Too Resilient?

Brian Sokolowski, CFA

October 25, 2023

A year ago, the call for the US economy to enter a recession over the subsequent 12 months was a high confidence prediction amongst economists, with the odds sitting at almost 70% according to Bloomberg, as we discussed earlier this year. The inverted yield curve, an historically accurate predictor of recessions, has been calling for a recession for roughly the last 18 months. While a US recession may still be on the near- to medium-term horizon (and is always on the long-term horizon), the resilience of the US economy has been remarkable.

Resurgent Economic Data

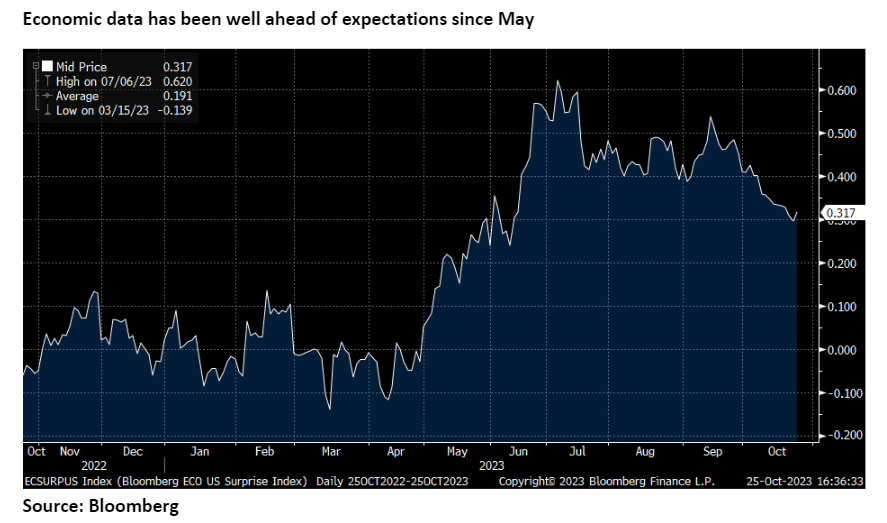

According to the Bloomberg Economic Surprise Index, economic activity has been tracking ahead of consensus expectations since the start of 2023, with the positive surprises accelerating over the past six months (see chart below). A few recent data points were particularly notable. The October 6th payroll report delivered a meaningful upside surprise in terms of jobs added in the month of September, with the US adding 336,000 new jobs, versus expectations of 170,000 additional jobs. The initial reaction from markets was for equities to decline and interest rates to increase, but that was gradually reversed through the day as investors were encouraged that the Average Hourly Earnings component came in below expectations (a sign that inflation should continue to gradually cool) and the unemployment rate was also steady and not lower than expected, which would indicate an overly tight job market and stoke inflation concerns.

September retail sales data was also well ahead of consensus expectations, growing 0.7% for the month, versus expectations of 0.3%. Strength was broad-based, with growth across almost all categories. The strong September retail sales report was on top of a stronger than expected summer for consumer spending. Given the continued increase in interest rates, consumer resilience has been particularly surprising.

In contrast, one area of the economy that has been challenged is the housing sector, as the rapid increase in mortgage rates has finally resulted in a sharp slowdown in sales of existing homes. Existing home sales were down 15% in September 2023 compared to September 2022, resulting in the lowest annual sales pace since October 2010. Stronger than expected underlying data is resulting in increased GDP expectations for the second half of 2023. GDP growth has been slightly above 2% for each of the past four quarters and is expected to have accelerated to 4% or more in the third quarter of 2023. The Atlanta Federal Reserve’s GDP Nowcast estimates 3Q GDP growth of more than 5%, up from roughly a 2% expectation for the quarter a few months ago. That forecast can be volatile, but the direction and magnitude of the increase clearly indicates that the US economy has accelerated in recent months.

Why has the US economy been so resilient?

