Passing the Baton to Inflation

by Brian Sokolowski, CFA

Bluebird Wealth Management

The dominant theme for the market this year has been the continued strong economic recovery, albeit at a rate slightly slower than the consensus had expected entering the year. Strong – but slightly disappointing – economic growth explains above-average equity returns paired with relatively defensive leadership, and rotations between growth and value groups through the year.

As we emerge from the current third quarter corporate earnings season, we believe the baton will be passed from demand concerns to supply/inflation concerns as the dominant factors for investors to watch through the end of 2021 and into 2022.

A Quick Recap

By historical standards, the first nine months of 2021 were excellent from a return (and volatility) perspective for US markets. Large cap stocks returned 15.9% through three quarters (as measured by the S&P 500), and bonds recorded modest positive returns. Volatility has been very low relative to history, with the S&P 500 finally experiencing its first 5% drawdown in almost a year in September/October. Markets recovered this weakness through October, and currently sit near all time highs.

US large cap stocks continued to outpace international stocks which were up 6% through the first nine months, as measured by the MSCI All County World Index, and US domestic small cap stocks, which returned 12.5% through the same period. Mega cap growth stocks, most notably the FAANG group, helped to lead the market higher thus far in 2021, which is a contrast to the final nine months of 2020, when this group performed well but lagged the average stock.

