Opportunities Abound

by Brian Sokolowski, CFA

Bluebird Wealth Management

Last quarter we wrote about significant crosscurrents and contradictions in the economy and markets and wondered how they would play out over the latter half of 2018, specifically if strong earnings growth would continue in the face of trade risks and rising interest rates. Rather than providing a balanced judgement over several months, the US equity market chose to mostly ignore these risks during the third quarter, and then suddenly price them in with a rapid selloff in October. Where to from here?

Markets

Although it seems like a distant memory, the third quarter was the best for the S&P 500 in almost five years, returning over 7%. The NASDAQ experienced similar gains for the quarter, which brought gains for the technology and growth-heavy index to almost 17% through the first nine months of 2018. International markets continued to lag the US in the third quarter and year-to-date, with a 1% gain for the MSCI All-County ex-US Index in the quarter (down ~4% for the year).

The good mood in US stocks in the third quarter ended abruptly as the fourth quarter began with all major US indices entering correction territory (a 10% pullback) towards the end of October. A late month bounce somewhat eased the damage, but not enough to erase some notable negative statistics:

-A 9.2% decline in the NASDAQ resulted in its worst month in 10 years, since November 2008

-The S&P recorded its worst month in 7 years, falling 6.9%

-Small cap stocks were even worse, down almost 16% from their September peak, as measured by the Russell 2000 Index.

-Over half of S&P 500 stocks reached bear market territory (a 20% pullback) towards the end of October.

Causes

The initial spark for the selloff were Fed Chair Jerome Powell’s October 3rd comments that current short-term interest rates are “a long way from neutral” and that it may be necessary to hike rates past neutral, which caused the 10 Year Treasury yield to leap from 3.06% to 3.18% that day, and to reach 3.25% a few days later.

This increase was in addition to the jump from 2.4% at the beginning to 2018 to 2.8% at the end of August, and a further spike to 3.05% as October started. As rates jumped in early October, an increasing amount of data appeared to indicate that the persistent climb throughout 2018 was negatively impacting sectors of the economy which are reliant on low borrowing costs, specifically housing and autos.

The third shoe to drop came in the form of disappointing earnings reports from a handful of companies as the month progressed. Many investors had been looking for strong earnings results to offset the impact of rising rates, but instead the market saw the first meaningful evidence of disruption from the President’s tariffs. While the absolute level of growth continues to be very strong, and aggregate earnings reports versus expectations remained positive versus historic measures, a few high-profile shortfalls and guidance disappointments, as well as cautious commentary from hundreds of CEOs, were enough to indicate that trade measures are reducing growth.

Changing Circumstances

We have learned some new information in the past month, or some prior suspicions have been confirmed including:

-We are likely past the peak rate of economic growth in the current cycle, and the duration at which we can stay near the top will be short-lived. This does not mean that the cycle is over, but we are unlikely to see growth acceleration in the current economic cycle.

-Earnings estimates are likely too high for 2019, as forward guidance from bellwethers such as Texas Instruments and 3M indicate a slower pace of growth relative to recent quarters and relative to expectations.

-Tariffs and the trade dispute with China are having a chilling effect on investment, as opposed to only isolated financial impacts on specific companies.

-Higher interest rates are slowing portions of the US economy and rates will have an increasing impact if they continue to rise from current levels.

Positives Outweigh Negatives

Despite these changes, we are increasingly positive on equities. We are using recent weakness as an opportunity to increase equity allocations to, or modestly above, the targeted midpoint for a given risk tolerance. We do not know if the near-term market low was reached on October 29th, and would not be surprised if the current market bounce reverses and re-tests or falls below the October 29 low, but we believe it is a good time to begin to take advantage of opportunities, due to positives including:

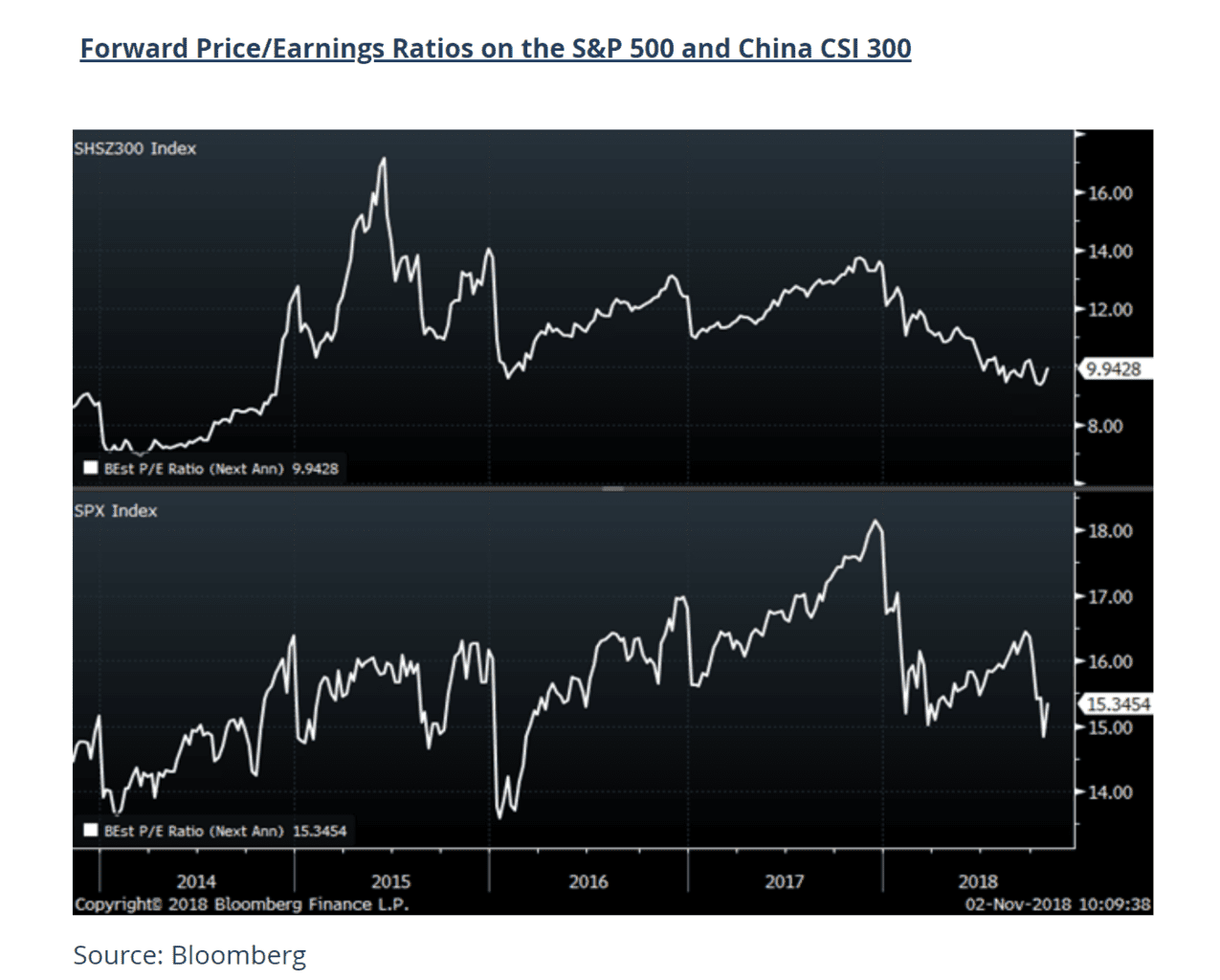

1. Valuation – the forward P/E on the S&P 500 has been on a downward trajectory this year, from 18x in January to 15.3x currently, which leaves it in-line with, or below, its long-term average, depending upon the period selected. Given current low inflation and interest rates, the P/E appears to be partially pricing in an increase in either or both measures, or a meaningful reduction in earnings estimates in 2019.

2. Despite our belief that we are past the peak of the cycle, we continue to believe the likelihood of a recession over the next 18 months remains low. Inflation and wages are rising but appear to be under control; unemployment is very low, but the participation rate continues to creep higher; productivity has finally been showing signs of life; consumer confidence remains extremely strong. There are limited imbalances in the US economy (perhaps capital formation at unprofitable companies the most meaningful), and although inflation has been rising the Fed’s gradual tightening of liquidity appears to be successfully cooling activity in interest rate-sensitive sectors. Limited imbalances lead us to believe a potential recession would be mild or average, as opposed to the deep recession after the financial crisis.

3. Sentiment has been somewhat reset by the recent selloff, although bearishness has not reached extreme levels. Frothy sentiment was evident in the rapid and deep selloff in some portions of the market where there was very little change to the fundamentals. For instance, Amazon was down almost 30% on a minor guidance miss versus expectations, which can be explained by the investor crowding into a very popular holding that has marched almost straight up in recent years.

-The AAII Investor Sentiment Bullish Index reversed from 46 (the third highest reading in 2018) at the beginning of October to 28 (the third lowest reading in 2018) during the last week of October.

-Anecdotally, the parade of investors on the financial news channels predicting bear markets (or even that the market is trading “50% above fair value”), increased dramatically during the closing days of October.

