A Bear Market Guide

by Brian Sokolowski, CFA

Bluebird Wealth Management

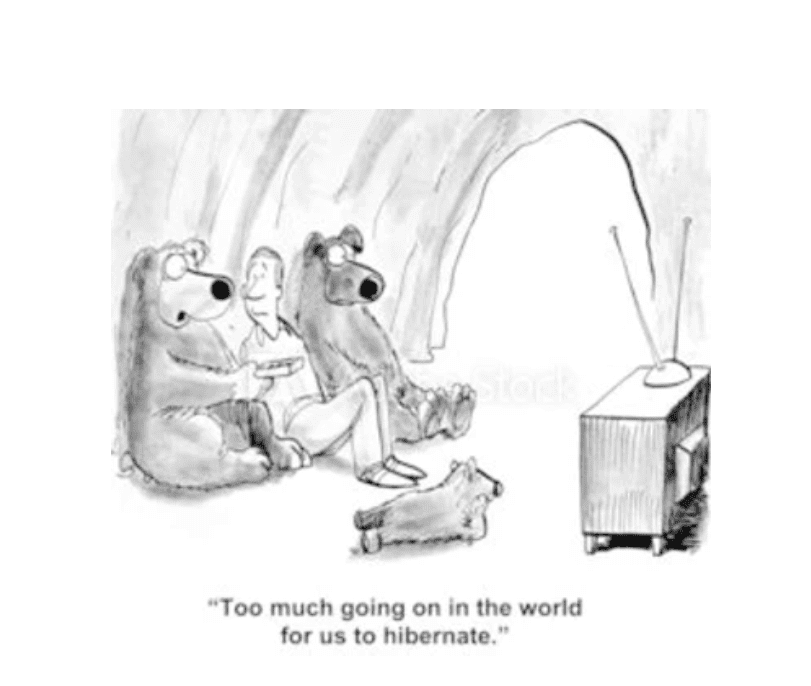

US stock market, as measured by the S&P 500, has thus far narrowly averted the standard definition of a bear market. The Christmas Eve rout left the S&P 500 down 19.8% from its September 20th high, slightly short of the 20% decline which traditionally defines a bear market. We’ll round up the 0.20% and call it a bear for the S&P 500, which puts it in company with groups such as the NASDAQ, US small-capitalization stocks, and most global stock markets. Markets have bounced from the lows, but volatility is likely here to stay for some time due to several unresolved issues including trade disputes, Federal Reserve policy, a slowing global economy, corporate earnings risks, and political tension.

For years, one of the most disconcerting market patterns to me has been the massive gap between market returns and the actual returns realized by individual investors. This has been evident in numerous studies over many years, with one study indicating that mutual fund investors realize a return of a whopping 7% per year less than the market¹. Other studies (such as a 2014 Morningstar study) have found the gap to be closer to 2.5% per year, which is still meaningful. While excessive mutual fund fees are an area of concern and were partially responsible for the 7% gap in the study noted above, they are not the culprit for the gap in the Morningstar study as investors’ actual mutual fund returns were measured against the stated returns of the mutual funds, which are net of fund fees, indicating that the discrepancy is likely timing related.

With this disturbing trend in mind, we thought it would be a good time to share some of our bear market thoughts for the individual investor.

Don’t panic. While this is intuitive to most investors, it is often much more difficult in practice than in theory, as rapidly declining retirement and brokerage statements can make it very difficult to stand firm and not unload equity investments in declining markets. We recommend carefully considering and reminding oneself of the statistics listed above – the reason investors realize substantially lower returns than the market or underlying investment vehicles is precisely due to very poor timing decisions such as selling after steep declines or buying after large increases.

Revisit your financial plan. Do you have a financial plan? A comprehensive financial plan is a critical tool to keep us on a sound long term path. Your plan should be available at your fingertips online and dynamic as markets, income, expenses, and circumstances change, and ideally it should be seamlessly integrated with your investment manager. The plan should be periodically stress tested for various market circumstances, and therefore anticipate just such an environment as the current bear market. This is a critical step in giving investors the confidence that they are on the right path despite market drawdowns and should serve to prevent crippling mistakes such as panicking and making fear-driven asset allocation decisions during difficult markets.