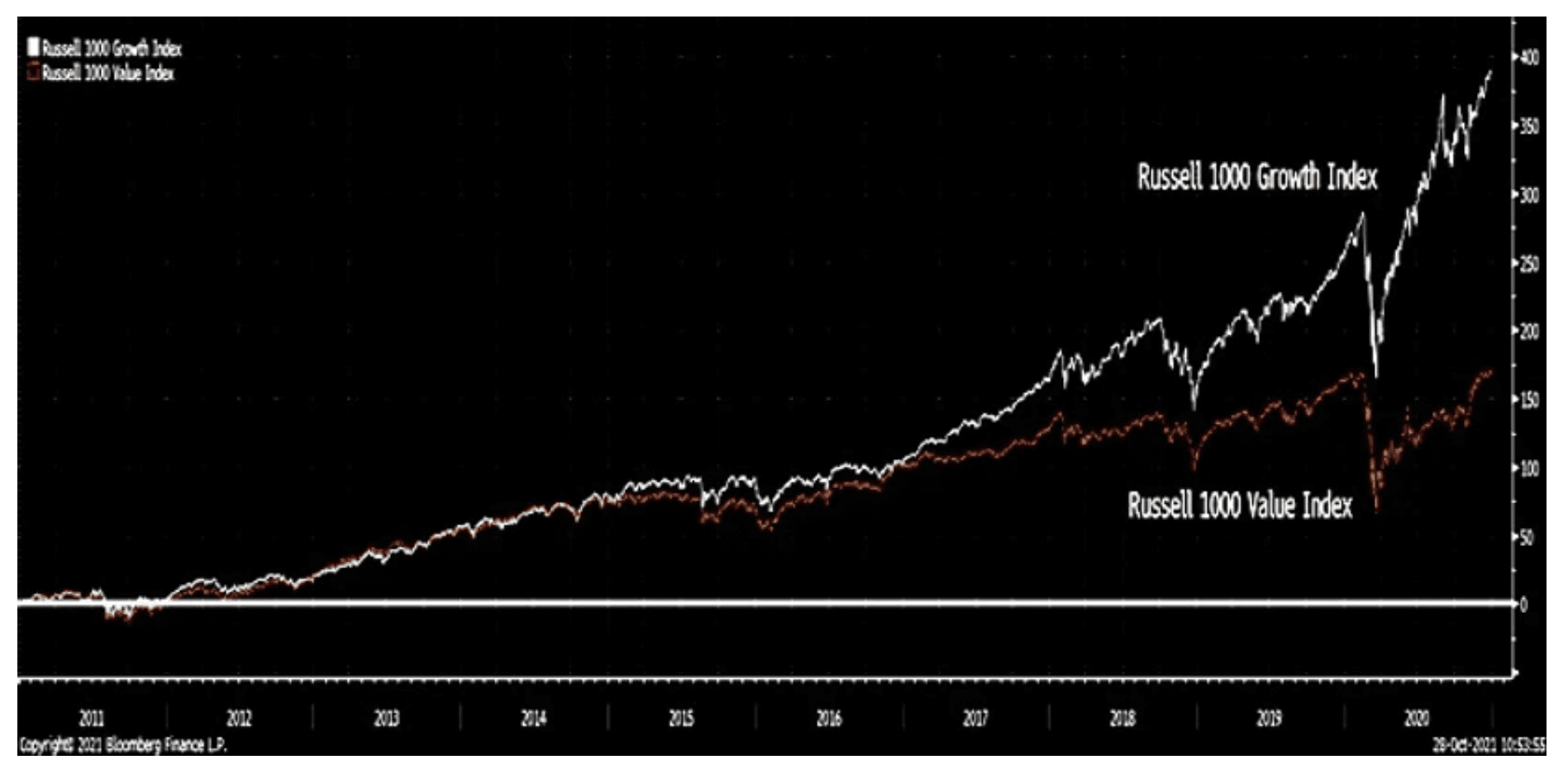

Over the 10 years ending December 31, 2020 growth stocks outpaced value stocks by a huge margin, with growth posting a ten year return of 389%, versus a 171% return for value stocks (chart below). Value outperformed growth in just one of those years (2016), with Growth winning six years, and three years which were essentially even. The two groups are approximately even thus far in 2021, although with significant rotation through the year. Stocks levered to rapid economic growth were very strong to start the year, as the initial vaccinations occurred and investors were optimistic about economic recovery. In May we wrote about the resurgence of an “analog” market, following a steep March-May selloff in the most aggressive growth stocks, and relative strength in the value group. The groups have ping-ponged back and forth since. Meanwhile, buoyed by some of the more defensive sectors such as Healthcare and Utilities, and relative stability in the largest technology stocks, the S&P 500 has continued to grind higher for most of the year.

Growth Outpacing Value

Source: Bloomberg

Economic Drivers

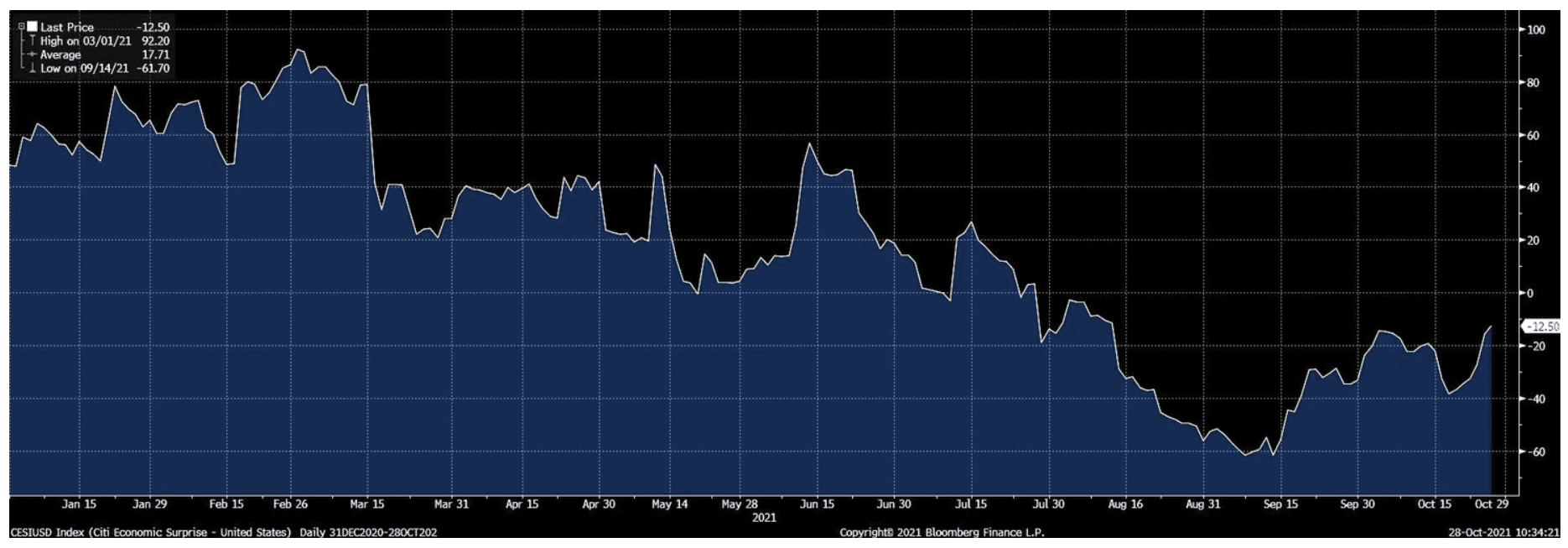

GDP growth is now estimated at 5.5% for 2021, versus the prior consensus expectation of 6.5% for the year, according to Bloomberg data. One of our favorite charts to revisit periodically is the Citigroup Economic Surprise Index (CESI), which measures economic performance versus expectations, rather than on an absolute level. The US CESI for 2021(chart below) shows that reported economic data peaked relative to expectations in mid-February and steadily declined through mid-September. Not coincidentally, as economic data was beating expectations through the first six weeks of the year, stocks levered to economic growth outperformed defensive stocks, and the inverse was the case as economic data began to mildly disappoint from February through September. As evident in the chart, over the past six weeks data has begun to positively surprise once again, a factor we are closely watching for durability.