4. We are likely close to or past a peak in concern around trade. Now that the market has seen the risks to fundamentals from the trade conflict with China, it is our belief that concern is likely peaking. There will of course be a negative impact to growth if all the tariffs are implemented, but the impact would be manageable at less than 1% of GDP. The stock market is very adept at discounting known fears, of which trade is now likely in the category. Further, this is a self-inflicted wound that was created by, and can be alleviated by, the actions of two world leaders.

Opportunities Abound

While there are opportunities across equities, due to the maturing portion of the cycle and – more importantly – the potential for even higher interest rates, we are moving incrementally towards stocks with nearer-term cash flows and stronger balance sheets. This does not mean that we favor traditional defensive equities (REITs, Utilities, Staples) to growth or cyclicals, but that within each style cohort we think it is a prudent time to reduce exposure to balance sheet risk, and the acknowledgement that higher funding costs and longer duration cash flows reduce intrinsic value at higher interest rates. Some interesting opportunities include areas such as:

International/Emerging Markets: while global risks are just beginning to be realized in US equity markets, International markets have been weak throughout 2018, particularly in Emerging Markets and China. China has been ground zero for global trade risks, with Chinese equity indices underperforming US indices by more than 20% year to date and declining more than 30% from their peaks.

From an Index perspective, China trades at less than 10x 2019 earnings estimates (as measured by the CSI 300 Index), a 33% discount to the S&P 500. There are plenty of risks in China, including a slowing economy as indicated by the recent disappointing Purchasing Managers Index reading of only 50.2, which points to a stagnating industrial economy. These risks may be more than priced into prices, however. For example, innovative technology and e-commerce leader Alibaba (BABA) now trades at 21x 2019 EPS estimates, down from 27x earlier this year. The stock may be a bargain given its 25%+ growth rate and excellent position in a huge and growing e-commerce market.

Circumstances can change rapidly in Emerging Markets, as seen recently in Turkey (where runaway inflation appears in the early stages of being restrained by interest rate increases) and Brazil (where stocks have rebounded sharply following recent elections). We do not expect the current trade dispute with China to necessarily be resolved at upcoming November meetings, but believe risk/reward skews positively given sentiment, expectations, and valuation.

Technology stocks were the worst performing major sector in October, as the sector had further to fall after leading the market through the first nine months of 2018. Valuations were stretched for many names coming into October, increasing the risk level for the group. For example, salesforce.com’s (CRM) forward Price/Cash Flow multiple hit a multi-year high of 34x at the end of September. A 20% stock pullback brought the multiple back down to 27x, in-line with its 7-year average, and reasonable given our expectation that cash flow can grow at a roughly 30% annual pace for the foreseeable future. While it would not be accurate to characterize salesforce.com and the software industry as cheap, frothy valuations have been brought back down towards historical ranges, and there are many attractive opportunities given the strong fundamentals in the group.

In the FAANG group Alphabet (GOOG) and Facebook (FB) both appear downright cheap at 20x and 22x 2019 GAAP estimates respectively, with the valuation for the latter name potentially more than compensating for recent fundamental challenges. Even the often-criticized Amazon (AMZN) valuation is approaching attractive levels following the pullback, with the stock trading at 23x 2019 cash flow estimates – reasonable given 30% annual cash flow growth.

While the Technology-heavy NASDAQ received most of the headlines for recent declines, Cyclical stocks have been battered throughout 2018, with Industrials, Energy and Banks getting hit especially hard. Industrials have been hurt by international weakness, China fears, and peaking industrial activity in the US. From their respective peaks, 3M (MMM) declined almost 30%, Caterpillar (CAT) by 35%, and construction equipment rental company United Rentals (URI) by 42%. Valuations for the cyclical names are extremely cheap, with URI trading at 7x 2019 EPS estimates, and CAT at 10x estimates. We recognize that there is likely downside risk to estimates, and that buying cyclicals when P/Es are low has been challenging historically. However, if our opinion that the cycle is not over is correct, and therefore the estimates will hold up, these stocks currently appear to be bargains.

Our investment philosophy is to buy quality growth companies at reasonable prices. As we discuss in Bluebird Wealth Investment Approach, quality growth companies are not often put on sale by the market. When these companies are available at reasonable prices, we have found it is often an opportune time to buy them, despite near term volatility or concerns.

I look forward to your questions or comments.

Disclaimer: This publication is the opinion of Bluebird Wealth Management LLC and is for informational purposes only. It should not be considered investment advice or a recommendation of any investment strategy or security. These opinions are subject to change at any time based upon future events or market conditions.

Bluebird Wealth Management, LLC

Metrowest Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

North Shore Office

(978) 775-1287

12 Oakland St.

Suite 308

Amesbury, MA 01913

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Metrowest Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

North Shore Office

12 Oakland St.

Suite 308

Amesbury, MA 01913

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.