We’re Onto 2019

by Brian Sokolowski, CFA

Bluebird Wealth Management

To borrow from a certain well known football coach in New England, we’re on to 2019. In his infamous press conference Coach Belichick was responding (well, refusing to respond) to questions regarding a difficult start to the 2014 season and he was clear that his focus was on the future. The Patriots responded by dominating the Bengals 43-17 the following week, and finished the season and playoffs by winning 13 of their last 15 games en route to another Super Bowl title.

Closing out 2018

Despite Mr. Belichick’s refusal to address questions regarding the past, I am confident he studied film and learned from it. The same should hold for investors generally and it definitely does for us at Bluebird – we owe it to our clients to constantly review the past to be better going forward.

We went into the fourth quarter neutral on equities (versus each client’s personalized asset allocation target), but we began to see buying opportunities emerge as the selloff accelerated. Although we were early, we increased equities to overweight during the fourth quarter, and implemented the change by adding to some of our favorite groups (Software), most beaten down groups (Semiconductors or China-exposed), or cyclical stocks (Industrials) in many client portfolios. In All-Equity portfolios we reduced defensive equities to increase exposure to cyclical or growth stocks.

While some of these purchases occurred before the equity market bottomed late in the quarter, resulting in near term losses, we were able to buy some excellent companies at very compelling valuations. The strength of the January rally has made many of these purchases successful much faster than we had anticipated.

It became clear through the quarter that a combination of slowing global growth, uncertainty from the US-China trade dispute, and fears that the Fed was ignoring these risks and would increase short term interest rates too rapidly and invert the yield curve was behind the selloff. With the risks and causes known, investors have been able to begin to get clarity in regards to reconciling the items, allowing the market to recover in January.

Three Big Issues of 2018

The Fed. Weakening data, signs of risks to growth, and the sharp equity market selloff has led to a clear change in Federal Reserve commentary, as communicated by Chairman Powell on multiple occasions in recent weeks. Modest inflation expectations in spite of continued wage and employment gains has given the Fed the space to pause, at least for now. If the economy (and, importantly, inflation) were to re-accelerate, interest rate increases would be back on the table. Some pundits believe this puts the market in a bind – the only way rates stay low is with the current modest level of growth continuing, and if growth were to accelerate the Fed would quickly subdue the stock market with rate increases. We see the situation differently. The recent Fed rhetoric has made it clear to us that the Fed will wait for obvious signs of higher inflation before acting. Therefore, it will take a strong economy (and likely higher long rates) for the Fed to resume increasing short rates. This scenario would result is at least a parallel shift higher in the yield curve, or perhaps a steepening, which we believe would be neutral to positive for stocks.

Trade. It has been our position over the last year that a US-China trade dispute would put modest but acceptable downward pressure on GDP growth in the two countries, but also cause painful earnings surprises for specific companies or sectors. These shocks have caused sharp selloffs in exposed companies, of course, and also created a risk aversion impact on the sector and wider market, leading to a reduction in P/E ratios. But with time, economic markets adjust and impacts dissipate. Inventory drawdowns stabilize. New markets or suppliers are identified. Commerce goes on. It appears as if the worst of the trade dispute induced disruption may have occurred and a nascent recovery stage has begun, as indicated by recent commentary from a number of semiconductor companies (Microchip, Lam Research, Texas Instruments) which are at the center of the storm. Therefore, while an agreement in current and upcoming talks would be a positive, we do not believe it is a prerequisite for a stabilization for the two economies.

Growth. S&P 500 earnings growth was robust in 2018, exceeding 20%. Expectations for 2019 have decreased over recent months, alongside the deterioration in global GDP growth and softer data from consumer confidence and industrial indices. Earnings growth is now expected to be in the 5% range, which while not particularly robust at least appears to be somewhat de-risked, as estimates have been cut roughly in half from previous expectations. CEOs and CFOs have no reason to go out on a limb and project robust growth for 2019 given the volatility and challenges apparent to everyone over the last 60 days. Investors were aware that the rapid earnings and GDP growth rates of 2018 could not be sustained, but the downward adjustment was sharper than most expected. Peak growth rate for the current cycle is clearly behind us, but that does not mean healthy growth cannot continue for some time.

Of course, it is typically not last year’s issues that trip up the market, but new concerns. On that front we are closely watching consumer confidence (which recently declined sharply from very high levels), wage growth (an acceleration towards 4% would indicate the Fed needs to act sooner than markets currently expect), and a coming US debt ceiling negotiation.

Outlook and Current Positioning

While the US market has rallied sharply off the lows, we maintain above average targets to equities in our client portfolios, despite the fact that we would not be surprised by a near term pause of the recent V-shaped rally. While valuation is not as favorable as it was in late December, when the S&P 500 hit an extremely cheap 14x P/E, the market still trades at a reasonable 16.5x forward P/E ratio. With a 10 Year Treasury yield bouncing around 2.7%, and very tight credit spreads in corporate bonds, equities appear more attractive versus bonds than they did a year ago or upon entering the fourth quarter of 2018, when the recent selloff began.