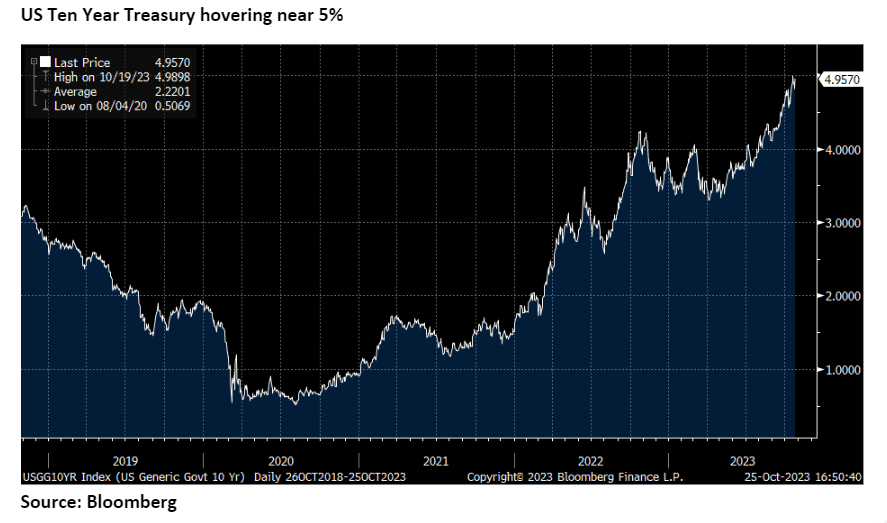

Recession concerns were and are reasonable, with CPI peaking above 9% in the middle of 2022, a level not seen in over 40 years. . The rapid deceleration of CPI back down to 3% in the second quarter of 2023 has eased some of the concerns around the impact of high levels of inflation on the economy and has been an encouraging factor for renewed economic optimism. Interest rates, however, have not declined and have recently begun to climb again – both Federal Reserve policy rates and longer rates set by the market. The US Ten Year Treasury rate increased sharply from under 1% in the middle of 2020 to over 4% in the fall of 2022. As inflation gradually declined over the past year, the 10 Year rate spent most of 2023 in a range under 4%, but has recently spiked to briefly surpass 5%, a level not seen since 2007.

There are several potential negative outcomes from this rapid increase in interest rates after several years of very low rates (and assets priced based on those low rates), including pressure on consumer and business spending, default risk for businesses as they need to roll debt at higher rates, and the general category of “something breaking” in the financial system. The latter did occur in early 2023, with the failure of a handful of medium to large US banks, most notably Silicon Valley Bank, and balance sheet pressure across the banking industry. Consistent with the theme of resilience, however, the banking pressure has not spread to the wider financial system or to the general economy.

Why has the economy remained so resilient in the face of these significant risks? Some of the reasons are straightforward. For example, the rapid post-Covid increase in energy prices that helped to drive inflation caused many observers to compare the current period to the stagflation of the 1970s. A key difference between now and then is energy intensity of the global economy is currently less than half the level it was in 1980, with an even greater decrease in the US.

A key aspect of the stagflation of the 1970s was the wage-price spiral. With record low unemployment in the US in recent years, demographic pressures of a retiring baby boom generation, fiscal support and the positive wealth effect of a 15 year run in asset prices (homes, equities, and other), employment data has been a key area of focus for economists in gauging expectations for the path of CPI (even though it is not a CPI component, as higher wages can be the fuel for higher prices across the economy). Much like CPI, growth in Average Hourly Earnings peaked at 6% in 2022 and has gradually decelerated to 4.1% in September, a welcome cooling regarding the outlook for inflation. This is despite an unemployment rate of only 3.8%, which is sitting near 50-year lows.

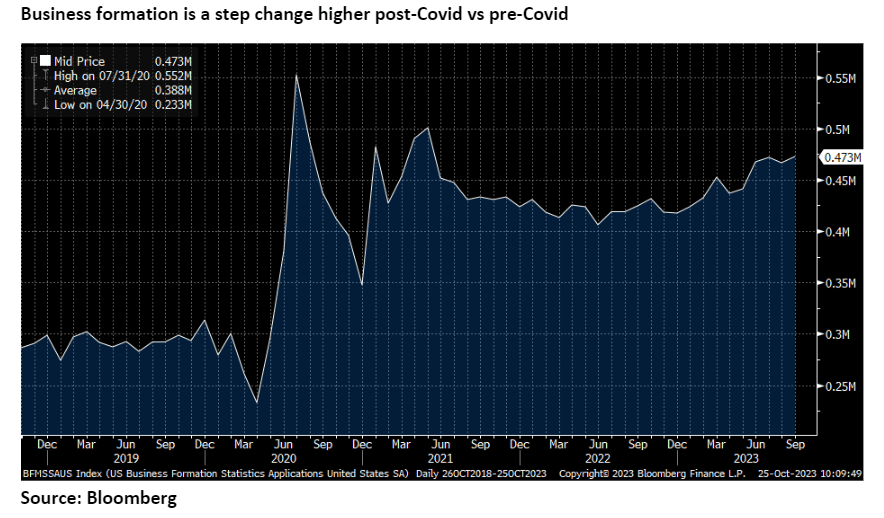

There are a few favorable factors in the US labor market allowing for deceleration in wage growth despite a low unemployment rate. First, the US labor force continues to expand and recover following the Covid contraction. According to the Bureau of Labor Statistics, the US labor force has grown by almost 3 million available workers in 2023 alone. Another interesting aspect of the US labor market is the sharp increase in business formation over the last three years, which is showing a remarkable step change increase over the pre-Covid years – for almost a 33% increase on average for the 2021-2023 period as compared to the 2017-2019 period (see chart below). Business formation and the gig economy are both supportive of labor supply, although in a different fashion than is historically captured in payroll data.

