The Remarkable American* Jobs Machine

by Brian Sokolowski, CFA

Bluebird Wealth Management

Last Friday’s jobs report confirmed remarkable and better than expected news. While the newly released December data was as expected and favorable job creation for an economy late in a growth cycle, the revision of November’s data supported the initial report released in early December. According to the Bureau of Labor Statistics, the US labor force added 256,000 new jobs in November, significantly more than the 180,000 expected by economists. In the early stages of an economic cycle these results would be positive but unremarkable. Eleven years into an economic expansion, 256,000 new jobs is very impressive. The result is an estimated unemployment rate of 3.5% (versus expectation of 3.6%), which is the lowest rate of US unemployment in 50 years. Data series at 50-year-lows are worth a bit of digging and discussion.

The stock market has been very strong since the initial November report (reported December 6th), with the S&P 500 up 6% over the period, and most growth-levered stocks up significantly more than the market. We believe the December 6th report was a critical factor in igniting this latest leg up in stock prices.

Why is employment data so important, particularly at this point in the cycle?

Equity markets are constantly trying to sniff out coming recessions. Indicators of all stripes are closely monitored, no matter the point of the cycle. Late in an economic recovery the labor market is watched particularly closely. Labor growth is a key input to the GDP growth equation (GDP growth = Labor growth + Capital growth + Productivity growth), and therefore a slowing in labor growth is often associated with a recession. Very low unemployment levels have historically proven unsustainable, and as the labor market weakens, so does the wider economy (there is a bit of chicken vs egg involved, but we can leave that discussion for another time).

Causes

Before we get to the key question of sustainability of these results, let’s take a look at some of the drivers of a 50-year low in unemployment.

Investors are not demanding profitability

The most interesting of the causes is the long list of free or extremely discounted stuff the American consumer is now able to get, funded by investors with long time horizons and minimal demands for near-term profitability. For example:

Are you one of the 26 million Netflix account owners who watched The Irishman in its first week? Of course a Netflix subscription isn’t free at around $12 per month, but the economics of forgoing blockbuster theater revenue that would likely top $500 million over its full lifecycle, and instead using the Martin Scorcese film as a $159 million advertising and retention tool is clearly a long-term investment decision as opposed to a short-term profitability decision.

Have you ever used Uber Eats? Right now, at 9:30am in a quiet Boston suburb I can order a bagel sandwich from a not-so-nearby restaurant for a delivery fee of 49 cents. The sandwich price is marked up by over 100%, but at a total incremental cost to me of around $6 (versus going to pick it up myself), I am able to get a sandwich delivered to me from a restaurant 10 minutes away. It is safe to say Uber and/or the bagel shop are losing money on this transaction.

The “Amazon effect” created investors willing to fund a generation of companies that lose money or break even much longer than in the past, in exchange for the potential for huge rewards far down the road. While this effect is observable in the public equity markets, it is particularly the case in private markets as unicorns swell in size, number, and prominence. If capital demands lower (or no) economic returns for an extended period of time, the two groups that benefit are customers and labor.

Low nominal interest rates

The current global interest rate environment is fascinating. A few months ago, 33% of the outstanding investment-grade debt in the world carried a negative interest rate, meaning that a lender had to pay for the right to lend money to a borrower. A recent increase in rates has cut that amount to 20% currently. Since US rates are influenced by global rates, long-dated US bond yields have remained very low despite the long recovery and 3.5% unemployment rate. The 10-Year US Treasury bond, a key input to most long term investment decisions, currently yields around 1.8%. After subtracting 2% inflation, the real yield on the US 10-Year is essentially zero (actually slightly negative). Zero percent (real) long-term cost of funds has two positive impacts on job growth. First, it helps capital flow to investments that may offer a large long-term win despite no return in the near-term, since investors are forgoing very little for the possible upside of a large gain down the road. Second, a lower discount or hurdle rate applied to investment projects across the real economy help to increase activity and associated jobs.

Debt/fiscal stimulus

For most of the Obama administration the annual fiscal deficit had been declining on a year-over-year basis, albeit from an inflated starting level due to the financial crisis (i.e. – still a deficit but a smaller deficit each year), which resulted in fiscal policy acting as a drag on GDP growth. Under the Trump administration, the deficit has increased from -2% in 2016 to the current level of -5%, providing a tailwind to GDP and job growth. The largest component of this stimulus has been in the form of the 2016 corporate tax cuts and repatriation which, while likely resulting in less jobs than its proponents forecast, has been a tailwind to GDP and job growth.

