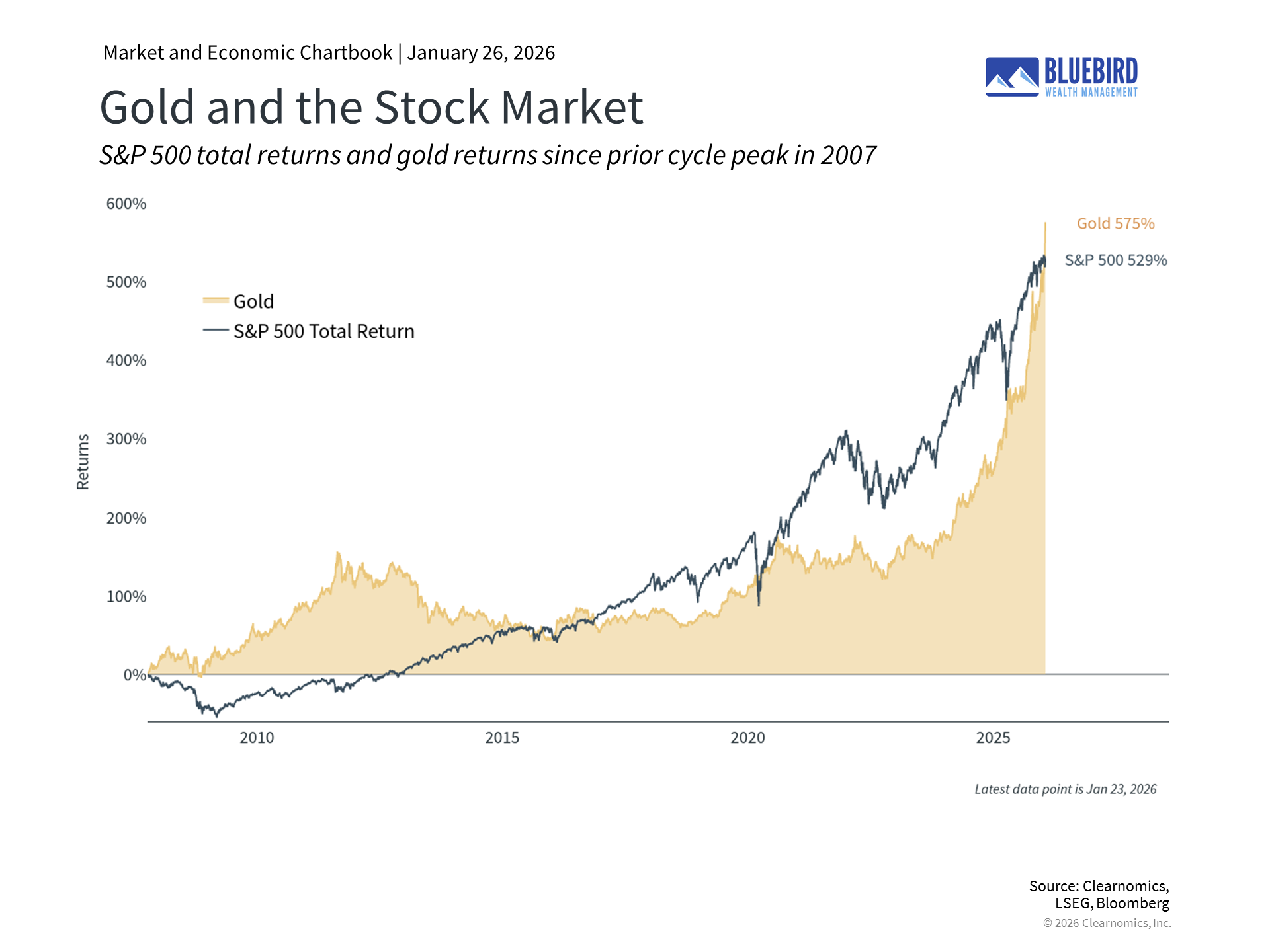

• Gold prices rallied throughout the year, finishing at $4,341 per ounce for a 64% gain. Silver prices also rose to $70.60 per ounce from $29.24 at the start of the year.