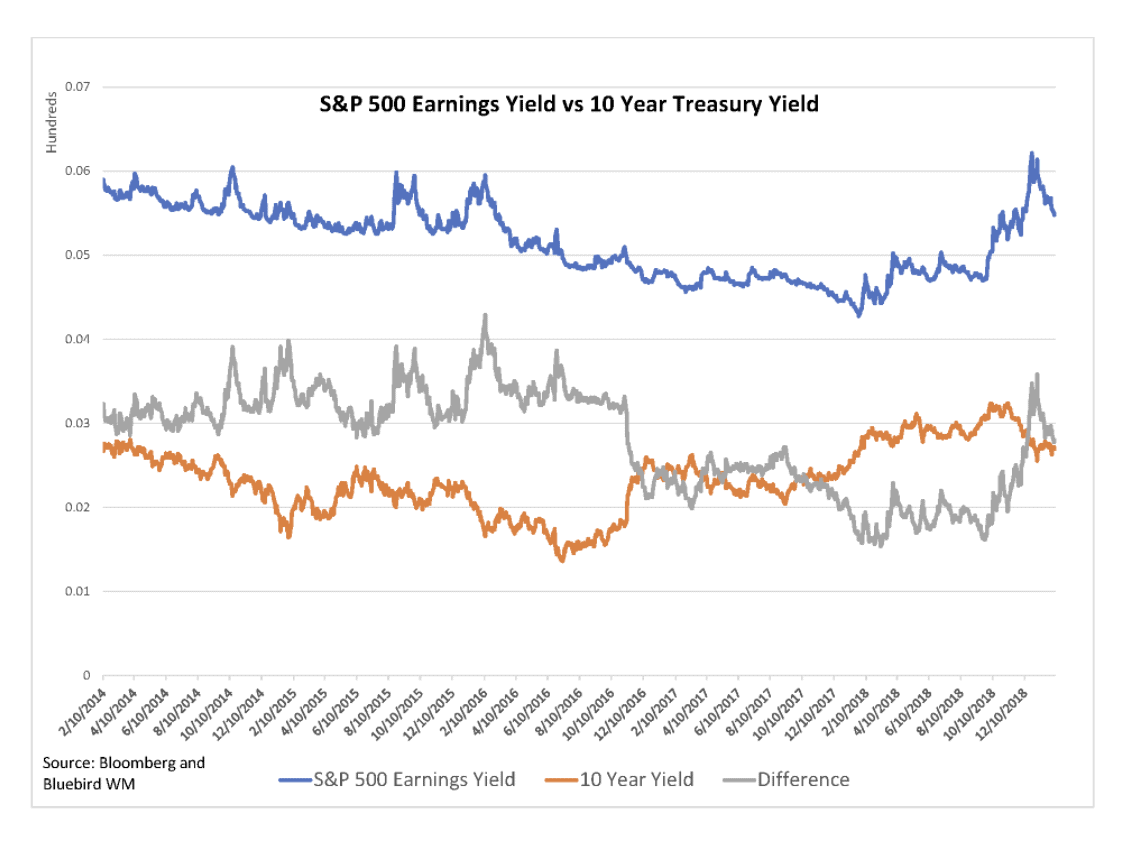

The chart below shows the earnings yield on the S&P 500 (the inverse of the P/E ratio), the 10 Year Treasury Yield, and the differential between the two series. The gap between the two series (or the Equity Risk Premium) reached a 5 year low in the fall of 2018, indicating a relatively more expensive equity market, and then reached a 30 month low at the depths of the December correction, indicating a cheaper equity market. The differential currently sits at almost 3%, indicating an equity market significantly cheaper relative to bonds than it was a year ago or entering the fourth quarter of 2018.

With potential resolution (or at least stabilization) of the three headwinds discussed above, cheaper valuations, reduced complacency following the recent bear market, and our higher level of confidence in an extended business cycle, we believe equity risks are lower than they were a year ago.

However, we are not complacent regarding the equity outlook for 2019. We expect volatility to return following several weeks of calm during the recent rally, as the inevitable end of the current business cycle approaches. Given current equity valuations in-line with historical averages (on a forward basis), above average corporate profitability, and following several years of a bull market, we continue to use below-historical-average equity returns in our planning assumptions for clients, yet recommend an overweight in equities vs bonds due to even lower assumptions for forward bond returns.

For the portion of clients’ portfolios which require current income and/or greater stability we continue to prefer some level of exposure to higher yielding equities in the place of bonds. In bond portfolios we are keeping duration very short and taking limited credit risk. Within credit we are finding the best value in the lowest portion of investment grade (BBBs), where we can add some level of yield to portfolios with an acceptable level of credit risk for a short period of time.

Within equities, the selloff has presented many opportunities across style, capitalization sizes, geography, and sector. For example, we have been finding opportunities in small and mid-cap software companies; semiconductors; large industrial turnarounds; select foreign banks; Chinese and South American internet retailers; and innovative healthcare companies, to name a few.

I look forward to your comments or questions.

Disclaimer: This publication is the opinion of Bluebird Wealth Management LLC and is for informational purposes only. It should not be considered investment advice or a recommendation of any investment strategy or security. These opinions are subject to change at any time based upon future events or market conditions.

Bluebird Wealth Management, LLC

Metrowest Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

North Shore Office

(978) 775-1287

12 Oakland St.

Suite 308

Amesbury, MA 01913

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Metrowest Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

North Shore Office

12 Oakland St.

Suite 308

Amesbury, MA 01913

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.