Long, modest economic expansion

The length of the current economic expansion, which is now at 10.5 years, has led many observers to repeatedly call for its demise based on age, a belief which we have not shared. While this expansion is longer than average, it is also more tepid than most economic expansions. There has only been one quarter (out of 44) when real GDP growth has exceeded 5% in the current growth cycle. The 1990s economic expansion experienced 10 quarters of growth in excess of 5%, out of a total of 41 quarters between the 1991 and 2000 recessions. The average growth rate in the current expansion (2.3%) is also slower than during other modern expansions. The economy grew 2.8% per year in the 2002-2007 expansion, and 3.8% per year in the 1990s expansion. The job growth process is gradual – a long, modest expansion is ideal for sustained job growth and lower unemployment readings. Sustained, moderate growth over an extended cycle also allows time for new entrants to the labor market, which is evident in the all-time low measure of the “U-6” under-employment/unemployment measurement of 6.7%. This wider view of the US employment market is particularly telling, as it indicated that the supply of jobs is ample enough to draw many previously marginalized workers back into the economy. (Data Source: Bloomberg)

Are these causes sustainable?

Let’s take another look at each of the causes to attempt to predict sustainability.

Lack of profitability demanded by investors

The public equity markets, while far from infallible, often have a wonderful way of forcing discipline on companies and investors. Public markets soundly rejected a large portion of the 2019 IPO class, despite a 30%+ return year for the US equity market, with lack of profitability the clear reason for the market’s distaste of these firms. The Uber and Lyft IPOs in particular were rejected by the market (not to mention the WeWork debacle), and were a turning point in investor views on profitability. The ride-sharing firms responded to the market’s rejection pretty quickly, by beginning to raise prices late last summer. We think the poor 2019 IPO class will be a catalyst to begin to instill some small amount of discipline for later stage unicorn companies, if not at the operating level, at least at the level of unit economics. If we have indeed reached peak loss-acceptance, the result should be modest downward pressure on employment demand.