Check your asset allocation. If an investor’s asset allocation was set correctly (according to his or her time horizon, liquidity needs, and risk tolerance) coming into a bear market then he or she may be operating from a position of strength, at the least knowing that market declines could be endured without the need to sell assets, and at best holding cash or bonds which could be used as a source of funds to increase equity exposure. A very fortunate situation would be someone with an overly conservative asset allocation entering the bear market who has the ability to increase equity exposure to a more appropriate long-term allocation when stocks are trading at lower prices. Of course, the inverse situation is the most concerning – an overly aggressive asset allocation for someone with short- or medium-term liquidity needs. While not panicking and selling equities is an important consideration in a bear market, it is critical to take a close look at upcoming funding needs and ensure that your portfolio can handle a further drop in asset prices. While it is painful to reduce equities after a 20% drop, it may be necessary – and it would be even more painful if forced to liquidate at even lower prices.

Diversify. This is a critical time to make sure that investments are properly diversified, particularly regarding potential concentrations of holdings in the equity of one’s employer (or other single-stock concentrations). Equity in employer stock is potentially a great way to grow wealth, but also carries a particularly high level of risk if allowed to become a significant portion of personal wealth due to the risk of concurrently losing employment and a reduction in the value of the company stock. While it may be painful to reduce exposure to a favorite stock (employer’s or otherwise) following a selloff, there are plenty of other equities to purchase in a bear market which have likely experienced a similar decline in price. A swap from a concentrated position to other equities reduces idiosyncratic risk during a period when the likelihood of a significant negative outcome is higher (company bankruptcy, equity dilution, layoff, etc.), while maintaining exposure to a stock market which is now less expensive.

Tax Loss Harvest. A silver lining to weak markets may be the ability to offset a significant portion of one’s tax bill by selling investments at a loss. This should be a regular practice, throughout the year, every year, but with the multi-year run in asset prices there have been limited harvesting opportunities in many portfolios. Make sure to consult an accountant if you manage your own investments to ensure the mechanics are performed correctly to avoid wash sales. If you have an advisor, check losses were harvested in 2018 and if he or she plans to continue to harvest tax losses throughout 2019. With the wider trend away from individual stocks and towards index funds, many investors may not have the same opportunity to realize losses as in the past. Precise tax management is one of the casualties of the move to indexing. You may want to see if your advisor can offer a tax-sensitive portfolio of individual equities to realize this meaningful benefit in weak markets going forward.

Don’t Time the Market. We have all heard the cocktail party stories about people who sold all the equity funds from their 401k at the market peak and then went from cash back into equities at the bottom. While I imagine a few of these stories are true the much more typical result is reflected in the studies presented above – market timing is usually a losing game, including for most professional investors. Resist the urge to reduce equities in your 401k and follow the same sound asset allocation program as for non-retirement assets. If you are in the position to increase equity exposure consider averaging-in over a predetermined period, as opposed to buying on a single day.

Do you have a financial advisor or investment manager? Fees have come down dramatically and transparency and goal-alignment have increased in the industry, resulting in a significantly better deal for individual investors than in the past. If you do not have an advisor, you may be surprised at the range of services you can receive and at the modest cost. If you have an advisor, a bear market is a good time to ensure that the fees are transparent and reasonable, he or she has a sound and robust investment approach, and you are receiving a full range of services that fit your needs.

We are happy to act as a resource on any of these topics, or to provide a courtesy portfolio review. You can reach me at brian@bluebirdwealthmanagment.com

¹ This study by market research firm DALBAR may overestimate the problem as it compares investors’ mutual fund returns to an index (which has no fee) and begins in 1984 when fees were much higher than today.

Disclaimer: This publication is the opinion of Bluebird Wealth Management LLC and is for informational purposes only. It should not be considered investment advice or a recommendation of any investment strategy or security. These opinions are subject to change at any time based upon future events or market conditions.

Bluebird Wealth Management, LLC

Metrowest Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

North Shore Office

(978) 775-1287

12 Oakland St.

Suite 308

Amesbury, MA 01913

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Metrowest Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

North Shore Office

12 Oakland St.

Suite 308

Amesbury, MA 01913

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.