Major events in 2025

Many of the events of the past year were “known unknowns”. Concerns around tariffs, for instance, were very much on investors’ radars ahead of April 2. While this didn’t diminish the market reaction due to the size of these tariffs, it did allow the market to rebound quickly once events played out. Investors also knew the Fed would likely adjust rates once the job market weakened. Many also expected a new tax bill to pass given that Republicans control both houses of Congress.

Even concerns around AI, which are one of the biggest uncertainties for markets today, have also been at the top of investors’ minds. While the DeepSeek moment in January, when a Chinese AI company showed that models could be created and run more cheaply, was unexpected, the parallels to the dot-com boom and past surges in capital expenditures by large companies are well understood.

To summarize the major market-moving events over the year, here are the top 10:

•January 20: President Trump is inaugurated.

• January 21: The $500 billion private-sector Stargate project is announced.

• January 27: AI stocks fall on DeepSeek news.

• April 2 to 9: “Liberation Day” tariff announcement leads to a market correction. This was followed by a 90-day pause which sparked a rally.

• July 4: The “One Big Beautiful Bill Act” is signed into law, extending many Tax Cuts and Jobs Act provisions.

• September 17: The Fed begins cutting interest rates again.

• September 22: Nvidia and OpenAI announced a major strategic partnership and investment, raising concerns of “circular deals.”

• October 1: The government shuts down for what would be a record-setting 43 days.

• October 14: Jamie Dimon warns of “cockroaches” after the bankruptcies of Tricolor and First Brands.

• December 16: According to the BEA, the unemployment rate hit a four-year high of 4.6% in November.

Three key themes defined the past year

What themes drove markets across these events?

First, tariff policy created uncertainty but has had less economic impact than expected. Tariffs on imported goods have risen sharply for many trading partners, yet the feared economic consequences largely failed to materialize. This is because companies adapted, tariffs were paused or scaled back, and consumer spending remained strong. For investors, this highlights that the outcomes of policy changes in Washington, whether its trade or federal finances, do not always have an obvious effect on the economy or markets.

Second, it’s hard to miss the fact that artificial intelligence dominated market narratives throughout 2025. From massive infrastructure investments to concerns about market concentration, AI grew as an important source of economic growth and market returns. Over the first 9 months of 2025, the market rewarded most AI-exposed stocks with strong returns, while over the final quarter of the year investors began to differentiate amongst AI-related stocks by selling those where fundamentals were in question or valuation became stretched, and bidding up those experiencing growth acceleration or outperforming cautious expectations. This is a healthy process in public markets.