Low nominal interest rates

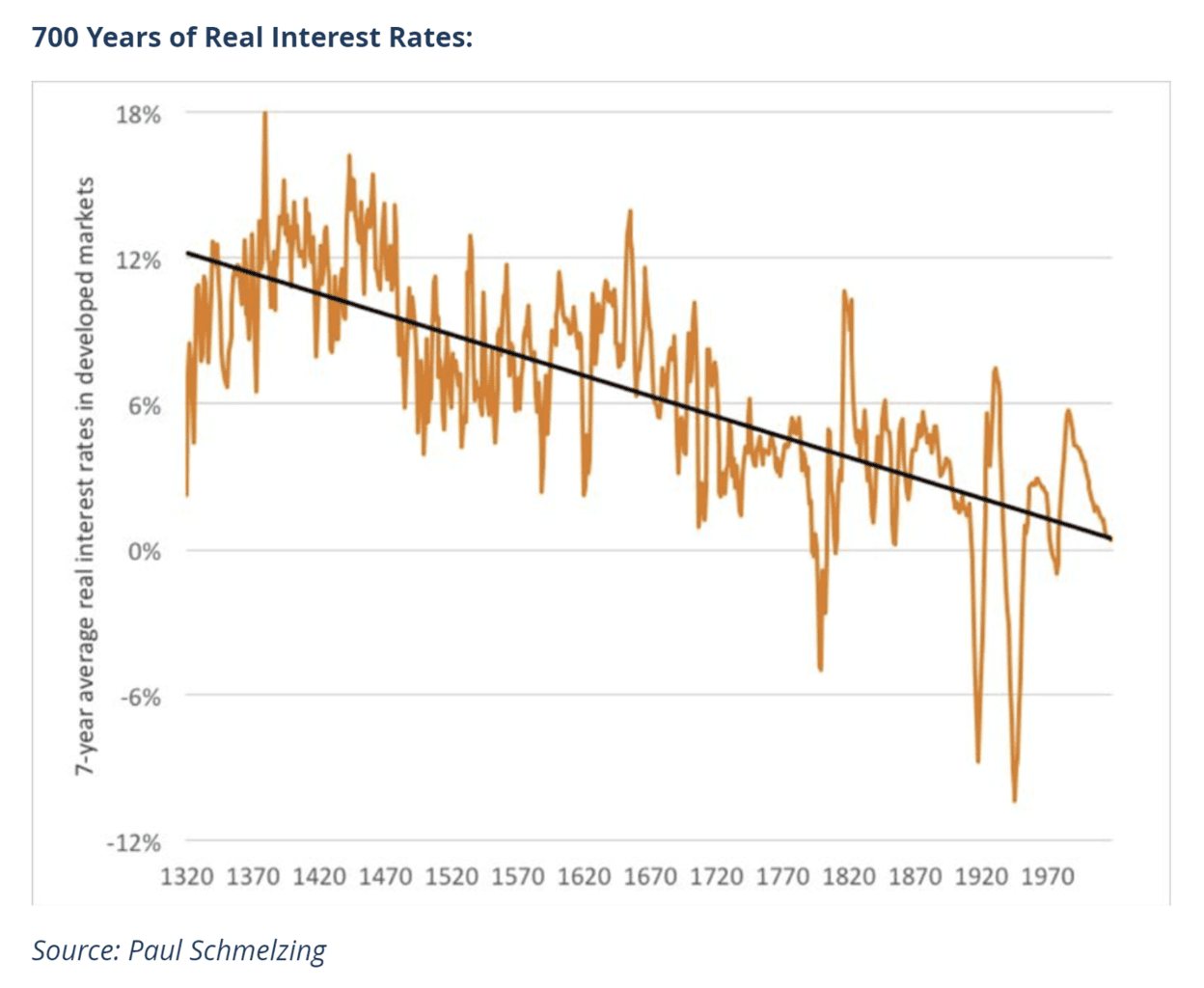

Predicting interest rates is no easy task, and the consensus view of higher rates over the last decade has been wrong. In the event of a US recession, the potential for the US to join much of the developed world with negative interest rates is quite high, in our estimation. But perhaps negative interest rates are not such an anomalous event? As a history major and money manager, the following chart is perhaps my favorite in many years (700 years of real interest rates!):

The full article is worth a read; Professor Paul Schmelzing’s theory is that perhaps the consensus position that interest rates will eventually “normalize” at a meaningfully higher level is incorrect. On the other hand, a brief upward tick on the chart above would indicate a decade of higher rates which would be more than enough to wreak havoc on the current 50-year low in unemployment. Our conclusion on rates and employment remains the same as it has been: our guess is for modestly higher interest rates which would have minimal negative pressure on employment statistics. But the largest risk for the US and global economy, and therefore for US employment, would be an unexpected and sharp rise in long-term interest rates.

Debt/Fiscal Stimulus

With the upcoming presidential election, there is little prospect of a change in fiscal policy in 2020. Looking out to 2021, policy is dependent upon the result of the elections, but what appear to be the least likely outcomes (either party sweeping the White House and both houses of Congress) are also the outcomes that would carry the greatest opportunity for more fiscal stimulus. A split result would likely leave fiscal policy as a neutral for at least the next few years.

In terms of the private sector, while corporate debt is at an all time high, this growth should be expected given both low interest rates and natural growth of GDP. Since 1969 US corporate debt has grown by 7.25% per year, or 1% faster than US nominal GDP growth of 6.25% per year, resulting in a slow creep of debt relative to the economy, not a spike (Bloomberg).

The expansion has been long, but the modest growth rate…

…should reduce the risk of large imbalances occurring in the economy. After the current cycle ends imbalances will become apparent, although we do not believe these imbalances will be as damaging as they were during the last two recessions. The most likely culprit to cause/magnify the next recession is the significant amount of capital invested in loss-making companies, as discussed above. As this capital retreats during a recession there will be negative impacts to growth, innovation, and jobs, but these impacts are likely to be much more moderate than the crushing blows from the last two recessions. The 2008 housing-driven recession cut to the core of the US economy (hitting the consumer’s most important asset) and was significantly exaggerated by the pyramid of financial products built on top of a faulty foundation. The late 1990s Technology bubble overvaluation was 1) more extreme and widespread than today’s valuation excesses, and 2) more prevalent in the public equity markets and therefore impacted more, and more average, Americans.

Less severe imbalances do not have a direct impact on employment growth, but they should lead to a smaller shock if there were to be a recession, and they reduce the chance of an overheating economy being the cause of a recession.

Conclusion

The US economy currently needs to add approximately 100,000 jobs to keep pace with the growth of its working age population. While we do not expect November’s 256,000 additions to be the norm at this point in the cycle, we believe the outlook on the above factors should result in a continuation of above-trend job growth which will continue to drive a modest reduction in both the official unemployment rate, and the U-6 rate. Importantly, these trends will also continue to place modest upward pressure on wage growth, which was slightly less than 3% through most of 2019.

Thank you for reading.

* Note: While the US is not alone in currently experiencing a cyclical decline in unemployment (several European countries are at 10-30 year lows, aided by factors such as low interest rates) the US economy’s dynamism, population growth, and (relative) acceptance of immigration are critical factors in its continued outperformance in employment growth, level, and labor participation rates versus much of the developed world.

Bluebird Wealth Management, LLC

Metrowest Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

North Shore Office

(978) 775-1287

12 Oakland St.

Suite 308

Amesbury, MA 01913

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Metrowest Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

North Shore Office

12 Oakland St.

Suite 308

Amesbury, MA 01913

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.