Citigroup Economic Surprise Index

Source: Bloomberg

Of course, the dominant influence over economic growth for the last 20 months has been Covid. Vaccination rollout last winter and relaxation of restrictions led to increased hopes for a rapid return towards the prior normal. As Delta’s spread became increasingly apparent through the spring, and resumption of in-person activity faltered, overall economic data modestly disappointed the high expectations. While the extent and impact of the Delta variant was a surprise to many, including us, we continue to believe that the net result is growth deferred, not growth lost.

Inflation and Disrupted Supply Chains

While Covid’s impact on demand was the dominant economic factor of the last 20 months, we believe that the baton is currently being passed to inflation and supply chain disruptions, which will be the dominant economic factors heading into 2022.

To state the obvious, this is a unique cycle. Inflation and supply chain disruptions have been building in some areas (housing, autos) since the onset of the pandemic in early 2020 and have escalated and spread since. Our society is discovering that putting supply chains back together is much more difficult than halting them, and the result is accelerating inflation across the economy. Consumer Price Inflation (CPI) of 5.4% in both the second and third quarters is the highest quarterly reading since 1990. If the fourth quarter rate is 5% or higher, 2021 will be the first year since 1982 to experience three consecutive quarters of 5% or greater CPI.

A disrupted global supply chain is a key cause of this higher inflation. Initially narrow disruptions which were expected to correct relatively quickly have instead expanded through 2021. Root causes such as labor supply issues, national and regional shutdowns, unexpected shipping patterns and demand changes have snowballed to include almost all sectors. The semiconductor chip shortage is well known, impacting almost every industry, including personal computers, solar panels, autos, and even precious metals. An estimated $24 billion in goods is sitting on cargo ships off the coast of California, waiting to dock and unload. Lack of available products to sell is even causing manufacturers to buy fewer advertisements on social media services, according to Snap Inc.’s Q3 earnings report. Why buy ads if there is no inventory to sell?

Federal Reserve Chair Jerome Powell has been describing the current elevated level of inflation as “transitory” since March 2021. This may indeed be the case, as it is reasonable for a global economy resetting from an exogenous halt to exhibit increased inflation, exacerbated by the supply chain issues discussed above. CPI is a year-over-year measure, implying that after the “base effects” of comparing to the shuddered economy of 2020 roll off, there should be some relief, at least regarding the growth rate of the official measures. However, recent events around a critical aspect of the supply chain are casting doubt on the transitory moniker: labor.

The Great Resignation

Through most of 2021, labor shortages across the US were widely blamed on a combination of extended unemployment benefit and Covid-related safety concerns and protocols. These factors surely played a part, but as some of these conditions ease through benefit lapses and vaccinations, labor shortages have not relaxed and appear to be worsening. The Bureau of Labor Statistics recently reported that an unprecedented 4.3 million US workers quit their jobs in August, or 2.9% of the entire workforce. These resignations occurred across sector, including union and nonunion, white collar and blue. Labor concerns driving the resignations are varied and myriad, including flexibility, working conditions, hours, and compensation. While some of the concerns cannot be addressed by pay increases, the simplest and common mechanism across the diverse US economy is, indeed, higher pay. If the US economy is closer to the beginning than the end of a wage cycle, the current elevated inflation level is unlikely to prove transitory.

Outlook and Portfolio Actions

While it appears inflation may be stickier than initially conveyed by the Federal Reserve’s “transitory” characterization, we do not expect a scenario resembling the 1970s stagflation environment. Technology is deflationary, the global economy is less reliant upon physical raw materials and energy, and the US economy is dynamic and competitive. We do, however, expect inflation to remain elevated into 2022 and would not be surprised by markets expressing concern periodically through volatility and sharper asset price movements. Next week the Fed is widely expected to announce a gradual tapering of its bond purchasing program, an important tool to begin to tighten monetary policy. The relationship between inflation expectations, supply-side impact on GDP growth, pace of Federal Reserve policy tightening, and interest rates is the major dynamic we are watching into 2022.

At our core we are Quality Growth investors, preferring to own durable growth companies for long periods of time. Quality Growth companies continue to form the core of Bluebird client equity portfolios, and we expect these businesses to remain resilient in an inflationary environment due to pricing power enabled by their high gross margins. We are currently supplementing portfolios with a modestly higher exposure to cyclical companies, which should benefit from higher interest rates (banks) or higher inflation (select commodity producers). Finally, as some of the growth deferred from 2021 falls into 2022, we believe demand for in-person activity (travel, leisure, and business) will reaccelerate, benefitting companies across multiple sectors.