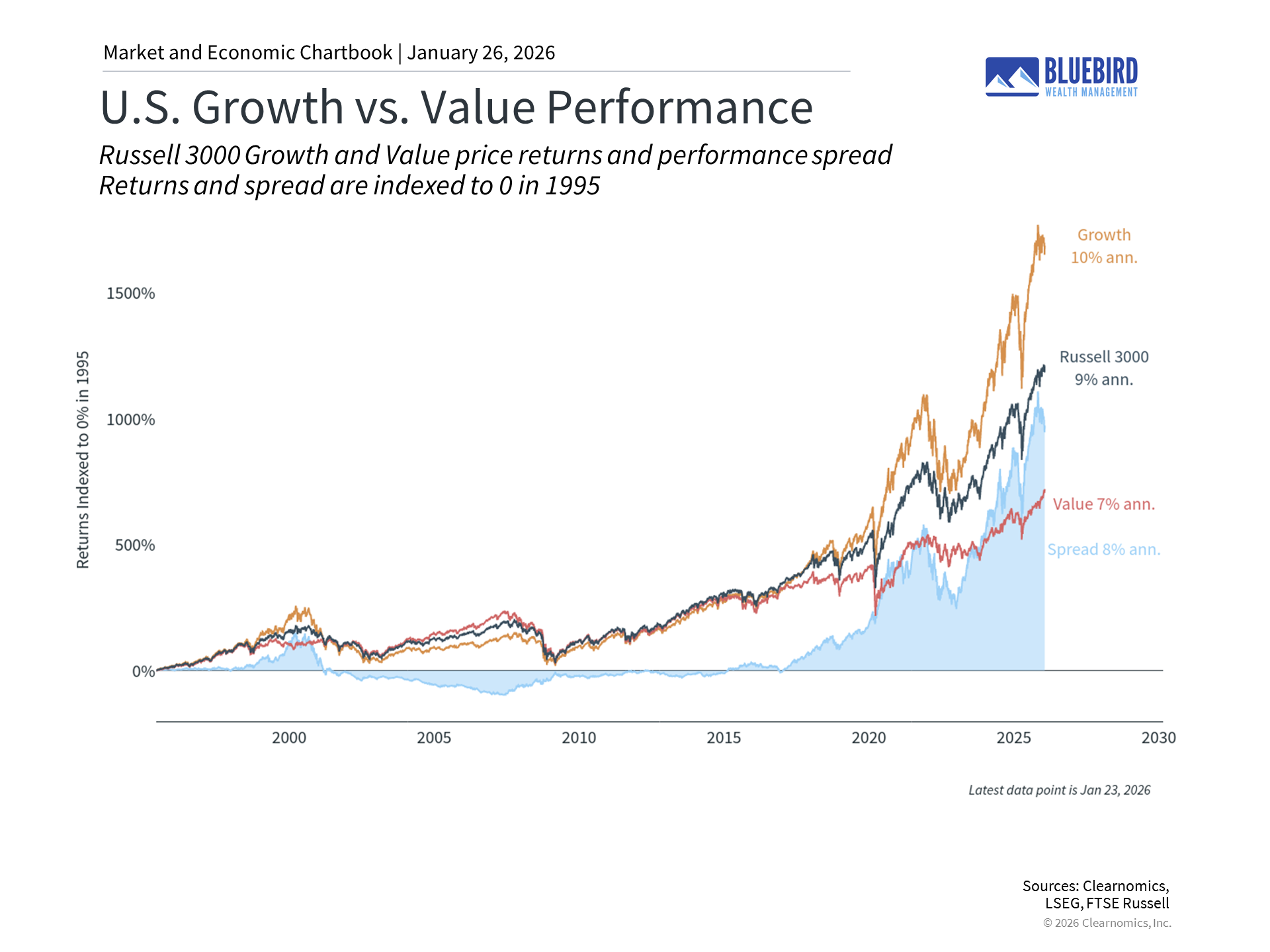

This differentiation amongst AI-related stocks coincided with a shift in style factor returns in the US in the 4th quarter. As measured by the Russell 1000 Growth and Russell 1000 Value indices, growth outperformed value by about 10.5% to 5.3% over the first nine months of the year. In the fourth quarter, however, value outpaced growth by a margin of 3.8% to 1.2% Value’s recent outperformance has extended into January, with value up roughly 4% over the first few weeks of 2026, and growth declining ~1% over this period. Accelerating GDP growth and stretched valuations for growth stocks following three very strong years have resulted in the recent rotation from growth into value.

Third, in addition to a recent surge in value stocks, many other asset classes that have also lagged large US growth performed well in 2025. International stocks outperformed U.S. markets, due in part to the decline in the U.S. dollar. Bonds generated strong returns and have nearly recovered their losses from 2022. Gold, silver, and other precious metals had a very strong year, and are on a tear to start 2026. Small cap stocks, as measured by the Russell 2000 Index, returned almost 15% in the second half of 2025, after a small decline in the first half. Small caps are up sharply thus far in 2026.