A very interesting theory is that Artificial Intelligence is partially responsible for the resilience of the US economy in 2023. According to IDC, AI spending will reach $154 billion in 2023, for a 27% increase over 2022. In the scope of the global economy, $154 billion is a rounding error. However, with the US position as a technology leader, much of the value accrues to the US, and there are likely knock-on spending effects of the $154 billion in pure AI spending (and some offsets in reduced spending in other areas). Perhaps more important is the difficult to measure but very real impact on business confidence from this growth theme, especially with the importance of technology for the US corporate landscape. Nvidia, the semiconductor and software company at the center of the AI boom, has been reporting eye-popping financial results throughout 2023, including quarters with a 400% income increase versus the prior year and a doubling of revenue. Analysts have not been able to keep pace with the growth, with earnings estimates repeatedly needing to double for subsequent quarters – almost unheard-of adjustments for a company of Nvidia’s size. While AI hype is currently very high and expectations potentially too rosy, Nvidia’s results indicate that the excitement is real and companies across the economy are confident enough to continue to spend and invest in growth.

How have markets reacted?

One would think that a resilient economy which has thus far avoided recession would be a positive for equity returns. The reality is more complex. Avoiding a full recession clearly helped to prevent deeper declines in stock prices in 2022 and has allowed for prices to stabilize and somewhat recover. But the recovery has been uneven, with a narrow group of companies driving a significant portion of equity returns in 2023, while the average stock has struggled. Through the end of September, while the S&P 500 returned 13% year to date, almost all other indices (with one notable exception) trailed well behind. The equally weighted S&P 500 was only up 1.9%; the Dow Jones has returned 2.7%; and the Russell 2000 Small Cap Index was up 2.4%. The difference in returns is almost completely due to the “Magnificent Seven”, the latest moniker given to a cohort of large growth stocks, this time referring to the largest seven holdings in the S&P 500, all of which are technology or technology-driven companies. This group (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta) had an average return of 87% through the end of September. These seven companies comprise 28% of the S&P 500. One notable exception that has outpaced the S&P 500 this year is the NASDAQ 100, which was up 35% through the end of September. These seven stocks comprise a whopping 42% of the NASDAQ 100 Index.

Artificial Intelligence is often cited as the reason the Magnificent Seven have wildly outperformed the average stock in 2023 and AI is clearly a factor for most of the cohort. Strong balance sheets, without the need for debt financing at increasing interest rates, is another factor for most of the group; as is healthy and predictable near-term cash flows, which are sought out by investors in rising interest rate environments.

While equity returns have not been widely helped due to the economy’s resilience, interest rates have responded in a somewhat more predictable direction – by rising, particularly on the longer end of the yield curve (see chart), as markets are pricing in a more-resilient-than-expected economy that has been able to withstand an historic increase in both short- and long-term rates, at least thus far. (There is also the possibility that perhaps higher rates are at least partially due to concern around the long-term fiscal situation in the US). Higher rates continue to present increasingly attractive prospective bond returns for savers, while pressuring current bond prices and returns in bond funds.

Looking forward

The term “Goldilocks” was used to (often appropriately) describe the economy during the 2012-2020 expansion – just enough growth to not spur inflation, allowing for low interest rates, durable expansion, and attractive stock returns. The current environment has been “too resilient” for short-term equity returns this year, driving interest rates ever higher and raising the prospect of resurgent inflation. A moderately softer economy, or a mild recession, might be a positive for stock returns by allowing policymakers and the market to price in somewhat lower interest rates (although unlikely to return to the ultra-low rates of the pre-Covid era), relieving pressure on consumers, the housing and other interest rate sensitive sectors, and corporate balance sheets.

As always, we look forward to your questions or comments. If you would like to schedule a time to speak directly with Bluebird Wealth Management about these strategies, or any other personal finance topics, please reach out to us We offer a free consultation to answer your questions and review our unique service structure.

Bluebird Wealth Management is an independent, fee-only, Registered Investment Adviser. This information is not intended to be a substitute for specific individualized tax or investment advice. Have questions?