Looking out to 2026, we are paying attention to the signals that gold and precious metals are sending to market participants (changing global trade order, geopolitical risks, weaker US Dollar, deterioration of Federal Reserve independence), and believe there is a case for continued expansion of returns beyond the largest US growth names. We are also aware that earnings growth drives stock returns over time, and that while valuation adjustments to growth stocks occurs periodically, ultimately the market will continue to reward strong earnings and cash flow growth so we remain committed to finding these opportunities – particularly when they are out of favor.

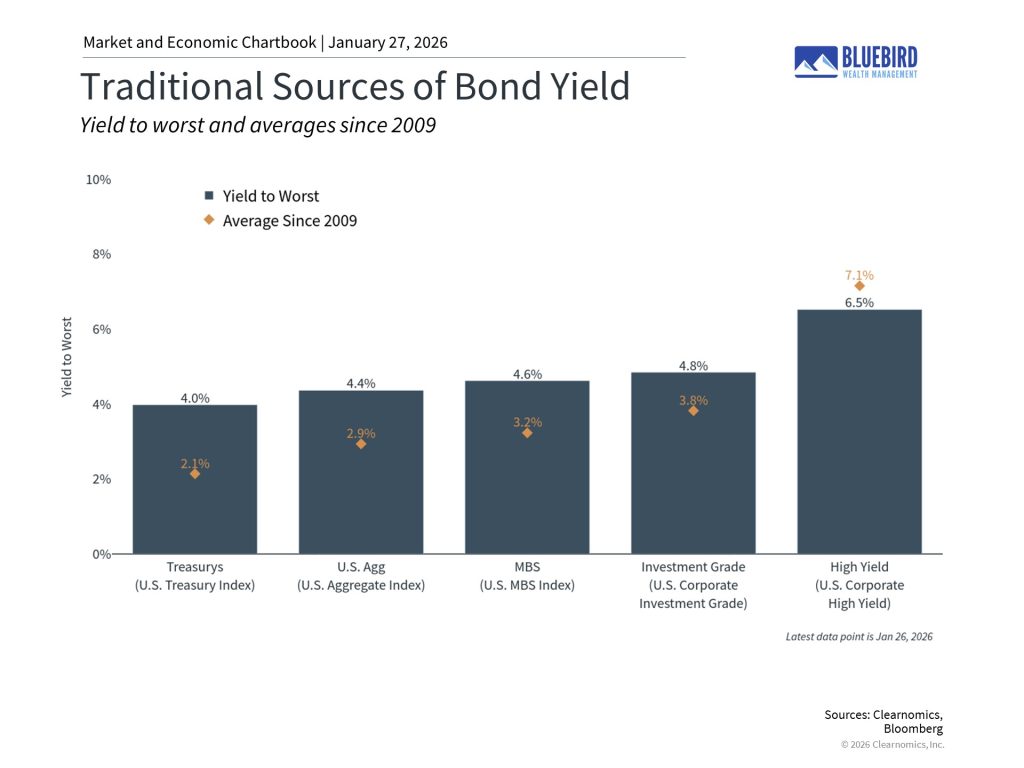

Following a relatively strong year in 2025, fixed income currently offers yields that are attractive compared to recent history although not quite as compelling as one or two years ago. Rates for shorter maturities in particular have declined over the past two years, with money market rates falling from over 5.5% at the beginning of 2024 to about 3.5% today. As measured by the Bloomberg US Aggregate Index, a wide bond market index with an average duration of around 7 years, the US bond market is currently offering yields of 4.4%, well above the 2.9% average since 2009. Credit spreads remain relatively tight, with investment grade corporate yields only 0.80% above Treasuries, as compared to the 1.7% average since 2009. High yield spreads are particularly tight versus history. With attractive yields fixed income should continue to act as a ballast for investor portfolios, although due to tight spreads caution is warranted on the lower portion of the credit scale.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This information is not intended to be a substitute for specific individualized tax or investment advice. Have questions?

This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.